Question: ... Part B: (Open book) Answer the following two questions Q4) The projected costs for a new plant are given below (all numbers are in

...

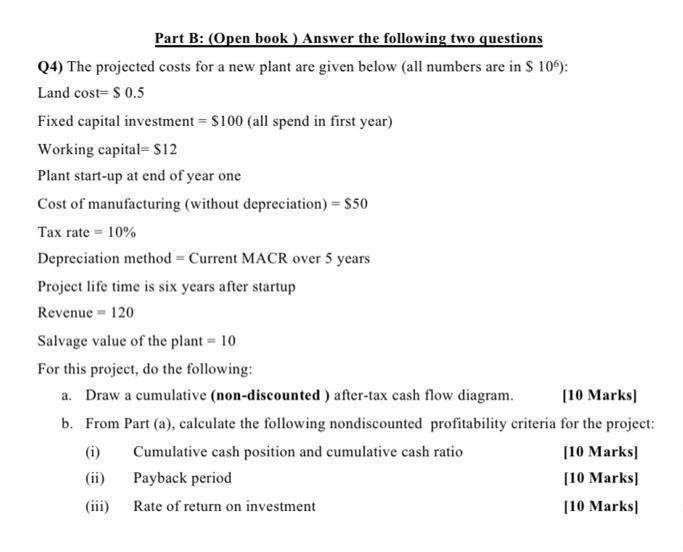

Part B: (Open book) Answer the following two questions Q4) The projected costs for a new plant are given below (all numbers are in $ 106): Land cost- $ 0.5 Fixed capital investment = $100 (all spend in first year) Working capital $12 Plant start-up at end of year one Cost of manufacturing (without depreciation) = $50 Tax rate = 10% Depreciation method = Current MACR over 5 years Project life time is six years after startup Revenue = 120 Salvage value of the plant = 10 For this project, do the following: a. Draw a cumulative (non-discounted) after-tax cash flow diagram. b. From Part (a), calculate the following nondiscounted profitability criteria Cumulative cash position and cumulative cash ratio (i) (ii) Payback period (iii) Rate of return on investment. [10 Marks] for the project: [10 Marks] [10 Marks] [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts