Question: Part B (8.5 Marks) Your client Electrical Services Pty Ltd has 52 employees and has approached you for advice on the following transactions: a Payment

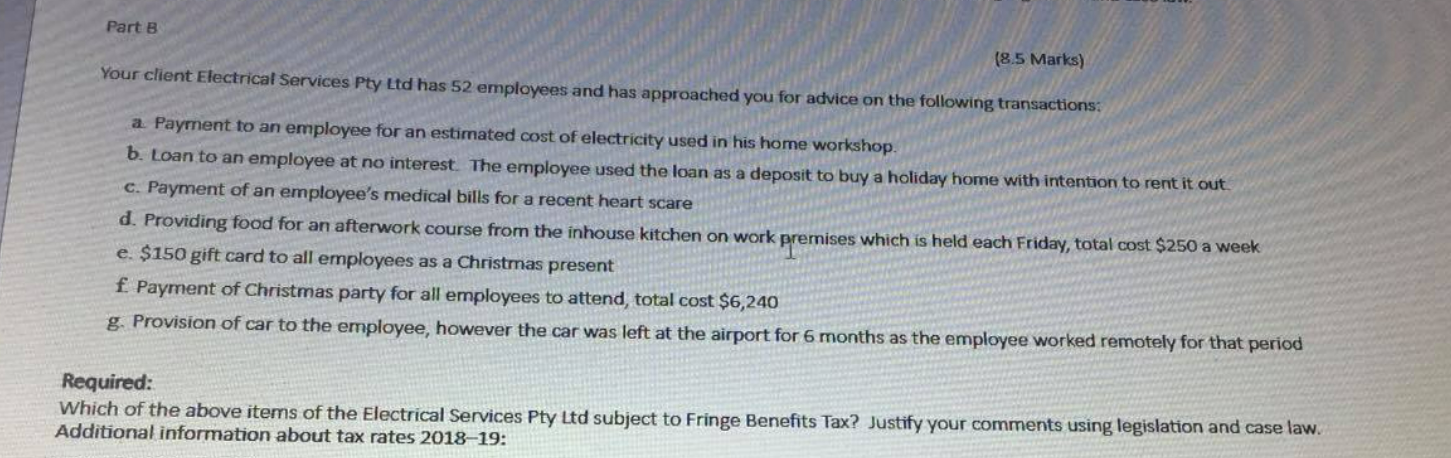

Part B (8.5 Marks) Your client Electrical Services Pty Ltd has 52 employees and has approached you for advice on the following transactions: a Payment to an employee for an estimated cost of electricity used in his home workshop b. Loan to an employee at no interest. The employee used the loan as a deposit to buy a holiday home with intention to rent it out c. Payment of an employee's medical bills for a recent heart scare d. Providing food for an afterwork course from the inhouse kitchen on work premises which is held each Friday, total cost $250 a week e. $150 gift card to all employees as a Christmas present f Payment of Christmas party for all employees to attend, total cost $6,240 g. Provision of car to the employee, however the car was left at the airport for 6 months as the employee worked remotely for that period Required: Which of the above items of the Electrical Services Pty Ltd subject to Fringe Benefits Tax? Justify your comments using legislation and case law. Additional information about tax rates 2018-19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts