Question: Part A. Risk, Return, and Capital Allocation (14 points) 1. (4 points) Discuss two major differences between the capital market line (CML) and the security

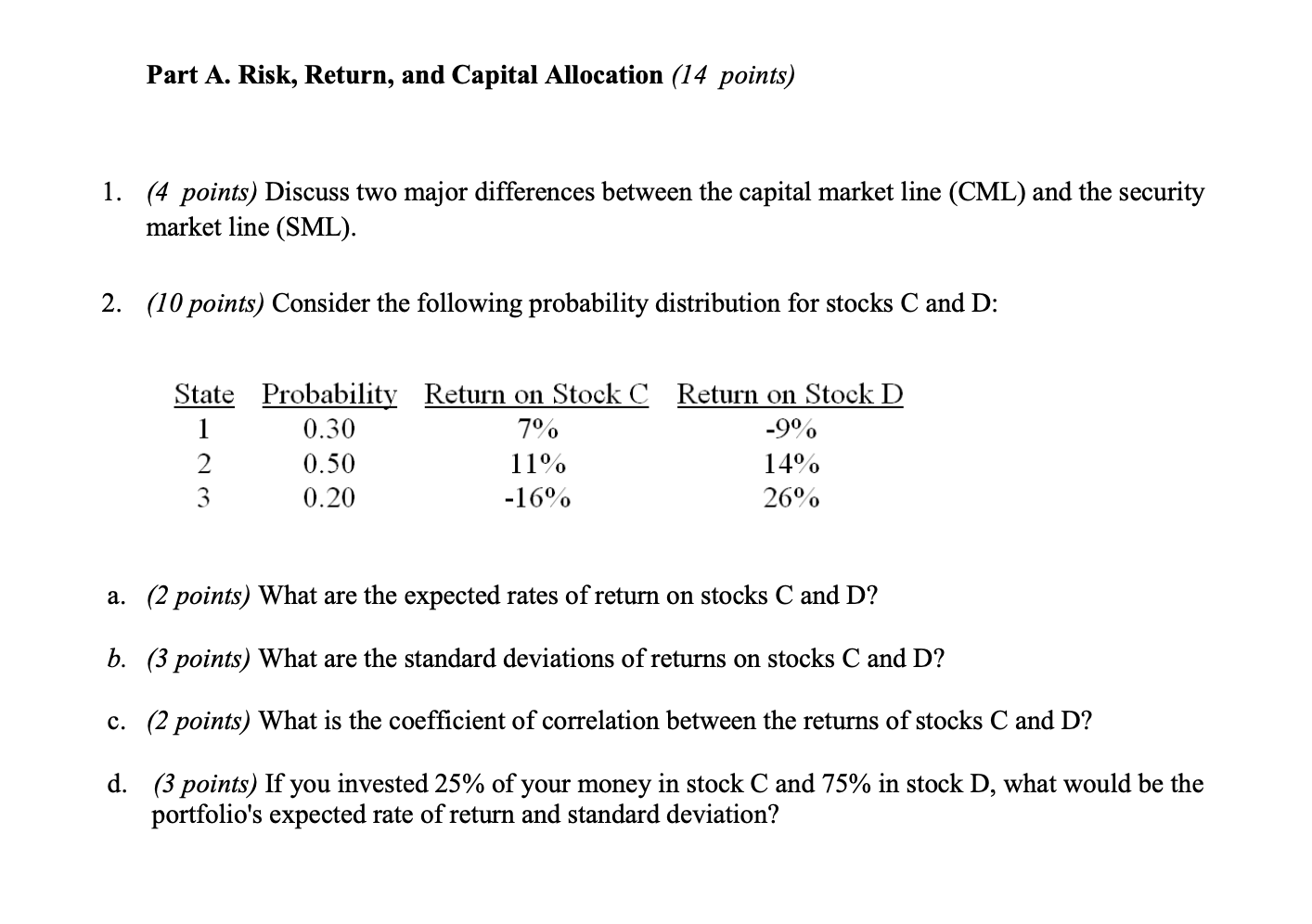

Part A. Risk, Return, and Capital Allocation (14 points) 1. (4 points) Discuss two major differences between the capital market line (CML) and the security market line (SML). 2. (10 points) Consider the following probability distribution for stocks C and D: State Probability Return on Stock C Return on Stock D 1 0.30 7% -9 2 0.50 11% 14% 3 0.20 -16% 26% a. (2 points) What are the expected rates of return on stocks C and D? b. (3 points) What are the standard deviations of returns on stocks C and D? c. (2 points) What is the coefficient of correlation between the returns of stocks C and D? d. (3 points) If you invested 25% of your money in stock C and 75% in stock D, what would be the portfolio's expected rate of return and standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts