Question: Part (B) Case Analysis - Second Iteration Tanner has been informed that AIC's expense to process subrogated claims is 15% of the value of their

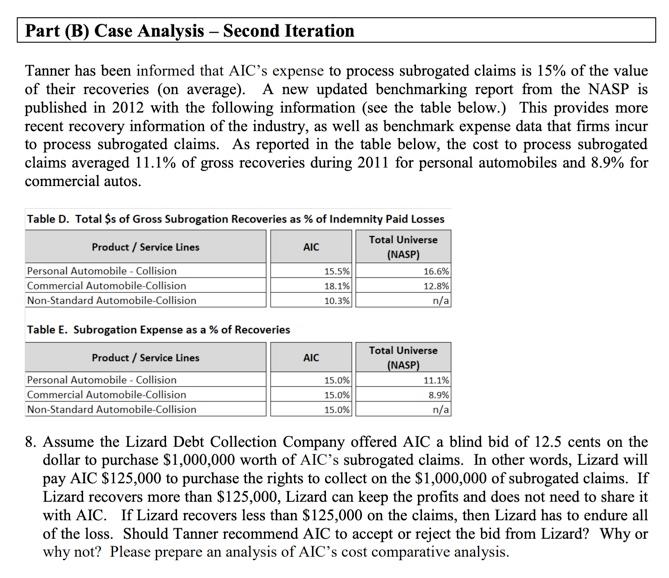

Part (B) Case Analysis - Second Iteration Tanner has been informed that AIC's expense to process subrogated claims is 15% of the value of their recoveries (on average). A new updated benchmarking report from the NASP is published in 2012 with the following information (see the table below.) This provides more recent recovery information of the industry, as well as benchmark expense data that firms incur to process subrogated claims. As reported in the table below, the cost to process subrogated claims averaged 11.1% of gross recoveries during 2011 for personal automobiles and 8.9% for commercial autos. AIC 15.5% 18.1% 10.3% 16.6% 12.8% n/a Table D. Total $s of Gross Subrogation Recoveries as % of Indemnity Paid Losses Total Universe Product/Service Lines (NASP) Personal Automobile - Collision Commercial Automobile-Collision Non-Standard Automobile-Collision Table E. Subrogation Expense as a % of Recoveries Total Universe Product/Service Lines AIC (NASP) Personal Automobile - Collision Commercial Automobile-Collision 8.9% Non-Standard Automobile-Collision 15.0% n/a 11.1% 15.0% 15.0% 8. Assume the Lizard Debt Collection Company offered AIC a blind bid of 12.5 cents on the dollar to purchase $1,000,000 worth of AIC's subrogated claims. In other words, Lizard will pay AIC $125,000 to purchase the rights to collect on the $1,000,000 of subrogated claims. Lizard recovers more than $125,000, Lizard can keep the profits and does not need to share it with AIC. If Lizard recovers less than $125,000 on the claims, then Lizard has to endure all of the loss. Should Tanner recommend AIC to accept or reject the bid from Lizard? Why or why not? Please prepare an analysis of AIC's cost comparative analysis. Part (B) Case Analysis - Second Iteration Tanner has been informed that AIC's expense to process subrogated claims is 15% of the value of their recoveries (on average). A new updated benchmarking report from the NASP is published in 2012 with the following information (see the table below.) This provides more recent recovery information of the industry, as well as benchmark expense data that firms incur to process subrogated claims. As reported in the table below, the cost to process subrogated claims averaged 11.1% of gross recoveries during 2011 for personal automobiles and 8.9% for commercial autos. AIC 15.5% 18.1% 10.3% 16.6% 12.8% n/a Table D. Total $s of Gross Subrogation Recoveries as % of Indemnity Paid Losses Total Universe Product/Service Lines (NASP) Personal Automobile - Collision Commercial Automobile-Collision Non-Standard Automobile-Collision Table E. Subrogation Expense as a % of Recoveries Total Universe Product/Service Lines AIC (NASP) Personal Automobile - Collision Commercial Automobile-Collision 8.9% Non-Standard Automobile-Collision 15.0% n/a 11.1% 15.0% 15.0% 8. Assume the Lizard Debt Collection Company offered AIC a blind bid of 12.5 cents on the dollar to purchase $1,000,000 worth of AIC's subrogated claims. In other words, Lizard will pay AIC $125,000 to purchase the rights to collect on the $1,000,000 of subrogated claims. Lizard recovers more than $125,000, Lizard can keep the profits and does not need to share it with AIC. If Lizard recovers less than $125,000 on the claims, then Lizard has to endure all of the loss. Should Tanner recommend AIC to accept or reject the bid from Lizard? Why or why not? Please prepare an analysis of AIC's cost comparative analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts