Question: Part B: (8 Marks, 20 Minutes) Continental Logistics Inc. (CLI) is a public company with a December 31 year end. CLI has elected to use

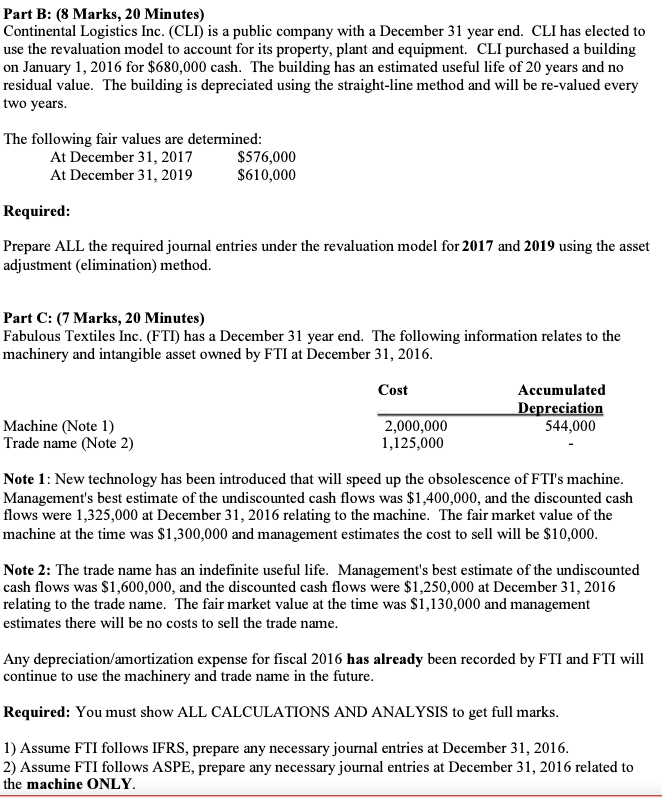

Part B: (8 Marks, 20 Minutes) Continental Logistics Inc. (CLI) is a public company with a December 31 year end. CLI has elected to use the revaluation model to account for its property, plant and equipment. CLI purchased a building on January 1, 2016 for $680,000 cash. The building has an estimated useful life of 20 years and no residual value. The building is depreciated using the straight-line method and will be re-valued every two years. The following fair values are determined: At December 31, 2017 $576,000 At December 31, 2019 $610,000 Required: Prepare ALL the required journal entries under the revaluation model for 2017 and 2019 using the asset adjustment (elimination) method. Part C: (7 Marks, 20 Minutes) Fabulous Textiles Inc. (FTI) has a December 31 year end. The following information relates to the machinery and intangible asset owned by FTI at December 31, 2016. Cost Accumulated Depreciation Machine (Note 1) 2,000,000 544,000 Trade name (Note 2) 1,125,000 Note 1: New technology has been introduced that will speed up the obsolescence of FTI's machine. Management's best estimate of the undiscounted cash flows was $1,400,000, and the discounted cash flows were 1,325,000 at December 31, 2016 relating to the machine. The fair market value of the machine at the time was $1,300,000 and management estimates the cost to sell will be $10,000. Note 2: The trade name has an indefinite useful life. Management's best estimate of the undiscounted cash flows was $1,600,000, and the discounted cash flows were $1,250,000 at December 31, 2016 relating to the trade name. The fair market value at the time was $1, 130,000 and management estimates there will be no costs to sell the trade name. Any depreciation/amortization expense for fiscal 2016 has already been recorded by FTI and FTI will continue to use the machinery and trade name in the future. Required: You must show ALL CALCULATIONS AND ANALYSIS to get full marks. 1) Assume FTI follows IFRS, prepare any necessary journal entries at December 31, 2016. 2) Assume FTI follows ASPE, prepare any necessary journal entries at December 31, 2016 related to the machine ONLY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts