Question: Part A Part B . Remember, answer formats and inputs into Canvas matter: As a rule, do all calculations to four decimals of precision, then

Part A

Part A Part B

Part B

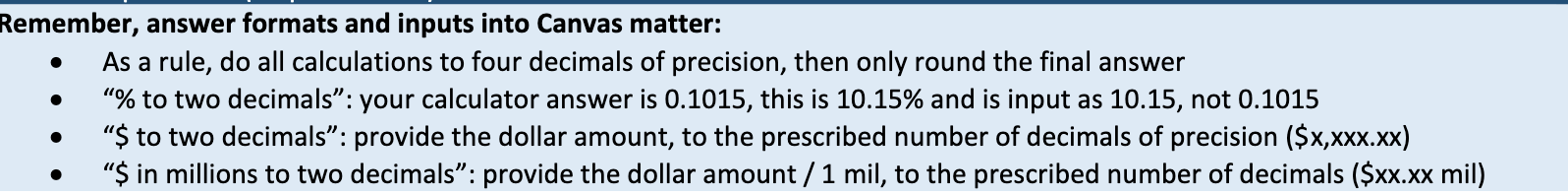

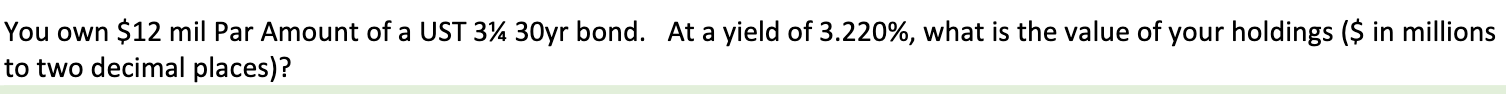

. Remember, answer formats and inputs into Canvas matter: As a rule, do all calculations to four decimals of precision, then only round the final answer % to two decimals: your calculator answer is 0.1015, this is 10.15% and is input as 10.15, not 0.1015 "$ to two decimals: provide the dollar amount, to the prescribed number of decimals of precision ($X,XXX.xx) $ in millions to two decimals: provide the dollar amount / 1 mil, to the prescribed number of decimals ($xx.xx mil) You own $12 mil Par Amount of a UST 344 30yr bond. At a yield of 3.220%, what is the value of your holdings ($ in millions to two decimal places)? You own $12 mil Par Amount of a UST 3% 30yr bond. At a yield of 3.220%, what is the bond's price (bond price to four decimal places)? . Remember, answer formats and inputs into Canvas matter: As a rule, do all calculations to four decimals of precision, then only round the final answer % to two decimals: your calculator answer is 0.1015, this is 10.15% and is input as 10.15, not 0.1015 "$ to two decimals: provide the dollar amount, to the prescribed number of decimals of precision ($X,XXX.xx) $ in millions to two decimals: provide the dollar amount / 1 mil, to the prescribed number of decimals ($xx.xx mil) You own $12 mil Par Amount of a UST 344 30yr bond. At a yield of 3.220%, what is the value of your holdings ($ in millions to two decimal places)? You own $12 mil Par Amount of a UST 3% 30yr bond. At a yield of 3.220%, what is the bond's price (bond price to four decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts