Question: PART B PLESE PART B PLEASE For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31. Step

PART B PLESE

PART B PLEASE

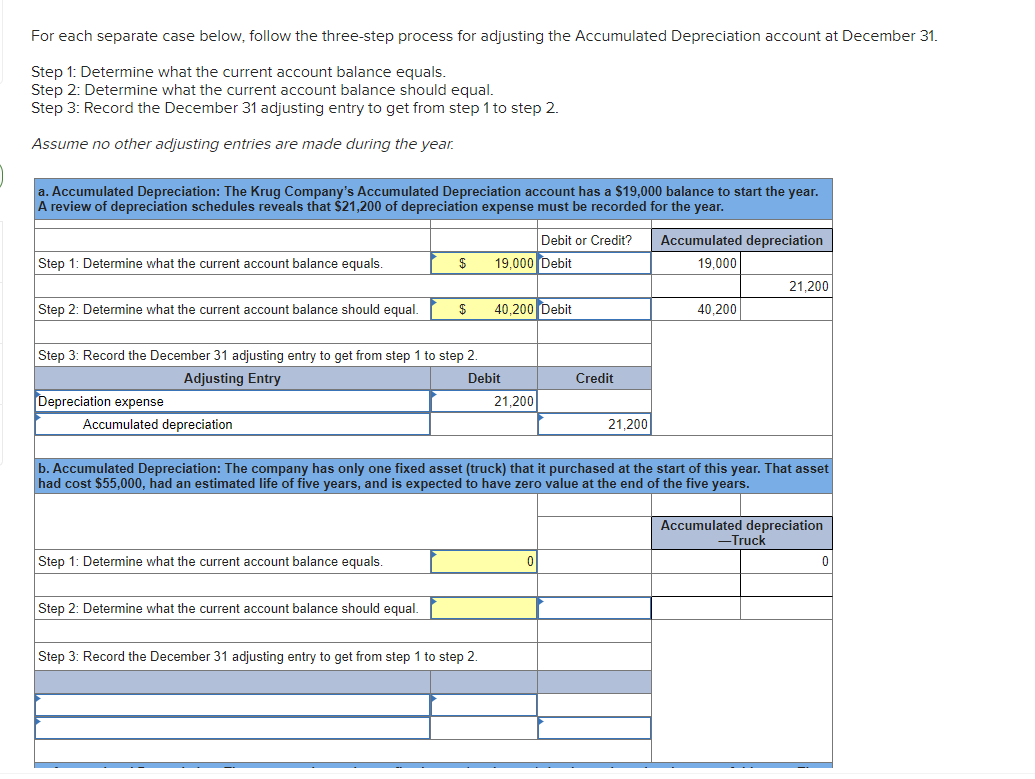

For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $19,000 balance to start the year. A review of depreciation schedules reveals that $21,200 of depreciation expense must be recorded for the year. Debit or Credit? 19,000 Debit Accumulated depreciation 19.000 Step 1: Determine what the current account balance equals. $ 21,200 Step 2: Determine what the current account balance should equal. $ 40,200 Debit 40,200 Credit Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Adjusting Entry Debit Depreciation expense 21,200 Accumulated depreciation 21,200 b. Accumulated Depreciation: The company has only one fixed asset (truck) that it purchased at the start of this year. That asset had cost $55,000, had an estimated life of five years, and is expected to have zero value at the end of the five years. Accumulated depreciation -Truck 0 Step 1: Determine what the current account balance equals 0 Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts