Question: Part A . Presented below is the amortization schedule related to Maple Ltd.'s 3-year bond investment. The bond investment has a face value of $100,000,

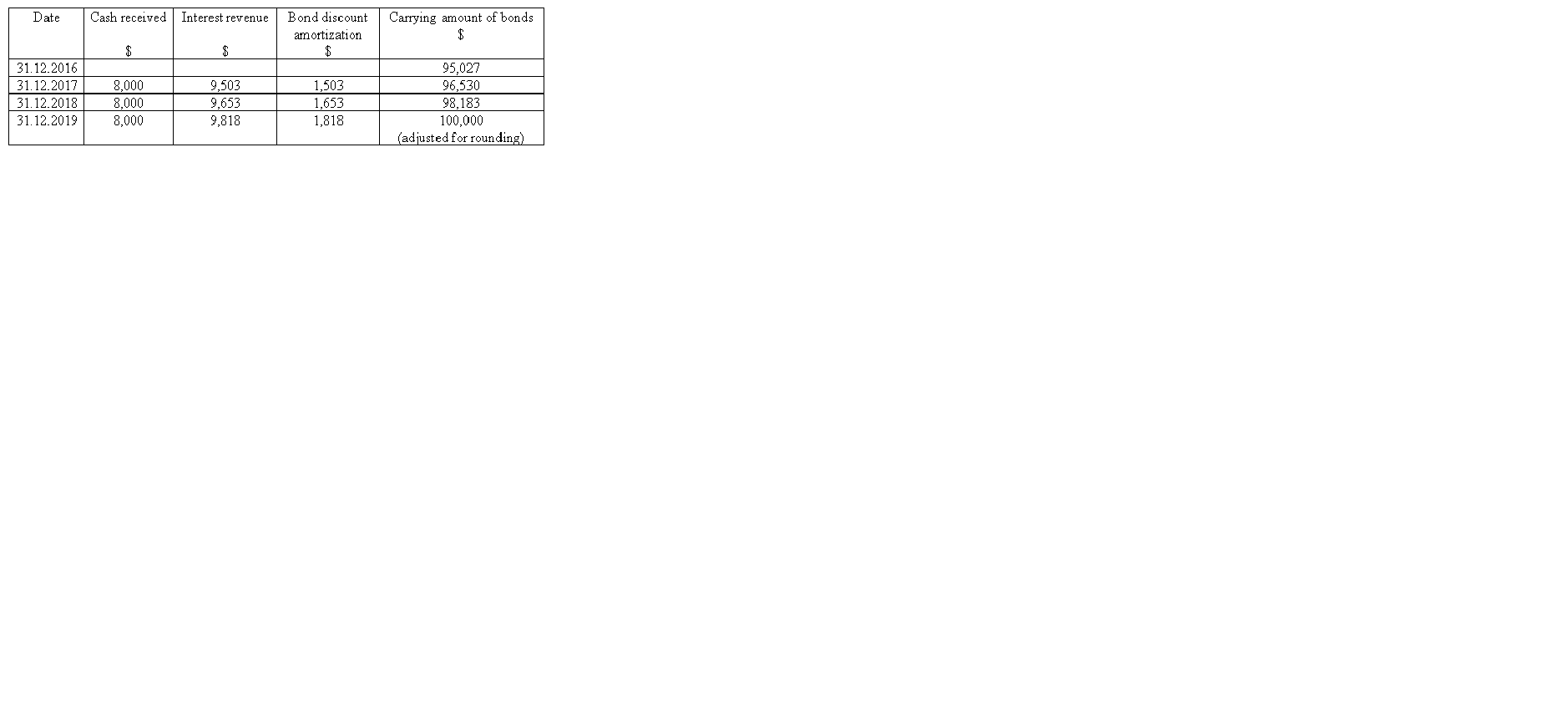

Part A. Presented below is the amortization schedule related to Maple Ltd.'s 3-year bond investment. The bond investment has a face value of $100,000, and it has an 8% stated interest rate and a 10% effective interest rate. The bond was purchased on December 31, 2016, for $95,027. Interests are paid at the end of each year. Maple Ltd. has a December 31 fiscal year-end.

Date Cash received Interest revenue Bond discount amortization Carrying amount of bonds $ $ $ $ 31.12.2016 95,027 31.12.2017 8,000 9,503 1,503 96,530 31.12.2018 8,000 9.653 1,653 98,183 31.12.2019 8,000 9,818 1,818 100,000 (adjusted for rounding)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts