Question: PART B - OPEN-ENDED PROBLEMS PROBLEM 2 Mr. and Mrs. Omarov are just married. They have decided to buy an apartment in Almaty. Mr. and

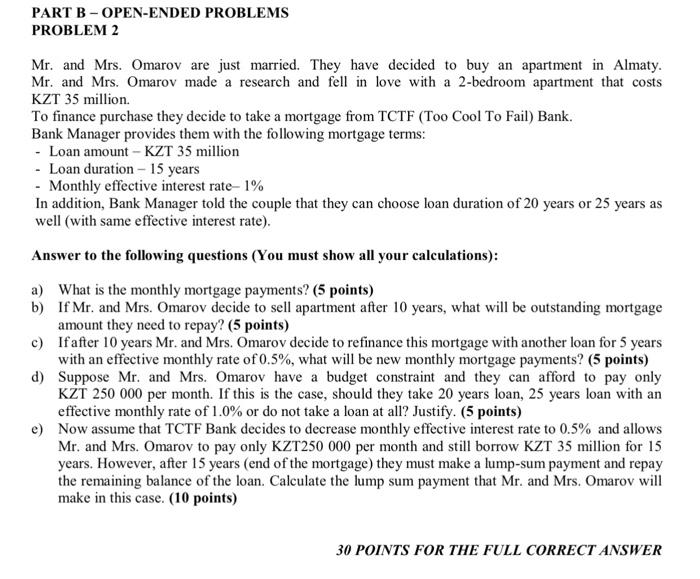

PART B - OPEN-ENDED PROBLEMS PROBLEM 2 Mr. and Mrs. Omarov are just married. They have decided to buy an apartment in Almaty. Mr. and Mrs. Omarov made a research and fell in love with a 2-bedroom apartment that costs KZT 35 million. To finance purchase they decide to take a mortgage from TCTF (Too Cool To Fail) Bank. Bank Manager provides them with the following mortgage terms: Loan amount - KZT 35 million - Loan duration - 15 years - Monthly effective interest rate 1% In addition, Bank Manager told the couple that they can choose loan duration of 20 years or 25 years as well (with same effective interest rate). Answer to the following questions (You must show all your calculations): a) What is the monthly mortgage payments? (5 points) b) If Mr. and Mrs. Omarov decide to sell apartment after 10 years, what will be outstanding mortgage amount they need to repay? (5 points) c) Ifafter 10 years Mr. and Mrs. Omarov decide to refinance this mortgage with another loan for 5 years with an effective monthly rate of 0.5%, what will be new monthly mortgage payments? (5 points) d) Suppose Mr. and Mrs. Omarov have a budget constraint and they can afford to pay only KZT 250 000 per month. If this is the case, should they take 20 years loan, 25 years loan with an effective monthly rate of 1.0% or do not take a loan at all? Justify. (5 points) e) Now assume that TCTF Bank decides to decrease monthly effective interest rate to 0.5% and allows Mr. and Mrs. Omarov to pay only KZT250 000 per month and still borrow KZT 35 million for 15 years. However, after 15 years (end of the mortgage) they must make a lump-sum payment and repay the remaining balance of the loan. Calculate the lump sum payment that Mr. and Mrs. Omarov will make in this case. (10 points) 30 POINTS FOR THE FULL CORRECT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts