Question: Part B is needed Consider the investment projects given in the table below. Assume that MAR-15% in the following questions. Click the icon to view

Part B is needed

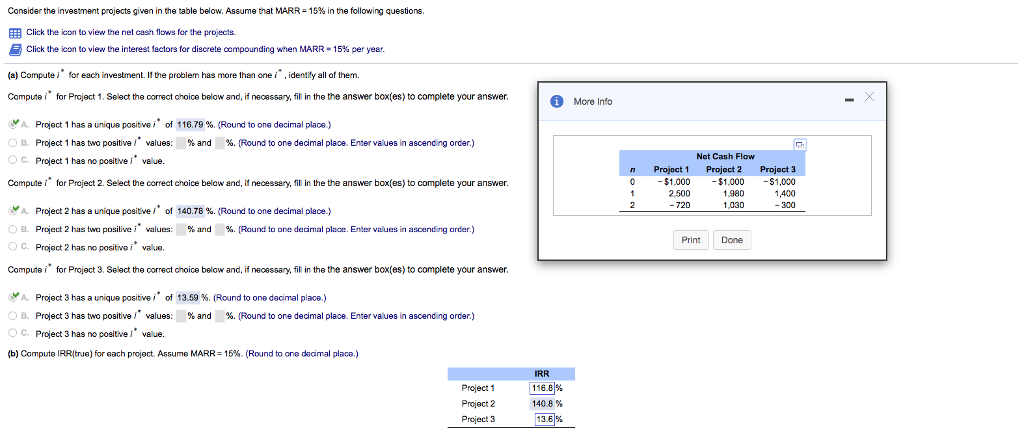

Consider the investment projects given in the table below. Assume that MAR-15% in the following questions. Click the icon to view the net cash flows for the projects. Click the icon to view the interest factors for discrete compounding when MARR-15% per year (a) Computei for each investment. If the problem has more than onei, identiy all of them. Compuifor Project 1. Select the correct choice below and, if necessary, fill in the the answer box(es) to complete your answer More Info A. Project 1 has a unique positive , of 116.79 %. (Round to one decimal place.) 0 B. Project 1 has two positive j. values: % and %. (Round to one dedmal place. Enter values in ascending order.) OC. Project 1 has no positve i' value. Computei for Project 2. Select the correct choice below and, if necessery, fillin the the answer box(es) to complete your answer Net Cash Flow n Projoct 1 Project 2 Project 3 $1,000 -$1,000 1400 300 $1,000 2,500 720 1,980 1,030 A Project 2 has a unique positive of 140.78 %. (Round to one decimal place.) 0 B. Proiect 2 has two positive ,values: % and %. Round to one decimal place. Enter values in ascending order.) 0 C. Project 2 has no positive ,+ value. Computei for Project 3. Select the correct choice below and, if necessary, il in the the answer box(es) to complete your answer . Print Done Project 3 has a unique positive i of 13.59 %. (Round to one decimal place.) O B. Project 3 has two positive j. values: % and %. (Round to one dedmal place. Enter values in ascending order.) OC. Project 3 has no positve i' value. (b) Compute IRR(true) for each project. Assume MARR-15%. (Round to one doimal place.) IRR Project 1 Project 2 Project 3 116.8% 140.8 % 13.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts