Question: part a,b,c please 08.03-PR036 Now that you are making the big bucks, your spouse has decided to venture into the rental property business. Your spouse

part a,b,c please

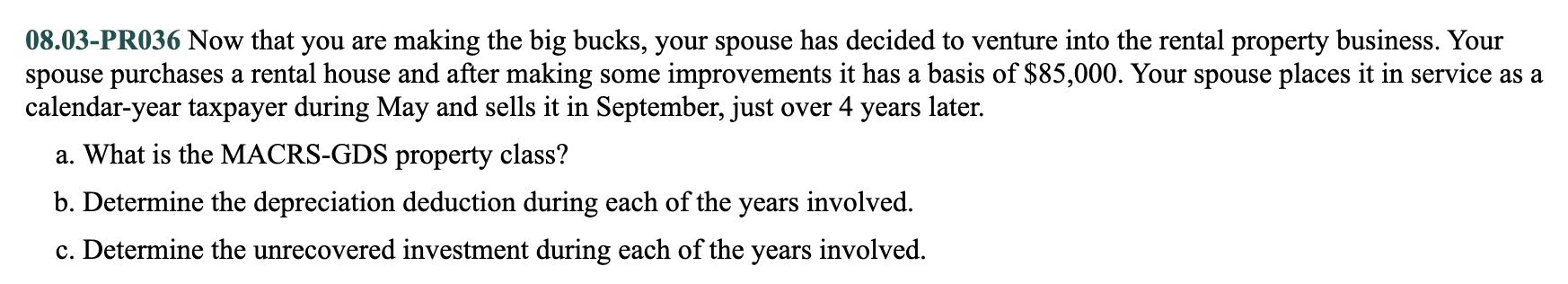

08.03-PR036 Now that you are making the big bucks, your spouse has decided to venture into the rental property business. Your spouse purchases a rental house and after making some improvements it has a basis of $85,000. Your spouse places it in service as a calendar-year taxpayer during May and sells it in September, just over 4 years later. a. What is the MACRS-GDS property class? b. Determine the depreciation deduction during each of the years involved. c. Determine the unrecovered investment during each of the years involved. 08.03-PR036 Now that you are making the big bucks, your spouse has decided to venture into the rental property business. Your spouse purchases a rental house and after making some improvements it has a basis of $85,000. Your spouse places it in service as a calendar-year taxpayer during May and sells it in September, just over 4 years later. a. What is the MACRS-GDS property class? b. Determine the depreciation deduction during each of the years involved. c. Determine the unrecovered investment during each of the years involved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts