Question: PART B 1. B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 4.2 percent. Calculate theinvestment's expected return and its

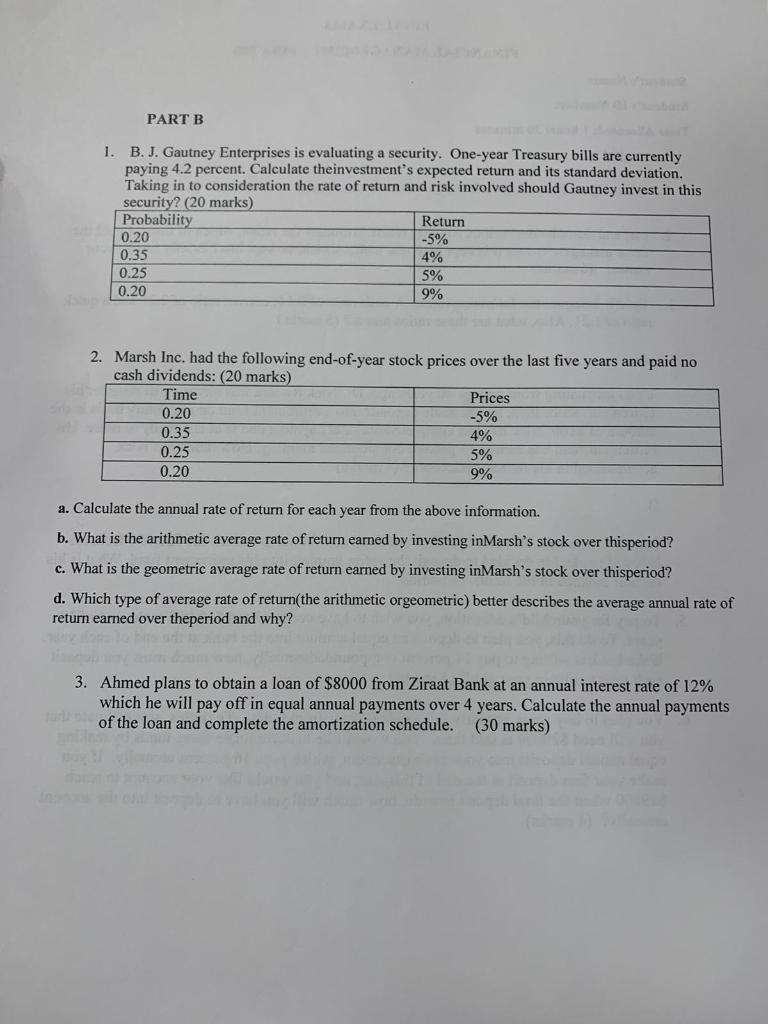

PART B 1. B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 4.2 percent. Calculate theinvestment's expected return and its standard deviation. Taking in to consideration the rate of return and risk involved should Gautney invest in this security? (20 marks) Probability Return 0.20 -5% 0.35 4% 0.25 5% 0.20 9% 2. Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends: (20 marks) Time Prices 0.20 -5% 0.35 4% 0.25 5% 0.20 9% a. Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of return earned by investing in Marsh's stock over thisperiod? c. What is the geometric average rate of return earned by investing in Marsh's stock over thisperiod? d. Which type of average rate of return(the arithmetic orgeometric) better describes the average annual rate of return earned over theperiod and why? 3. Ahmed plans to obtain a loan of $8000 from Ziraat Bank at an annual interest rate of 12% which he will pay off in equal annual payments over 4 years. Calculate the annual payments of the loan and complete the amortization schedule. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts