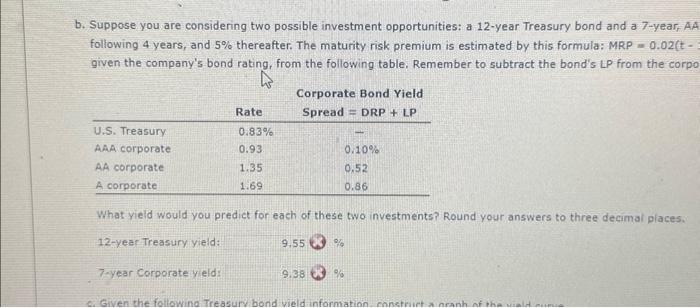

Question: part B please b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA following 4 years, and 5%

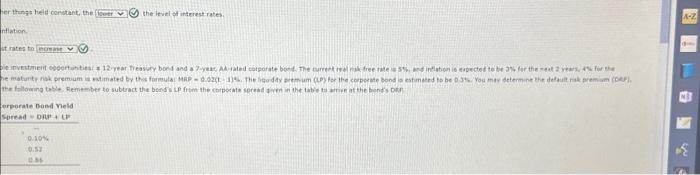

b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA following 4 years, and 5% thereafter. The maturity risk premium is estimated by this formula: MRP =0.02 ( t given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corpo What yieid would you predict for each of these two investments? Round your answers to three decimai places. 12-vear Treasury yield: 7-year Corporate yeld: % % or thengs heid constant; the the itvel of interest rates. flation. D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts