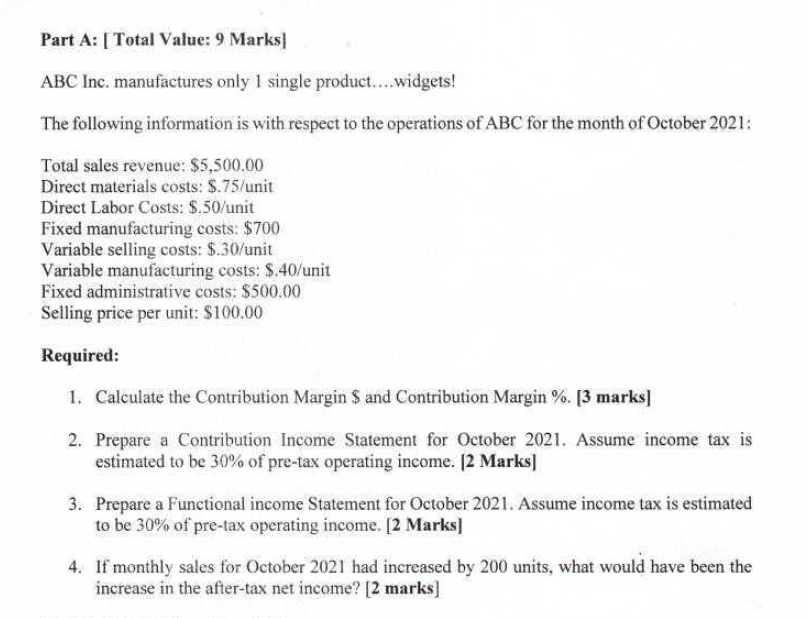

Question: Part A: [ Total Value: 9 Marks ABC Inc. manufactures only 1 single product....widgets! The following information is with respect to the operations of ABC

Part A: [ Total Value: 9 Marks ABC Inc. manufactures only 1 single product....widgets! The following information is with respect to the operations of ABC for the month of October 2021: Total sales revenue: $5,500.00 Direct materials costs: $.75/unit Direct Labor Costs: $.50/unit Fixed manufacturing costs: $700 Variable selling costs: $.30/unit Variable manufacturing costs: $.40/unit Fixed administrative costs: $500,00 Selling price per unit: $100.00 Required: 1. Calculate the Contribution Margin $ and Contribution Margin %. [3 marks) 2. Prepare a Contribution Income Statement for October 2021. Assume income tax is estimated to be 30% of pre-tax operating income. (2 Marks] 3. Prepare a Functional income Statement for October 2021. Assume income tax is estimated to be 30% of pre-tax operating income. [2 Marks] 4. If monthly sales for October 2021 had increased by 200 units, what would have been the increase in the after-tax net income? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts