Question: PART A) Which project would be selected on the basis of the IRR criterion? Choose the correct answer below. A. Project A B. Project B

PART A) Which project would be selected on the basis of the IRR criterion? Choose the correct answer below.

A. Project A

B. Project B

C. Project C

PART B) What is the borrow rate of return (BRR) for project D?

The borrowing rate of return (BRR) for project D is _ %. (Round to one decimal place)

PART C) Would you accept project D at MARR = 14%? Choose the correct answer below.

A. Yes

B. No

PART D) Assume that project C and E are mutually exclusive. Compute the IRR on incremental investment.

The IRR on incremental investment is _ %. (Round to one decimal place)

PART E) Using the IRR criterion, which project would you select? Assume that MARR = 9%. Choose the correct answer.

A. Project C

B. Project E

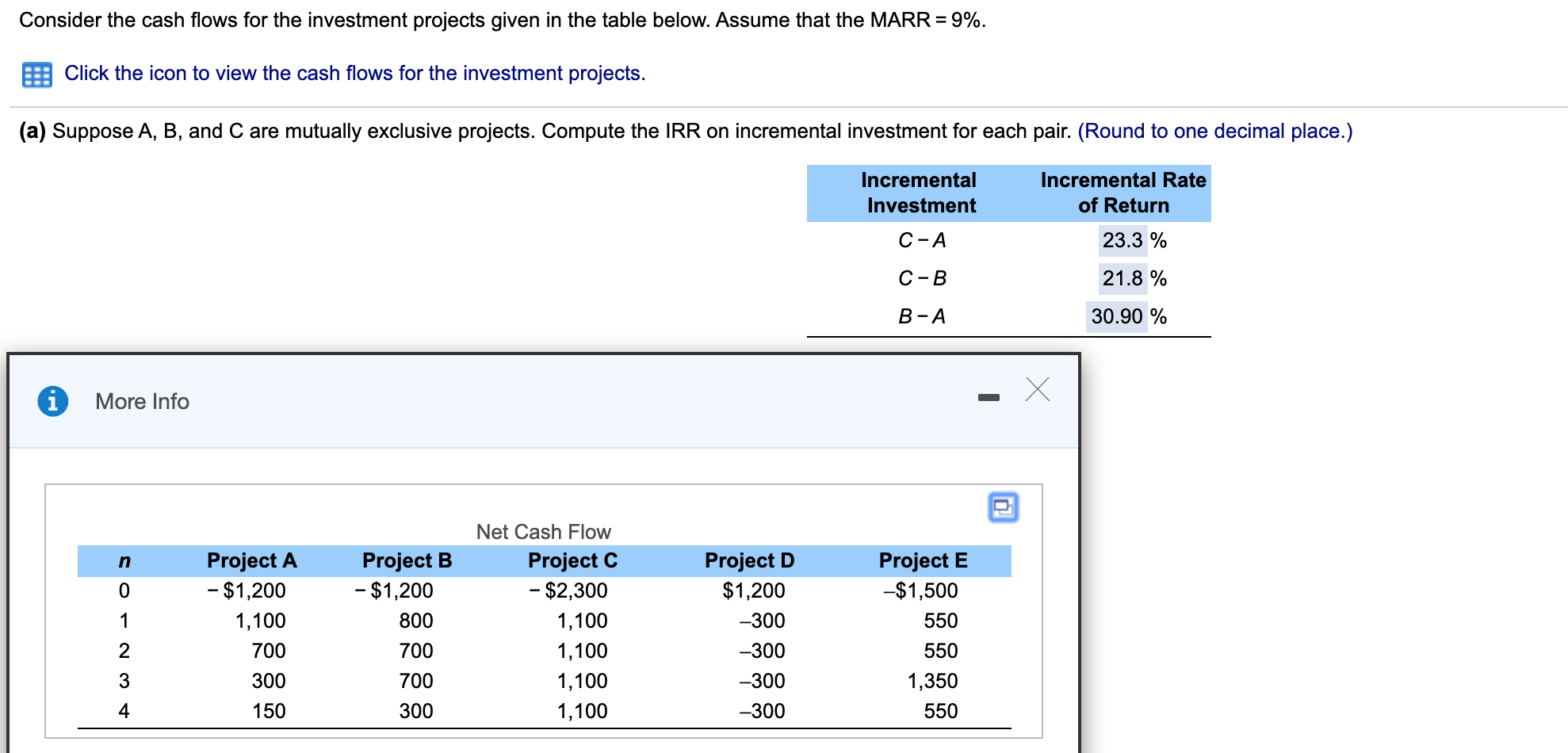

Consider the cash flows for the investment projects given in the table below. Assume that the MARR = 9%. : Click the icon to view the cash flows for the investment projects. (a) Suppose A, B, and C are mutually exclusive projects. Compute the IRR on incremental investment for each pair. (Round to one decimal place.) Incremental Investment C-A C-B Incremental Rate of Return 23.3 % 21.8 % 30.90 % B-A More Info AWN-OS Project A - $1,200 1,100 700 300 150 Project B - $1,200 800 700 700 Net Cash Flow Project C - $2,300 1,100 1,100 1,100 1,100 Project D $1,200 -300 -300 -300 -300 Project E -$1,500 550 550 1,350 550 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts