Question: Part A Part B Entries for notes payable A business issued a 90-day, 15% note for $87,000 to a creditor on account. Journalize the entries

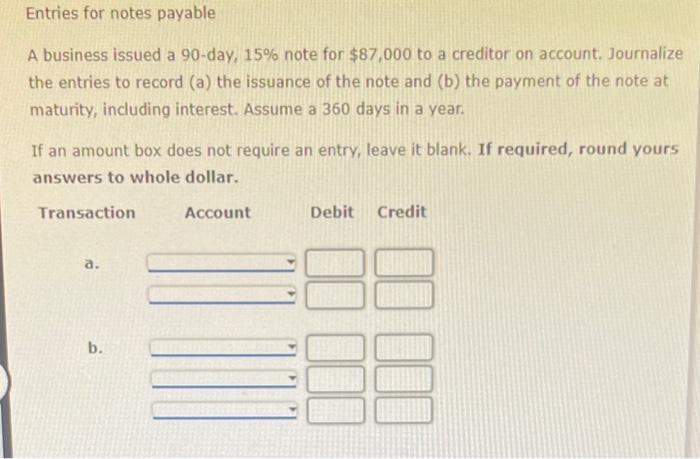

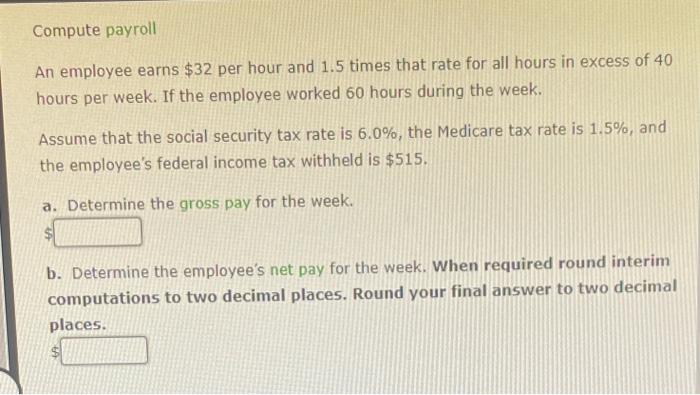

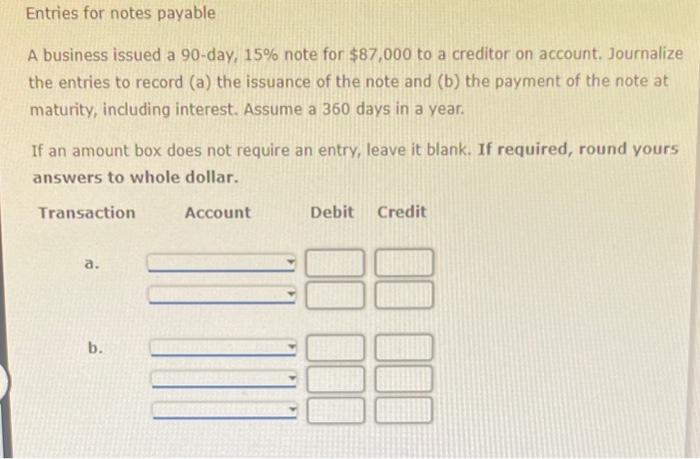

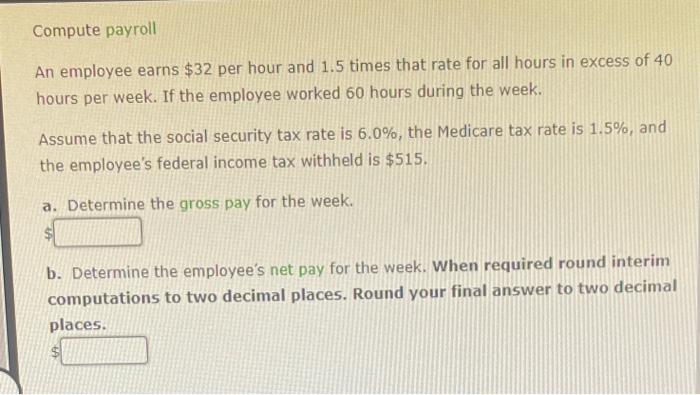

Entries for notes payable A business issued a 90-day, 15% note for $87,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360 days in a year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar. An employee earns $32 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 60 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $515. a. Determine the gross pay for the week. b. Determine the employee's net pay for the week. When required round interim computations to two decimal places. Round your final answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts