Question: Part A . Please read the scenario 1 ( below ) and formulate the problem by hand ( don ' t solve ) . To

Part A Please read the scenario below and formulate the problem by hand dont solve To understand how to formulate the problem see the following example.

Define variables.

Define the objective function.

Define the respective constraints.

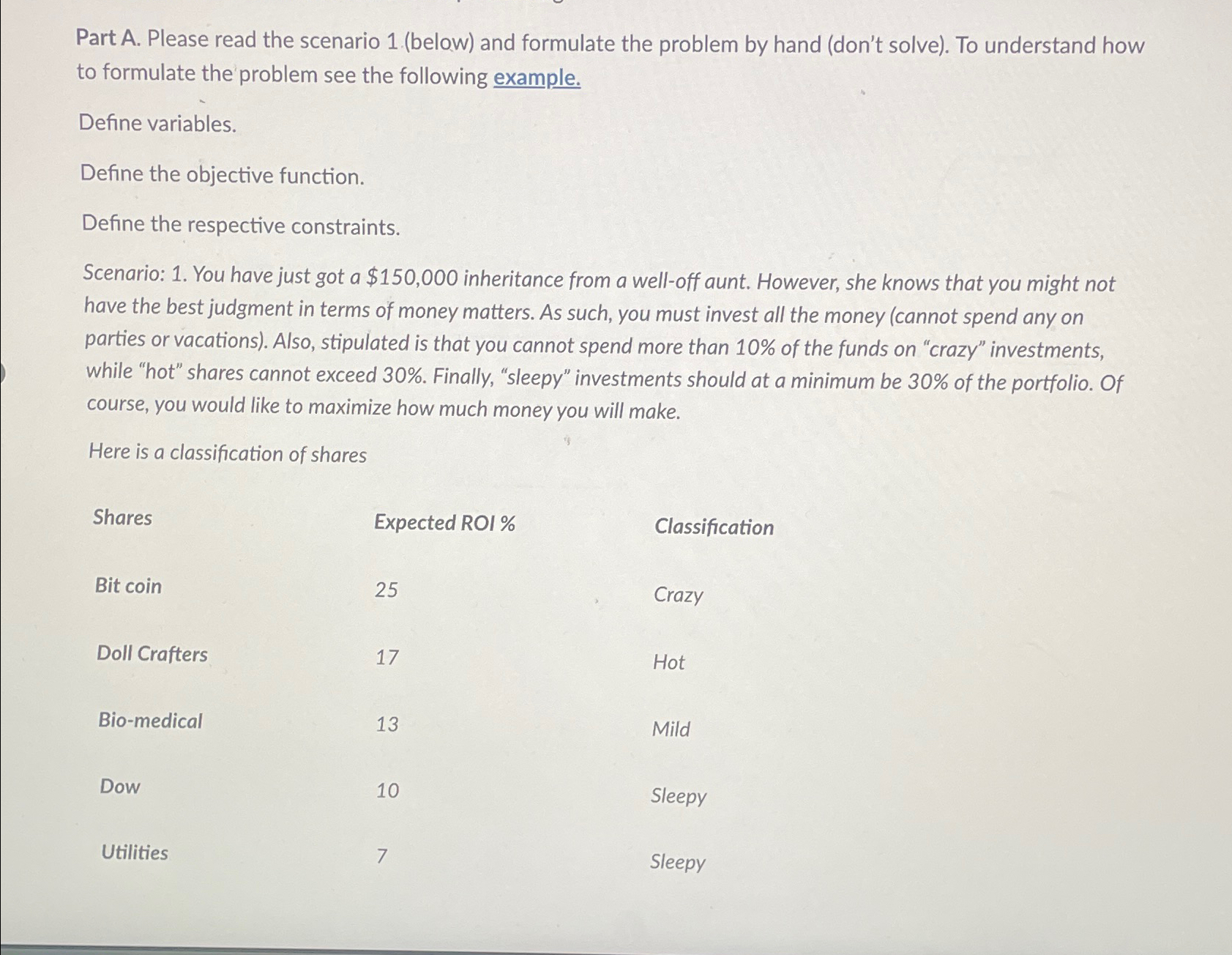

Scenario: You have just got a $ inheritance from a welloff aunt. However, she knows that you might not have the best judgment in terms of money matters. As such, you must invest all the money cannot spend any on parties or vacations Also, stipulated is that you cannot spend more than of the funds on "crazy" investments, while "hot" shares cannot exceed Finally, "sleepy" investments should at a minimum be of the portfolio. Of course, you would like to maximize how much money you will make.

Here is a classification of shares

Shares

Bit coin

Doll Crafters

Biomedical

Dow

Dow

Utilities

Expected ROI

Classification

Crazy

Hot

Mild

Sleepy

Sleepy

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock