Question: PART B - OPEN-ENDED PROBLEMS PROBLEM 1 Today is your first day as an intern at the large Consulting Company. Your supervisor Mrs. Filipovich approaches

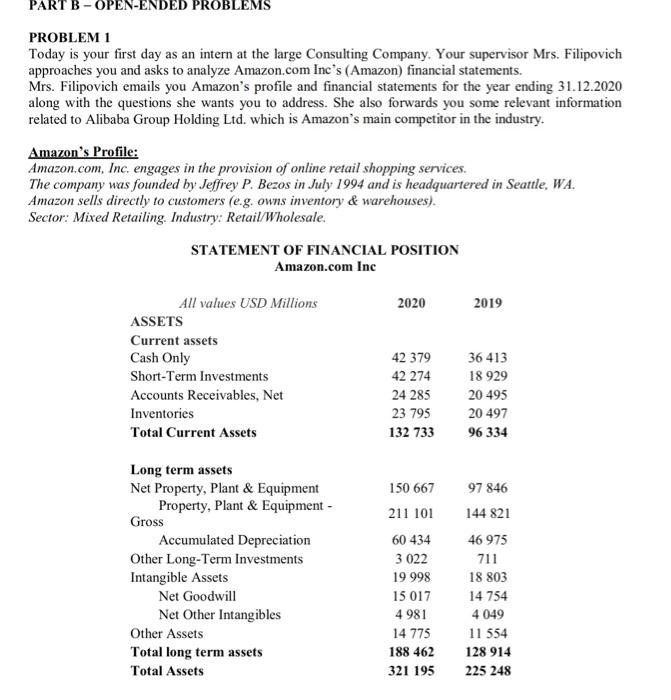

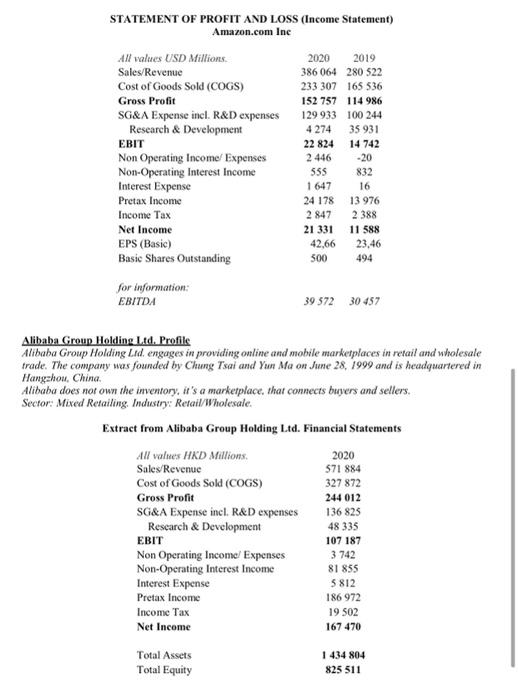

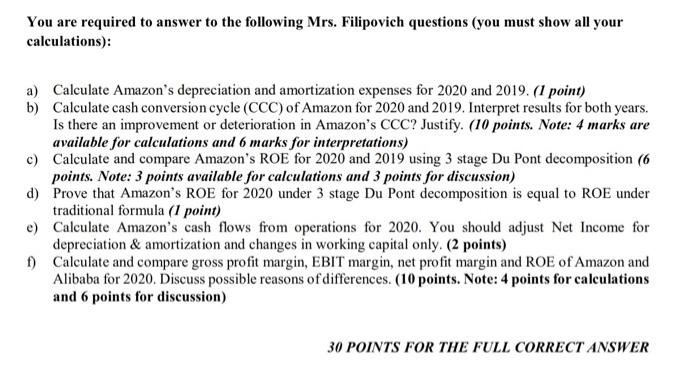

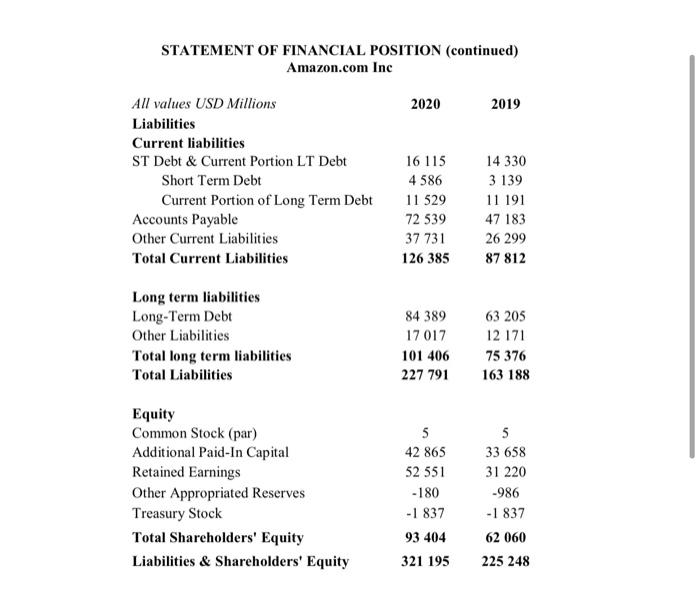

PART B - OPEN-ENDED PROBLEMS PROBLEM 1 Today is your first day as an intern at the large Consulting Company. Your supervisor Mrs. Filipovich approaches you and asks to analyze Amazon.com Incs (Amazon) financial statements. Mrs. Filipovich emails you Amazon's profile and financial statements for the year ending 31.12.2020 along with the questions she wants you to address. She also forwards you some relevant information related to Alibaba Group Holding Ltd. which is Amazon's main competitor in the industry. Amazon's Profile: Amazon.com, Inc. engages in the provision of online retail shopping services. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA. Amazon sells directly to customers (e.g. owns inventory & warehouses). Sector: Mixed Retailing. Industry: Retail/Wholesale. STATEMENT OF FINANCIAL POSITION Amazon.com Inc 2020 2019 All values USD Millions ASSETS Current assets Cash Only Short-Term Investments Accounts Receivables, Net Inventories Total Current Assets 42 379 42 274 24 285 23 795 132 733 36 413 18 929 20 495 20 497 96 334 Long term assets Net Property, Plant & Equipment Property, Plant & Equipment Gross Accumulated Depreciation Other Long-Term Investments Intangible Assets Net Goodwill Net Other Intangibles Other Assets Total long term assets Total Assets 150 667 211 101 60 434 3 022 19 998 15017 4981 14 775 188 462 321 195 97 846 144 821 46 975 711 18 803 14 754 4049 11 554 128 914 225 248 STATEMENT OF PROFIT AND LOSS (Income Statement) Amazon.com Inc All values USD Millions 2020 2019 Sales/Revenue 386 064 280 522 Cost of Goods Sold (COGS) 233 307 165 536 Gross Profit 152 757 114 986 SG&A Expense incl. R&D expenses 129 933 100 244 Research & Development 4 274 35 931 EBIT 22 824 14742 Non Operating Income Expenses 2 446 -20 Non-Operating Interest Income 555 832 Interest Expense 1 647 16 Pretax Income 24 178 13 976 Income Tax 2 847 2 388 Net Income 21 331 11 588 EPS (Basic) 42,66 23.46 Basic Shares Outstanding 494 500 for information: EBITDA 39 572 30457 Alibaba Group Holding Ltd. Profile Alibaba Group Holding Lid engages in providing online and mobile marketplaces in retail and wholesale trade. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China Alibaba does not own the inventory, it's a marketplace that connects buyers and sellers. Sector: Mixed Retailing. Industry: Retail/Wholesale. Extract from Alibaba Group Holding Ltd. Financial Statements All values HKD Millions 2020 Sales/Revenue 571 884 Cost of Goods Sold (COGS) 327 872 Gross Profit 244012 SG&A Expense incl. R&D expenses 136 825 Rescarch & Development 48 335 EBIT 107 187 Non Operating Income Expenses 3 742 Non-Operating Interest Income 81 855 Interest Expense 5812 Pretax Income 186 972 Income Tax 19 502 Net Income 167 470 Total Assets Total Equity 1 434 804 825 511 You are required to answer to the following Mrs. Filipovich questions (you must show all your calculations): a) Calculate Amazon's depreciation and amortization expenses for 2020 and 2019. (1 point) b) Calculate cash conversion cycle (CCC) of Amazon for 2020 and 2019. Interpret results for both years. Is there an improvement or deterioration in Amazon's CCC? Justify. (10 points. Note: 4 marks are available for calculations and 6 marks for interpretations) c) Calculate and compare Amazon's ROE for 2020 and 2019 using 3 stage Du Pont decomposition (6 points. Note: 3 points available for calculations and 3 points for discussion) d) Prove that Amazon's ROE for 2020 under 3 stage Du Pont decomposition is equal to ROE under traditional formula (1 point) e) Calculate Amazon's cash flows from operations for 2020. You should adjust Net Income for depreciation & amortization and changes in working capital only. (2 points) 1) Calculate and compare gross profit margin, EBIT margin, net profit margin and ROE of Amazon and Alibaba for 2020. Discuss possible reasons of differences. (10 points. Note: 4 points for calculations and 6 points for discussion) 30 POINTS FOR THE FULL CORRECT ANSWER STATEMENT OF FINANCIAL POSITION (continued) Amazon.com Inc 2020 2019 All values USD Millions Liabilities Current liabilities ST Debt & Current Portion LT Debt Short Term Debt Current Portion of Long Term Debt Accounts Payable Other Current Liabilities Total Current Liabilities 16 115 4 586 11 529 72 539 37 731 126 385 14 330 3 139 11 191 47 183 26 299 87 812 Long term liabilities Long-Term Debt Other Liabilities Total long term liabilities Total Liabilities 84 389 17017 101 406 227 791 63 205 12 171 75 376 163 188 Equity Common Stock (par) Additional Paid-In Capital Retained Earnings Other Appropriated Reserves Treasury Stock Total Shareholders' Equity Liabilities & Shareholders' Equity 5 42 865 52 551 -180 -1 837 93 404 321 195 5 33 658 31 220 -986 -1 837 62 060 225 248

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts