Question: Part B Defined benefit pension scheme - Maximum word limit for B = 900 words UB40 plc operates a defined benefit pension scheme for all

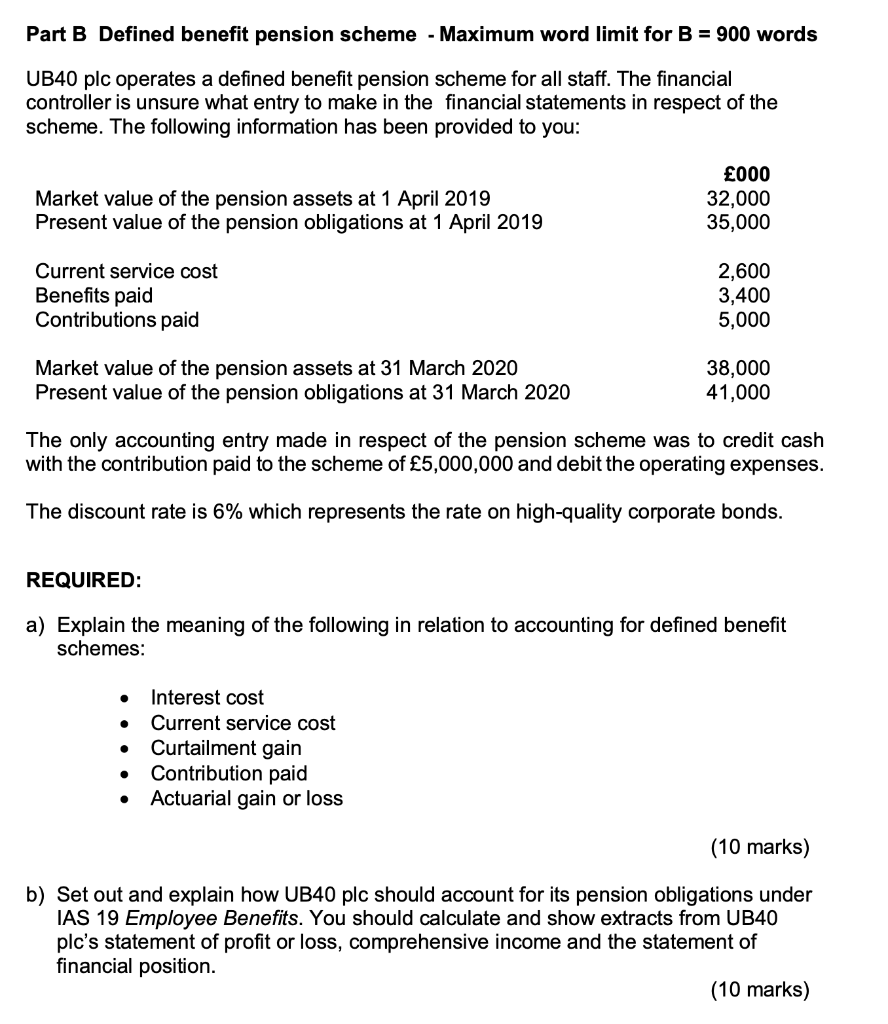

Part B Defined benefit pension scheme - Maximum word limit for B = 900 words UB40 plc operates a defined benefit pension scheme for all staff. The financial controller is unsure what entry to make in the financial statements in respect of the scheme. The following information has been provided to you: Market value of the pension assets at 1 April 2019 Present value of the pension obligations at 1 April 2019 000 32,000 35,000 Current service cost Benefits paid Contributions paid 2,600 3,400 5,000 Market value of the pension assets at 31 March 2020 Present value of the pension obligations at 31 March 2020 38,000 41,000 The only accounting entry made in respect of the pension scheme was to credit cash with the contribution paid to the scheme of 5,000,000 and debit the operating expenses. The discount rate is 6% which represents the rate on high-quality corporate bonds. REQUIRED: a) Explain the meaning of the following in relation to accounting for defined benefit schemes: . . Interest cost Current service cost Curtailment gain Contribution paid Actuarial gain or loss . (10 marks) b) Set out and explain how UB40 plc should account for its pension obligations under IAS 19 Employee Benefits. You should calculate and show extracts from UB40 plc's statement of profit or loss, comprehensive income and the statement of financial position. (10 marks) Part B Defined benefit pension scheme - Maximum word limit for B = 900 words UB40 plc operates a defined benefit pension scheme for all staff. The financial controller is unsure what entry to make in the financial statements in respect of the scheme. The following information has been provided to you: Market value of the pension assets at 1 April 2019 Present value of the pension obligations at 1 April 2019 000 32,000 35,000 Current service cost Benefits paid Contributions paid 2,600 3,400 5,000 Market value of the pension assets at 31 March 2020 Present value of the pension obligations at 31 March 2020 38,000 41,000 The only accounting entry made in respect of the pension scheme was to credit cash with the contribution paid to the scheme of 5,000,000 and debit the operating expenses. The discount rate is 6% which represents the rate on high-quality corporate bonds. REQUIRED: a) Explain the meaning of the following in relation to accounting for defined benefit schemes: . . Interest cost Current service cost Curtailment gain Contribution paid Actuarial gain or loss . (10 marks) b) Set out and explain how UB40 plc should account for its pension obligations under IAS 19 Employee Benefits. You should calculate and show extracts from UB40 plc's statement of profit or loss, comprehensive income and the statement of financial position. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts