Question: part b. prepare a comprehensive income statement part c. prepare a retained earnings statement -please show work and steps :) The following information was taken

part b. prepare a comprehensive income statement

part b. prepare a comprehensive income statement

part c. prepare a retained earnings statement

-please show work and steps :)

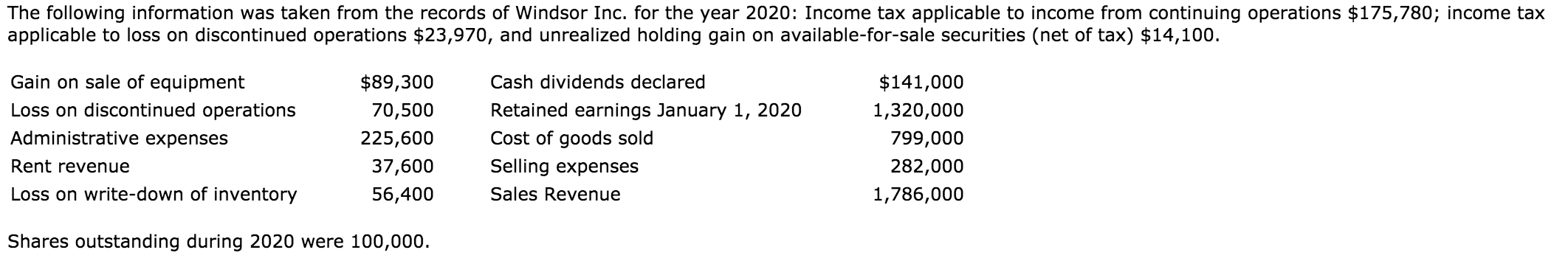

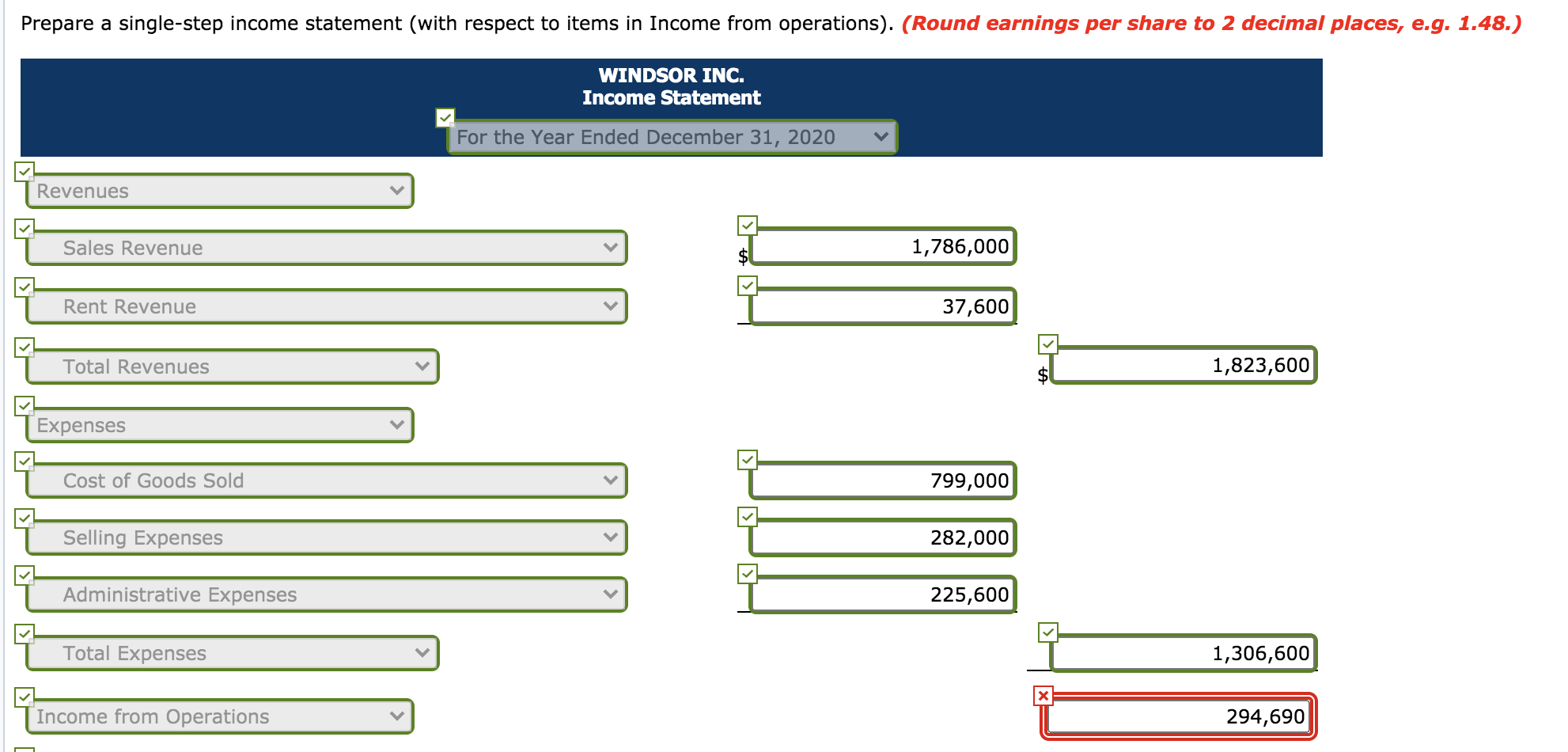

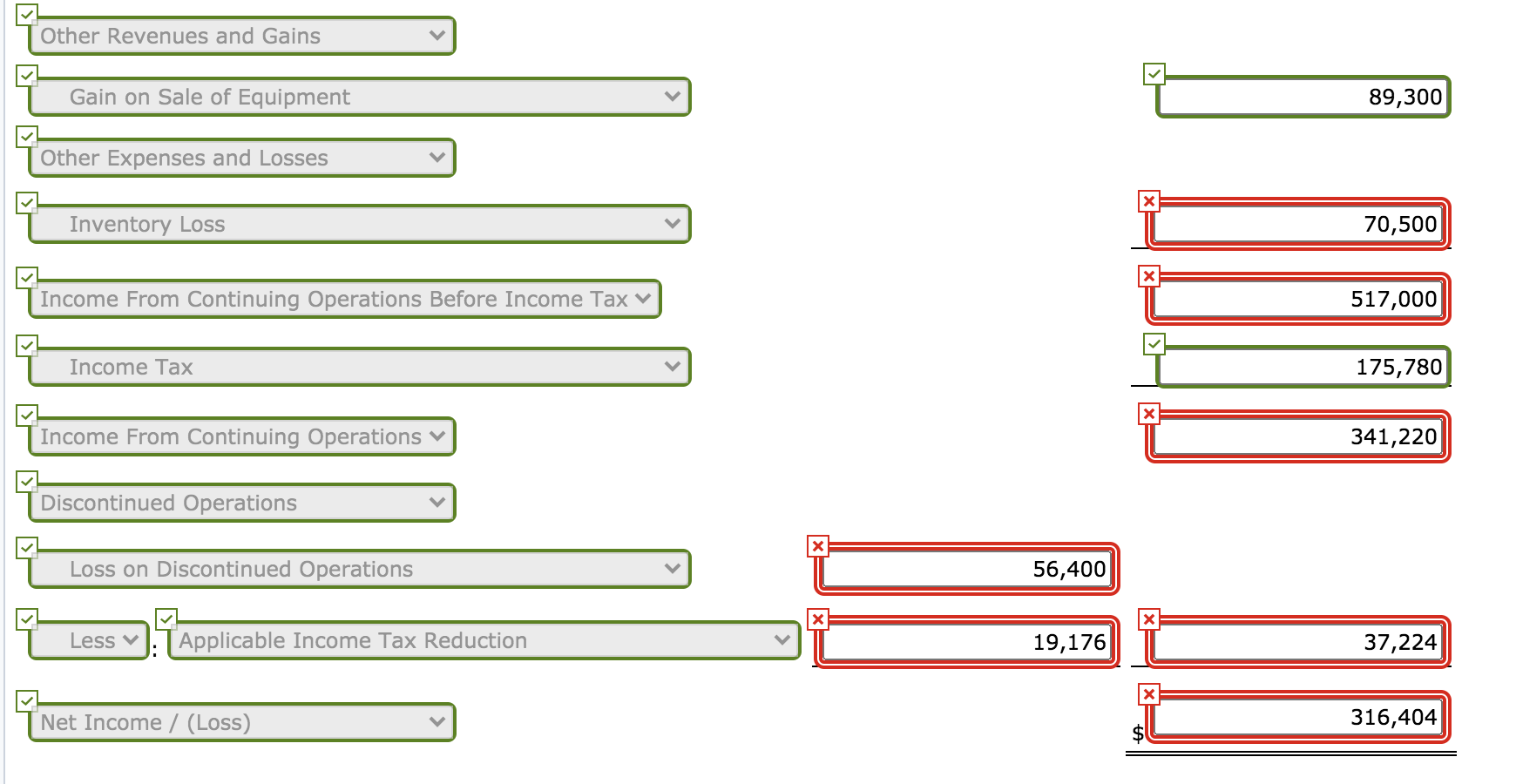

The following information was taken from the records of Windsor Inc. for the year 2020: Income tax applicable to income from continuing operations $175,780; income tax applicable to loss on discontinued operations $23,970, and unrealized holding gain on available-for-sale securities (net of tax) $14,100. Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write-down of inventory $89,300 70,500 225,600 37,600 56,400 Cash dividends declared Retained earnings January 1, 2020 Cost of goods sold Selling expenses Sales Revenue $141,000 1,320,000 799,000 282,000 1,786,000 Shares outstanding during 2020 were 100,000. Prepare a single-step income statement (with respect to items in Income from operations). (Round earnings per share to 2 decimal places, e.g. 1.48.) WINDSOR INC. Income Statement For the Year Ended December 31, 2020 Revenues Sales Revenue 1,786,000 Rent Revenue 37,600 Total Revenues 323,600 Expenses Cost of Goods Sold 799,000 Selling Expenses 282,000 Administrative Expenses 225,600 Total Expenses 1,306,600 Income from Operations 294,690 Other Revenues and Gains Gain on Sale of Equipment 89,300 Other Expenses and Losses Inventory Loss 70,500 X Income From Continuing Operations Before Income Tax v 517,000 Income Tax 175,780 Income From Continuing Operations V 341,220 Discontinued Operations Loss on Discontinued Operations 56,400 x Less v Applicable Income Tax Reduction 19,176 37,224 Net Income / (Loss) 316,404 Per Share of Common Stock Income From Continuing Operations 3.41 Loss on Discontinued Operations, Net of Tax v 0.47 Net Income / (Loss) 3.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts