Question: Part B. Prepare the journal entry (if any) to record depreciation expense for 2026 Current Attempt in Progress Presented below is information related to equipment

Part B. Prepare the journal entry (if any) to record depreciation expense for 2026

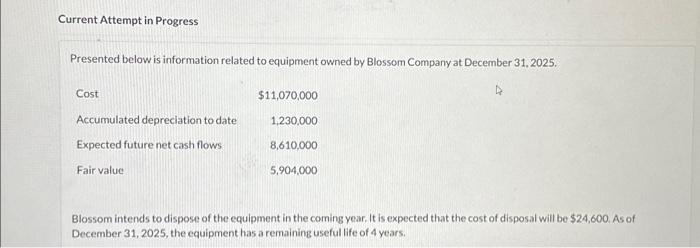

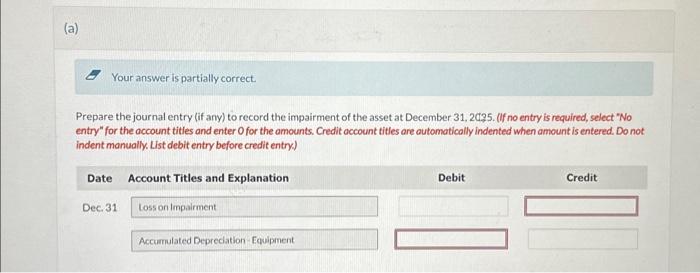

Current Attempt in Progress Presented below is information related to equipment owned by Blossom Company at December 31, 2025. Cost $11,070,000 Accumulated depreciation to date 1,230,000 Expected future net cash flows 8,610,000 Fair value 5,904,000 Blossom intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $24,600. As of December 31, 2025, the equipment has a remaining useful life of 4 years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock