Question: PART A: Using the upload, create a model that tracks 401k contributions, taxable income, spendable income, and the balance of the 401k account du ring

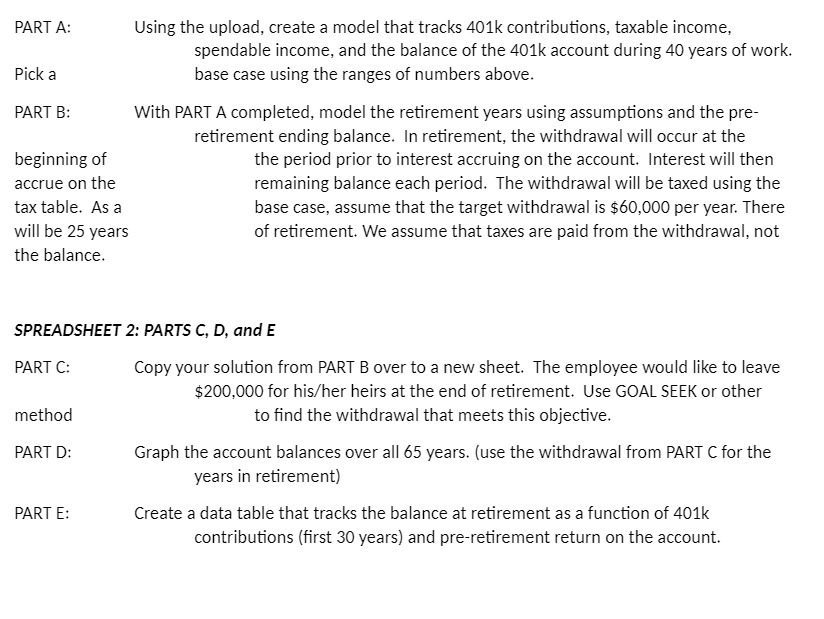

PART A: Using the upload, create a model that tracks 401k contributions, taxable income, spendable income, and the balance of the 401k account du ring 40 years of work. Pick a base case using the ranges of numbers above. PART B: With PART A completed, model the retirement years using assumptions and the pre retirement ending balance. In retirement, the withdrawal will occur at the beginning of the period prior to interest accruing on the account. Interest will then accrue on the remaining balance each period. The withdrawal will be taxed using the tax table. As a base case, assume that the target withdrawal is $60,000 per year. There will be 25 years of retirement, We assume that taxes are paid from the withdrawal, not the balance. SPREADSHEET 2': PARTS C, D. and E PART (I: Copy your solution from PART B over to a new sheet. The employee would like to leave $200,000 for hisfher heirs at the end of retirement. Use GOAL SEEK or other method to find the withdrawal that meets this objective, PART 0: Graph the account balances over all 65 years. {use the withdrawal from PART C for the years in reti rement} PART E: Create a data table that tracks the balance at retirement as a function of 401k contributions [rst 30 years} and preretirement return on the account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts