Question: Part a , question 1 and 2 please No need to do the theory PART A (60%) three questions.Your answer should be no more than

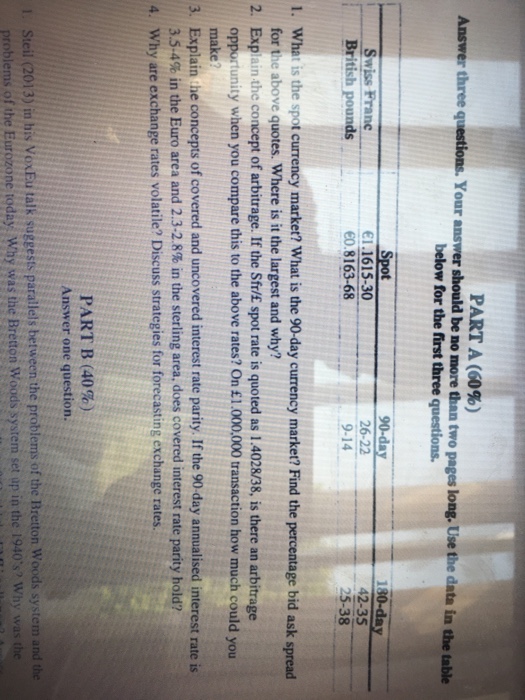

PART A (60%) three questions.Your answer should be no more than two pages long. Use the data in the table below for the first three questions Spot 1.1615-30 0.8163-68 26-22 9-14 42-35 25-38 British pounds 1. What is the spot currency market? What is the 90-day currency market? Find the percentage bid ask spread 2. Explain the concept of arbitrage. If the Sfr/E spot rate is quoted as 1.4028/38, is there an arbitrage 3. Explain the concepts of covered and uncovered interest rate parity. If the 90-day annualised interest rate is 4. Why are exchange rates volatile? Discuss strategies for forecasting exchange rates. for the above quotes. Where is it the largest and why? opportunity when you compare this to the above rates? On 1.000,000 transaction how much could you make? 3.5.4% in the Euro area and 2.3-2.8% in the sterling area, does covered interest rate parity hold? PART B (40%) Answer one question. 1. Steil (2013) in bis VoxEu talk suggests parallels between the problems of the Bretton Woods system and the problems of the Eurozone toda tton Woods system set up in the 1940's? Why was the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts