Question: Part A,B,C,D please Using the information provided, construct a monthly cash budget for October through December 2017. Based on your analysis, will Noble enjoy a

Part A,B,C,D please

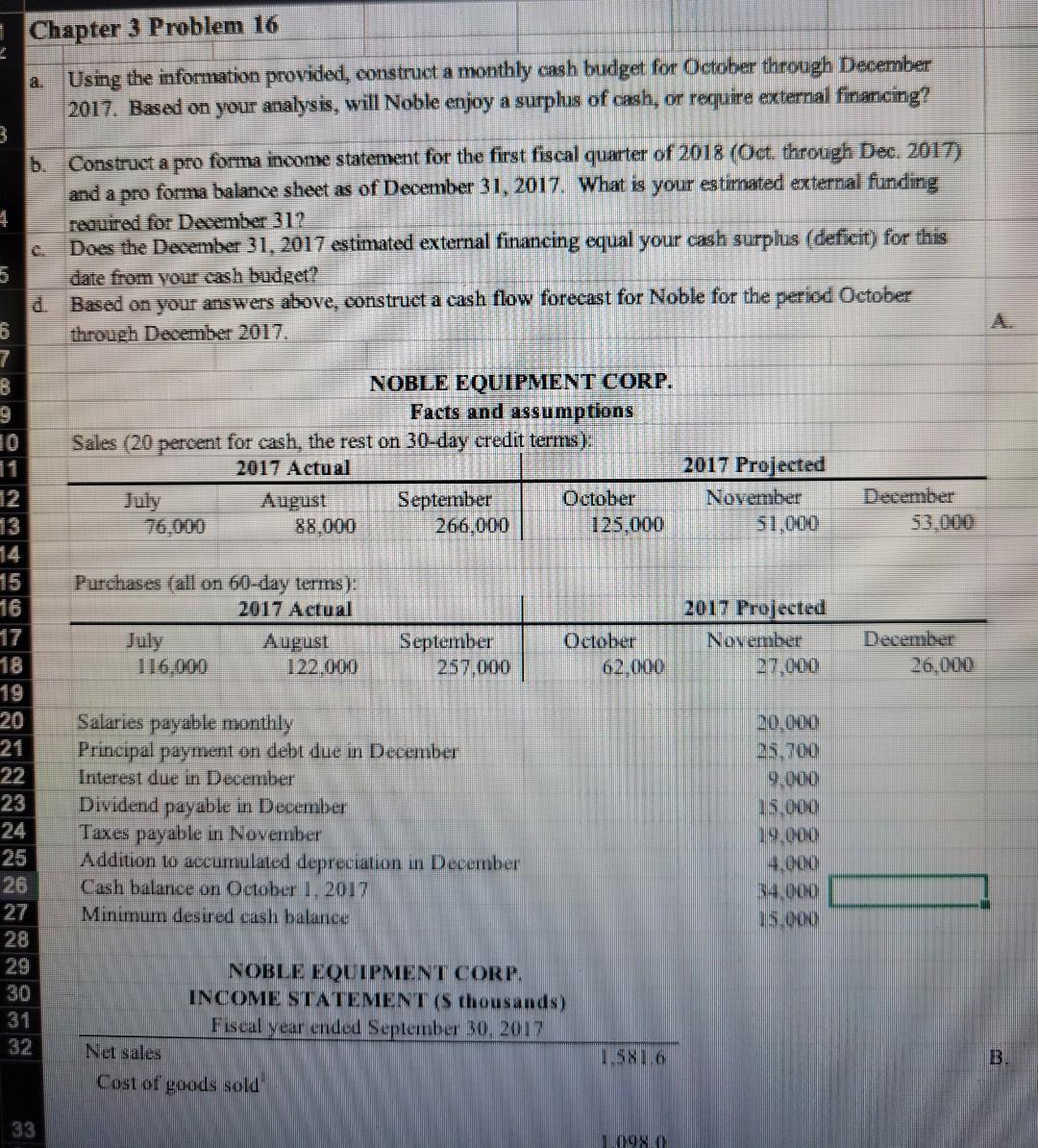

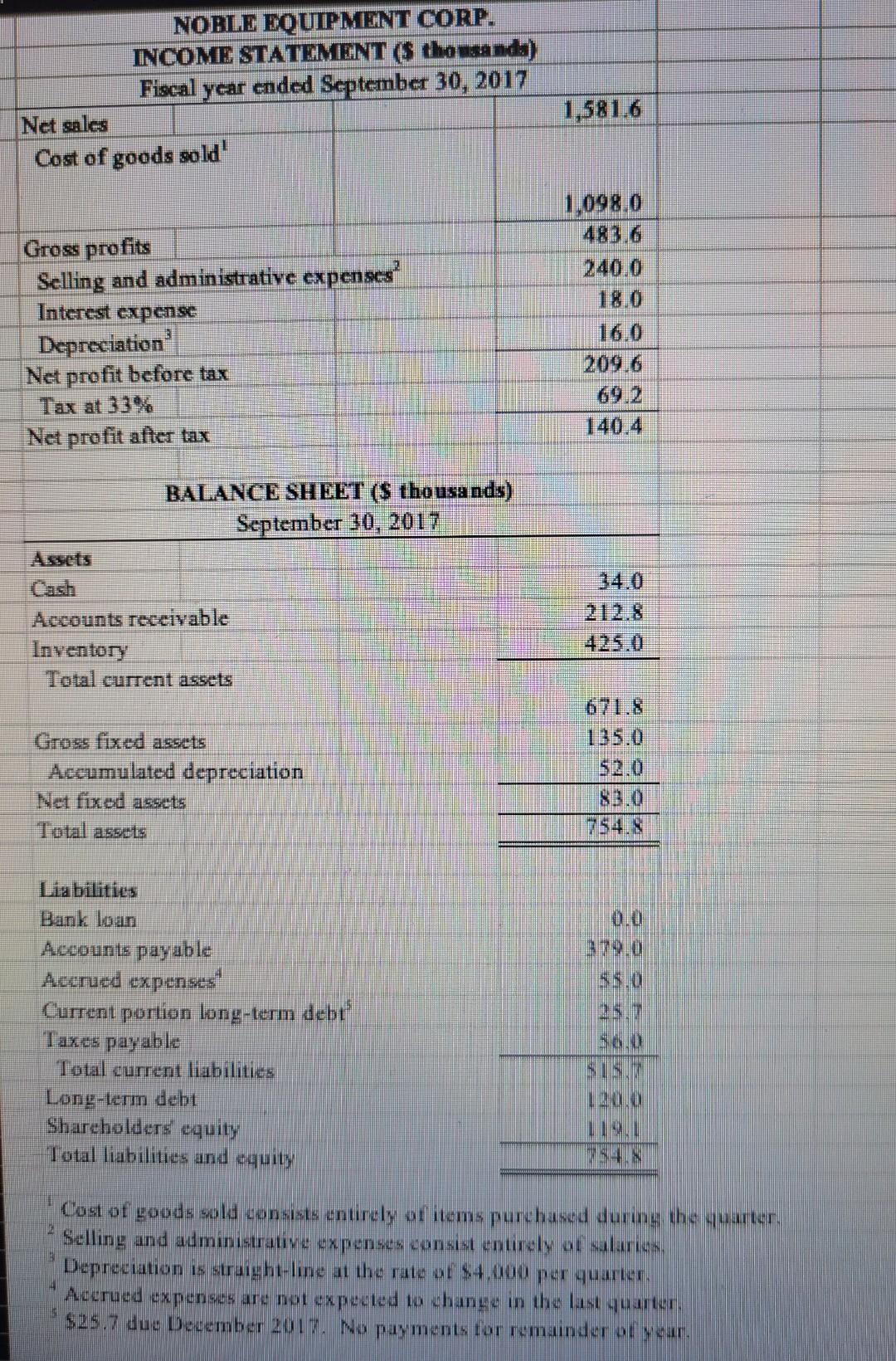

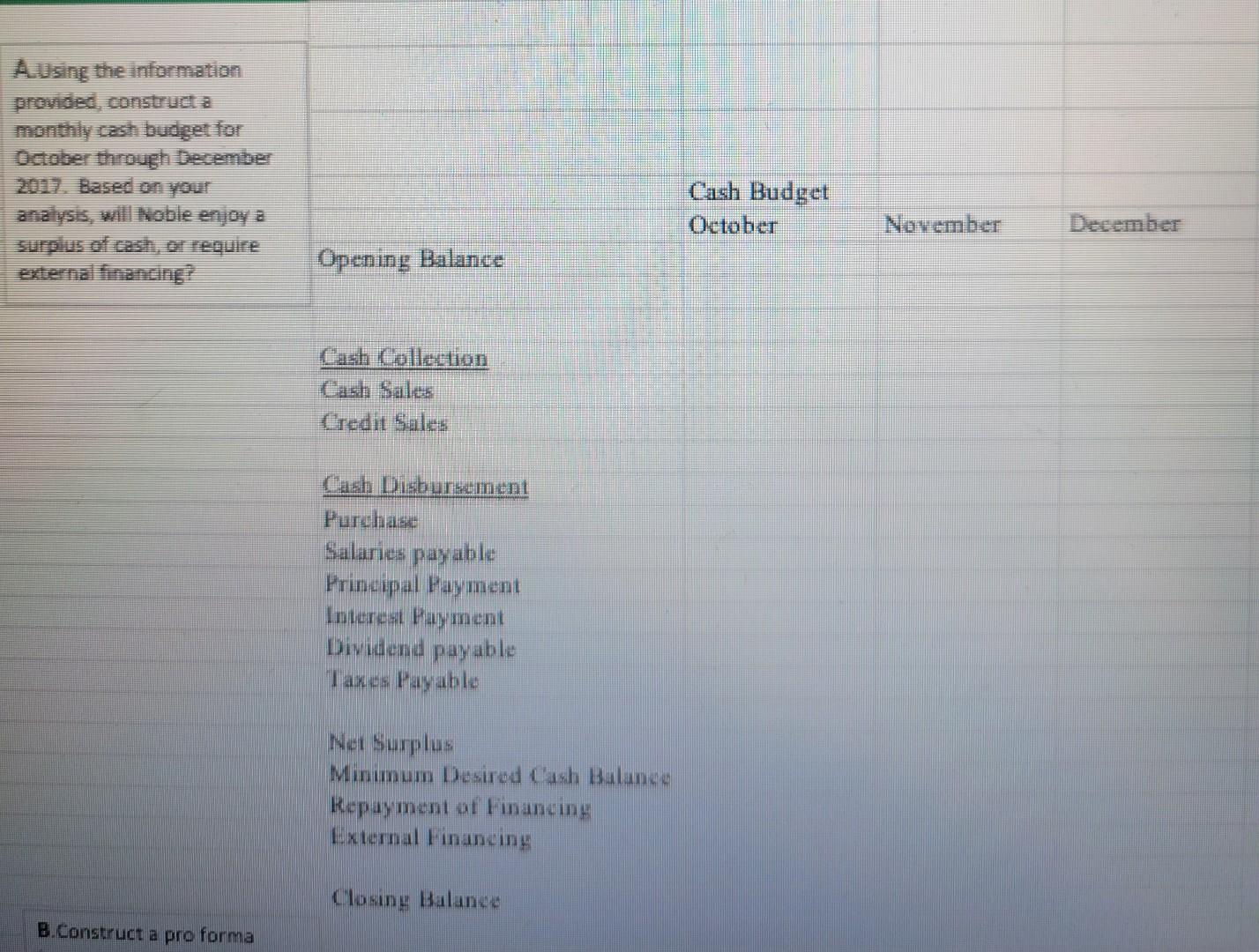

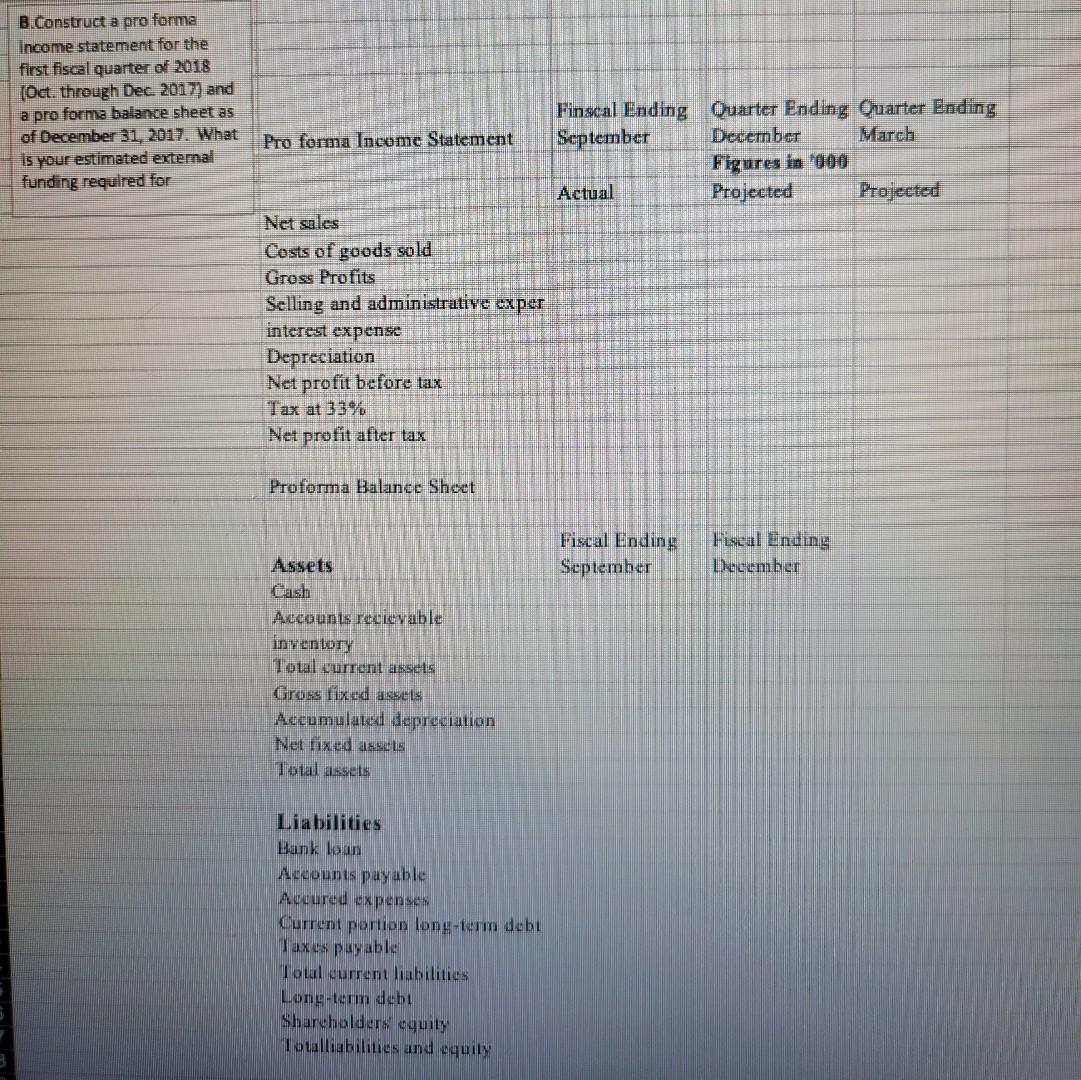

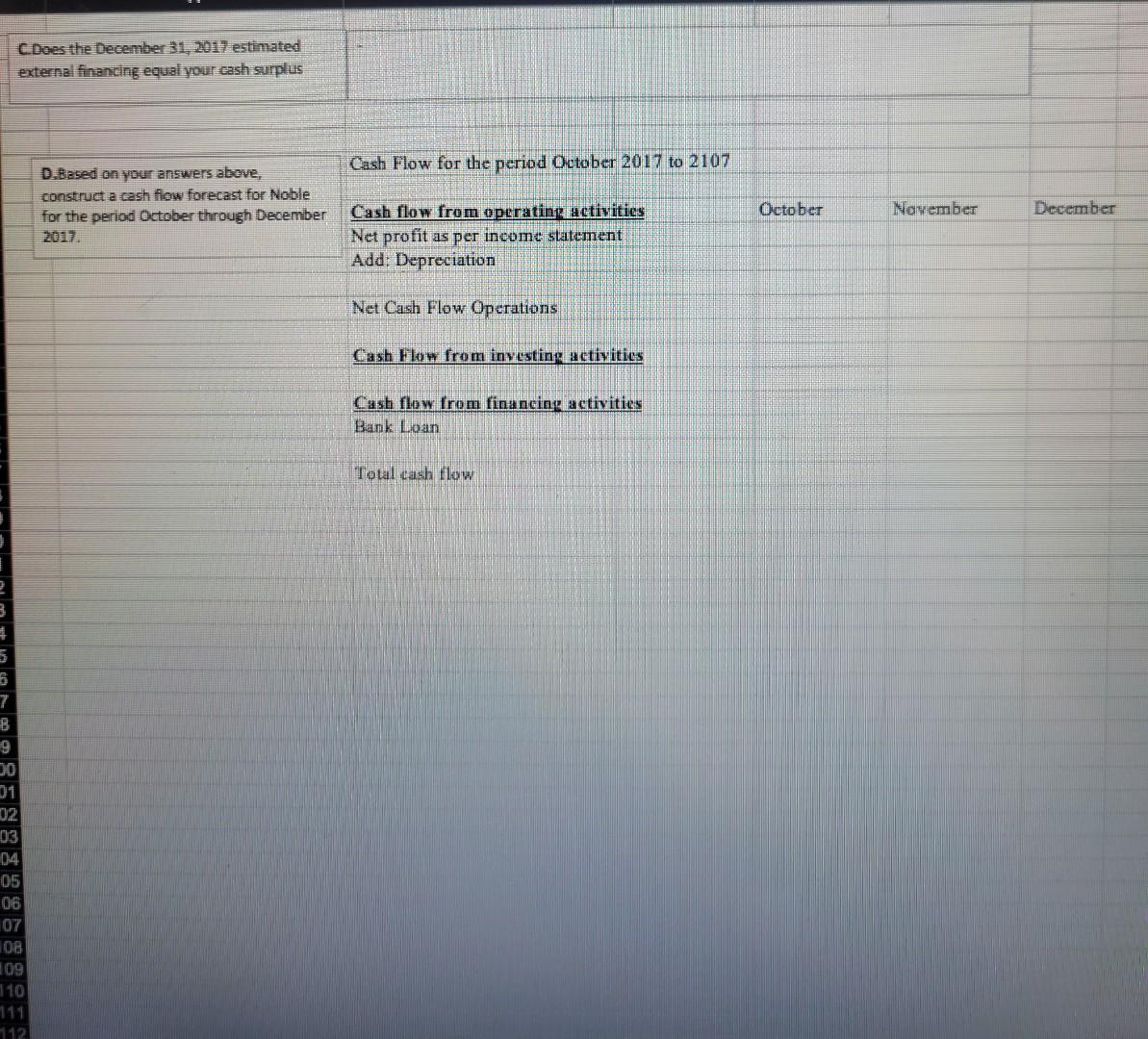

Using the information provided, construct a monthly cash budget for October through December 2017. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2018 (Oct. through Dee. 2017) and a pro forma balance sheet as of December 31, 2017. What is your estimated external funding required for December 31 ? c. Does the December 31,2017 estimated external financing equal your cash surplus (deficit) for this date from your cash budget? d. Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2017. a. Using the information provided, construct a monthly cash budget for October through December 2017. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2018 (Oet. through Dec. 2017) and a pro forma balance sheet as of December 31, 2017. What is your estimated external funding reouired for December 31 ? c. Does the December 31, 2017 estimated external financing equal your cash surplus (deficit) for this date from vour cash budget? d. Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2017. NOBLE EQUIPMENT CORP. Facts and assumptions Sales ( 20 percent for cash, the rest on 30 -day credit terms): Purchases (all on 60-day terms): 2 Selling and administrative expenses comstat entirely of salaricos. Depreciation is straight-line at the rate of 54 , ouo per quarter. Acerued expenses are not expeceted to ehange in the last quarter. S25.7 due Mecember 201.7. No payments for remainder af year. Ausing the information provided, construct a monthly cash budget for October through December 2017. 8ased on your Cash Budget analysis, will Hoble enjoy a October November Depember surplus of cash, or require external financing? Opening Balance Cash Ciollection Case Sales Credit Sales Cash Disbursement Purchase Salaries payable Principal Payment Intereat Payment Dividend payable I axes Payable Net Surplus Minimum Desired Cash Balance Repayment of financing External financing Closing Balance B.Construct a pro forma B. Construct a pro forma Income statement for the first fiscal quarter of 2018 [Oct. through Dec. 2017) and a pro forma balance sheet as Finscal Ending Quarter Ending Quarter Ending of December 31, 2017. What September December March is your estimated external Figures in 000 funding required for Actual Projected Projected Net sales Costs of goods sold Gross Profits Selling and adminisirative exper interest expense Depreciation Net profit before tax Tax at 33% Net profit after tax Proforma Balance Shcet Fiscal Ending Fiscal Ending Assets September December Cash Accounis recicvable inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed aspets Iotal assets Liabilities Hank loan Accounts payable Accured expenses Current portion long-termo debt Taxes payable Iotal eurrent liabilities Long-term debt Shareholders equity Totalliabilities and equity CDoes the December 31,2017 estimated external financing equal your eash surplus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts