Question: Part A. True/False Determine whether each statement below is True (T) or False (F). Your answers should be recorded on the Scan-Tron answer sheet. Using

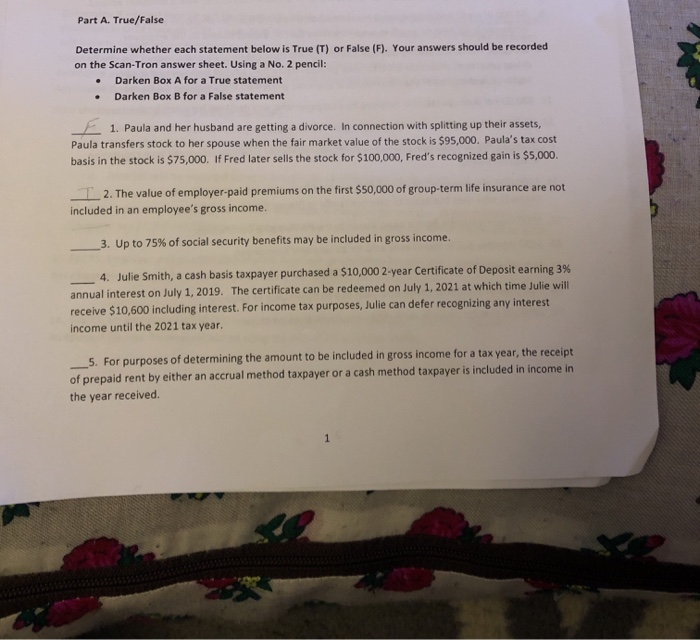

Part A. True/False Determine whether each statement below is True (T) or False (F). Your answers should be recorded on the Scan-Tron answer sheet. Using a No. 2 pencil: Darken Box A for a True statement Darken Box B for a False statement 1. Paula and her husband are getting a divorce. In connection with splitting up their assets, Paula transfers stock to her spouse when the fair market value of the stock is $95.000. Paula's tax cost basis in the stock is $75,000. If Fred later sells the stock for $100,000, Fred's recognized gain is $5,000. 1 2. The value of employer-paid premiums on the first $50,000 of group-term life insurance are not included in an employee's gross income. 3. Up to 75% of social security benefits may be included in gross income. 4. Julie Smith, a cash basis taxpayer purchased a $10,000 2-year Certificate of Deposit earning 3% annual interest on July 1, 2019. The certificate can be redeemed on July 1, 2021 at which time Julie will receive $10,600 including interest. For income tax purposes, Julie can defer recognizing any interest income until the 2021 tax year. __5. For purposes of determining the amount to be included in gross income for a tax year, the receipt of prepaid rent by either an accrual method taxpayer or a cash method taxpayer is included in income in the year received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts