Question: Part B (25 Marks) (Please include a timeline diagram to show the cash flows.) * It is now November 1st, 2018. Suppose you have a

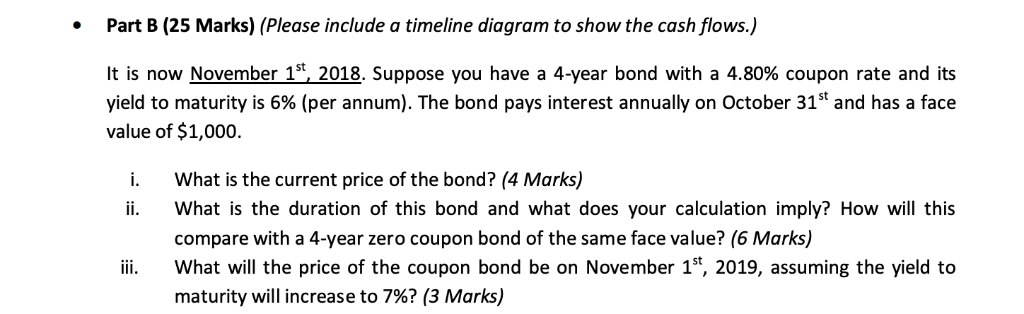

Part B (25 Marks) (Please include a timeline diagram to show the cash flows.) * It is now November 1st, 2018. Suppose you have a 4-year bond with a 4.80% coupon rate and its yield to maturity is 6% (per annum). The bond pays interest annually on October 31st and has a face value of $1,000. i. What is the current price of the bond? (4 Marks) What is the duration of this bond and what does your calculation imply? How will this compare with a 4-year zero coupon bond of the same face value? (6 Marks) ii. What will the price of the coupon bond be on November 1, 2019, assuming the yield to maturity will increase to 7%? (3 Marks) Part B (25 Marks) (Please include a timeline diagram to show the cash flows.) * It is now November 1st, 2018. Suppose you have a 4-year bond with a 4.80% coupon rate and its yield to maturity is 6% (per annum). The bond pays interest annually on October 31st and has a face value of $1,000. i. What is the current price of the bond? (4 Marks) What is the duration of this bond and what does your calculation imply? How will this compare with a 4-year zero coupon bond of the same face value? (6 Marks) ii. What will the price of the coupon bond be on November 1, 2019, assuming the yield to maturity will increase to 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts