Question: Part A: True/False (5 points each) 1. ( Options are attractive to investors because they provide very high leverage by mimicking the stock's profits and

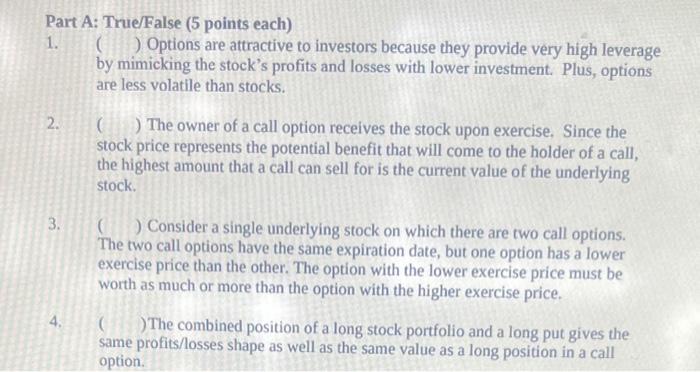

Part A: True/False (5 points each) 1. ( Options are attractive to investors because they provide very high leverage by mimicking the stock's profits and losses with lower investment. Plus, options are less volatile than stocks. 2. ( ) The owner of a call option receives the stock upon exercise, Since the stock price represents the potential benefit that will come to the holder of a call, the highest amount that a call can sell for is the current value of the underlying stock. 3. ( ) Consider a single underlying stock on which there are two call options. The two call options have the same expiration date, but one option has a lower exercise price than the other. The option with the lower exercise price must be worth as much or more than the option with the higher exercise price. 4. ( ) The combined position of a long stock portfolio and a long put gives the same profits/losses shape as well as the same value as a long position in a call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts