Question: Part B Prepare an income statement for the 3 months Part C Prepare a retained earnings statement for the 3months Part D Prepare a classified

Part B Prepare an income statement for the 3 months

Part C Prepare a retained earnings statement for the 3months

Part D Prepare a classified balance sheet. (List current assets in order ofliquidity.)

Part E If the note bears interest at 12%, how many monthshas it been outstanding?

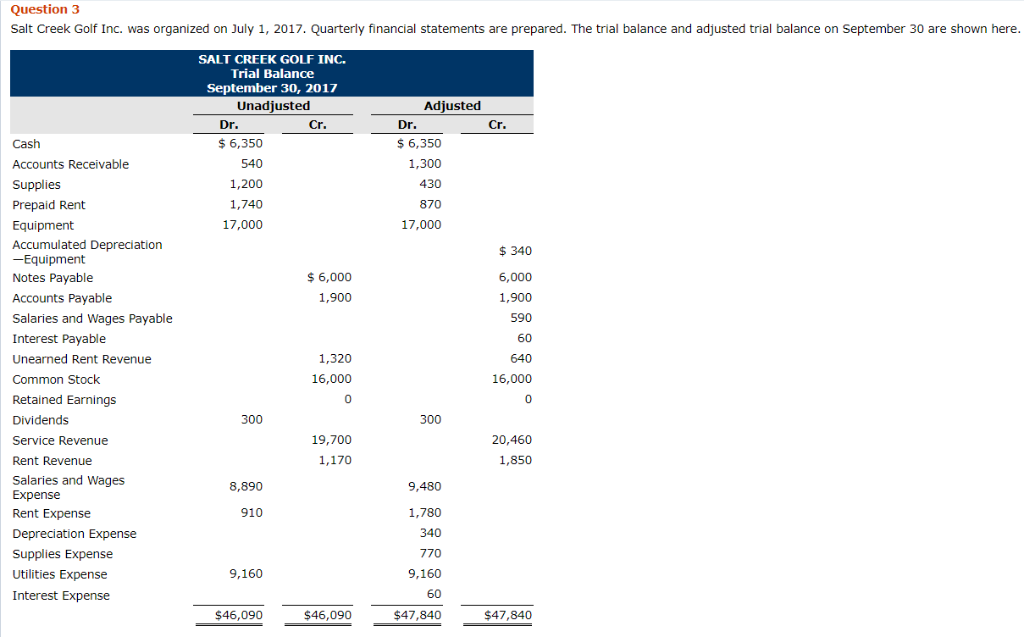

Question 3 Salt Creek Golf Inc. was organized on July 1, 2017. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30 are shown here. Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation -Equipment Notes Payable Accounts Payable Salaries and Wages Payable Interest Payable Unearned Rent Revenue Common Stock Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expense Rent Expense Depreciation Expense Supplies Expense Utilities Expense Interest Expense SALT CREEK GOLF INC. Trial Balance September 30, 2017 Unadjusted Dr. $ 6,350 540 1,200 1,740 17,000 300 8,890 910 9,160 $46,090 Cr. $ 6,000 1,900 1,320 16,000 0 19,700 1,170 $46,090 Adjusted Dr. $ 6,350 1,300 430 870 17,000 300 9,480 1,780 340 770 9,160 60 $47,840 Cr. $ 340 6,000 1,900 590 60 640 16,000 0 20,460 1,850 $47,840

Step by Step Solution

There are 3 Steps involved in it

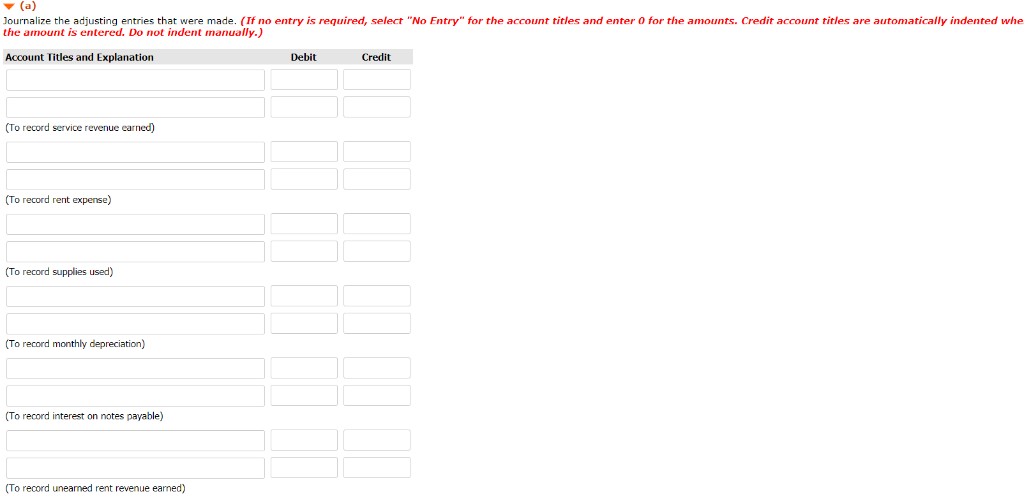

a Account Titles Debit Credit Working Accounts Receivable 760 1300540 Service Revenue 760 To record service revenue earned Rent Expense 870 1740870 Pr... View full answer

Get step-by-step solutions from verified subject matter experts