Question: part A2 please VERSION BACK NE Question 2 Sheffield Company purchased a delivery truck for $27,000 on January 1, 2020. The truck has an expected

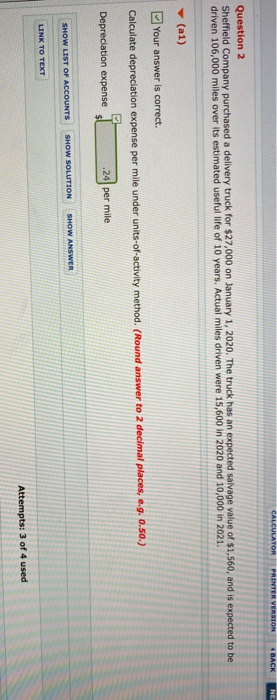

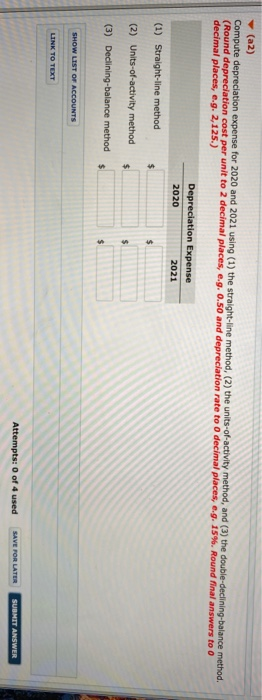

VERSION BACK NE Question 2 Sheffield Company purchased a delivery truck for $27,000 on January 1, 2020. The truck has an expected salvage value of $1,560, and is expected to be driven 106,000 miles over its estimated useful life of 10 years. Actual miles driven were 15,600 in 2020 and 10,000 in 2021. (1) Your answer is correct. Calculate depreciation expense per mile under units-of-activity method. (Round an cimal places, e.g. 0.50.) Depreciation expense .24 per mile SHOW ANSWER SHOW LIST OF ACCOUNTS SHOW SOLUTION LINK TO TEXT Attempts: 3 of 4 used (a2) Compute depreciation expense for 2020 and 2021 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation rate to o decimal places, e.g. 15%. Round final answers to o decimal places, e.g. 2,125.) Depreciation Expense 2020 2021 (1) Straight-line method (2) Units-of-activity method (3) Declining-balance method SHOW LIST OF ACCOUNTS LINK TO TEXT Attempts: 0 of 4 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts