Question: PART B: Additional information was available after the Financial Statements in Part A were completed. Critically analyze, the effect of each of the following

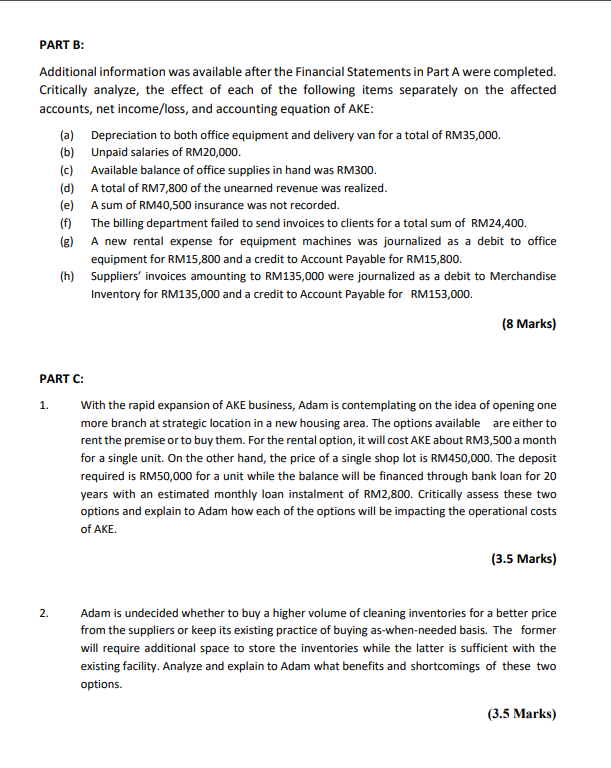

PART B: Additional information was available after the Financial Statements in Part A were completed. Critically analyze, the effect of each of the following items separately on the affected accounts, net income/loss, and accounting equation of AKE: Depreciation to both office equipment and delivery van for a total of RM35,000. Unpaid salaries of RM20,000. (a) (b) (c) A total of RM7,800 of the unearned revenue was realized. (d) (e) (f) (g) Available balance of office supplies in hand was RM300. A sum of RM40,500 insurance was not recorded. The billing department failed to send invoices to clients for a total sum of RM24,400. A new rental expense for equipment machines was journalized as a debit to office equipment for RM15,800 and a credit to Account Payable for RM15,800. (h) Suppliers' invoices amounting to RM135,000 were journalized as a debit to Merchandise Inventory for RM135,000 and a credit to Account Payable for RM153,000. (8 Marks) PART C: 1. With the rapid expansion of AKE business, Adam is contemplating on the idea of opening one more branch at strategic location in a new housing area. The options available are either to rent the premise or to buy them. For the rental option, it will cost AKE about RM3,500 a month for a single unit. On the other hand, the price of a single shop lot is RM450,000. The deposit required is RM50,000 for a unit while the balance will be financed through bank loan for 20 years with an estimated monthly loan instalment of RM2,800. Critically assess these two options and explain to Adam how each of the options will be impacting the operational costs of AKE. (3.5 Marks) 2. Adam is undecided whether to buy a higher volume of cleaning inventories for a better price from the suppliers or keep its existing practice of buying as-when-needed basis. The former will require additional space to store the inventories while the latter is sufficient with the existing facility. Analyze and explain to Adam what benefits and shortcomings of these two options. (3.5 Marks)

Step by Step Solution

There are 3 Steps involved in it

PART B a Depreciation to both office equipment and delivery van for a total of RM35000 Effect on affected accounts Depreciation expense account will increase while accumulated depreciation accounts fo... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6642ae6cddf3b_976112.pdf

180 KBs PDF File

6642ae6cddf3b_976112.docx

120 KBs Word File