Question: Ken is a Malaysian born engineer working and living in Brisbane, Australia, since 2015. In 2015, Ken had moved with his family from Malaysia

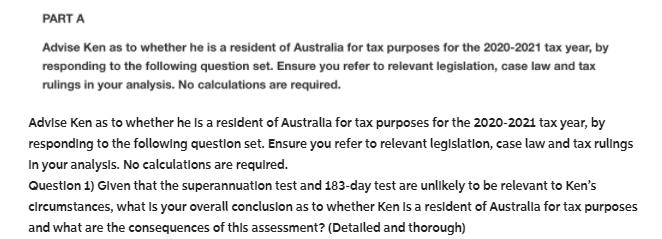

Ken is a Malaysian born engineer working and living in Brisbane, Australia, since 2015. In 2015, Ken had moved with his family from Malaysia with the intention of living in Australia permanently. With that in mind, Ken purchased a house in Brisbane and his children began attending a local primary school. Ken retains a joint bank account with his wife in Malaysia; however, also opened a joint account in Australia the year he arrived. Since moving to Australia, Ken has also invested in a Malaysian company. In July 2020, Ken was engaged in a project off the coast of the United States (US) for a period of three years. Ken was headhunted for this role, due to his specialist engineering skills, with the contract being signed in Australia before departing. The wages from his US role is paid into his jointly held Australian bank account. Since beginning his US role, to have regular visits with his family, Ken's family usually travels overseas, rather than returning to Australia. In which part of the world the family meets up at is decided on an ad hoc basis, although it is often in Malaysia, where his extended family resides. In fact, Ken has visited Australia only once during one of his rostered weeks off. PART A Advise Ken as to whether he is a resident of Australia for tax purposes for the 2020-2021 tax year, by responding to the following question set. Ensure you refer to relevant legislation, case law and tax rulings in your analysis. No calculations are required. Advise Ken as to whether he Is a resident of Australla for tax purposes for the 2020-2021 tax year, by responding to the following questlon set. Ensure you refer to relevant legislatlon, case law and tax rullngs In your analysls. No calculations are required. Questlon 1) Glven that the superannuatlon test and 183-day test are unlikely to be relevant to Ken's circumstances, what Is your overall concluslon as to whether Ken Is a resident of Australla for tax purposes and what are the consequences of this assessment? (Detalled and thorough) Part B The 3-year US contract that Ken signed included a clause stating that: "If your employment is terminated, you are not to work for any other company in the industry, other than this company for a period of one year." In agreeing to this clause, Ken was paid an additional one-off lump-sum of AU$65,000 on top of his annual wage. Advise Ken as to the Australian tax treatment of the money received from his US role by answering the following question set. Ensure you refer to relevant legislation, case law and tax rulings in your analysis. No calculations are required. Question Determine whether the one-off lump-sum will be treated as income or capital and explain your conclusion thoroughly

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

An individual is considered to be an Australian tax resident if the individual resides in Australia ... View full answer

Get step-by-step solutions from verified subject matter experts