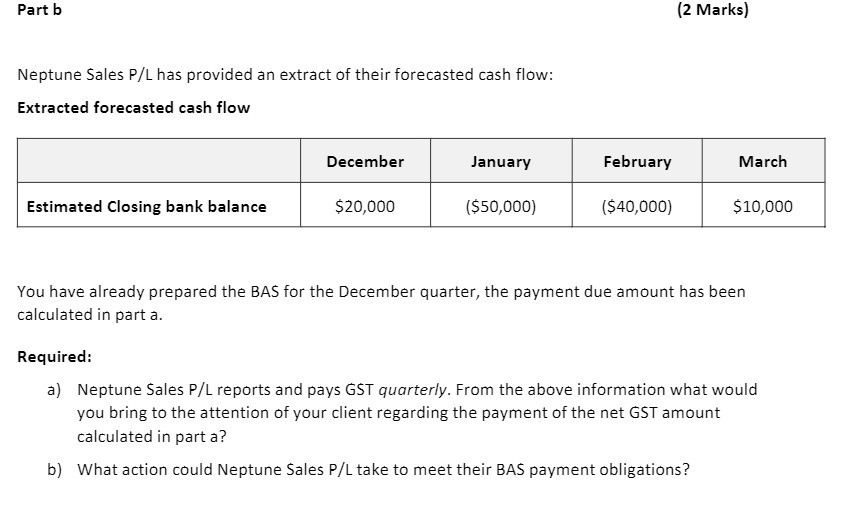

Question: Part b (2 Marks) Neptune Sales P/L has provided an extract of their forecasted cash flow: Extracted forecasted cash flow December January February March Estimated

Part b (2 Marks) Neptune Sales P/L has provided an extract of their forecasted cash flow: Extracted forecasted cash flow December January February March Estimated Closing bank balance $20,000 ($50,000) ($40,000) $10,000 You have already prepared the BAS for the December quarter, the payment due amount has been calculated in part a. Required: a) Neptune Sales P/L reports and pays GST quarterly. From the above information what would you bring to the attention of your client regarding the payment of the net GST amount calculated in part a? b) What action could Neptune Sales P/L take to meet their BAS payment obligations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock