Question: PART B ( 1 0 marks, 1 8 minutes ) Mr Mabena Morolong is the financial director of Defendify ( Pty ) Ltd . He

PART B marks, minutes

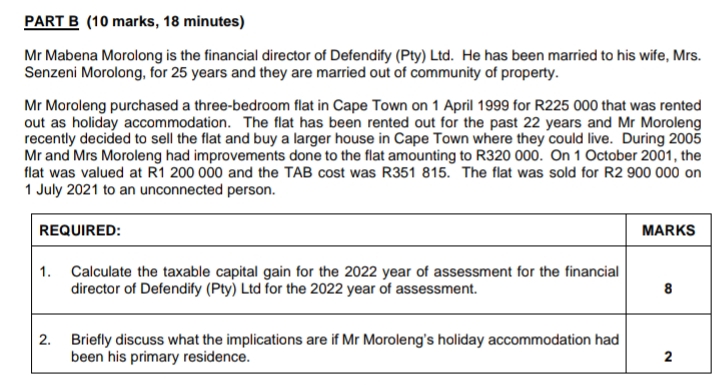

Mr Mabena Morolong is the financial director of Defendify Pty Ltd He has been married to his wife, Mrs Senzeni Morolong, for years and they are married out of community of property.

Mr Moroleng purchased a threebedroom flat in Cape Town on April for R that was rented out as holiday accommodation. The flat has been rented out for the past years and Mr Moroleng recently decided to sell the flat and buy a larger house in Cape Town where they could live. During Mr and Mrs Moroleng had improvements done to the flat amounting to R On October the flat was valued at R and the TAB cost was R The flat was sold for R on July to an unconnected person.

tableREQUIRED:tableMARKStableCalculate the taxable capital gain for the year of assessment for the financialdirector of Defendify Pty Ltd for the year of assessment.tableBriefly discuss what the implications are if Mr Moroleng's holiday accommodation hadbeen his primary residence.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock