Question: Part B: Pricing Based on Annexes 1& 2: 1. What inflation would you anticipate for next year? This affects local costs. ______ % 2. What

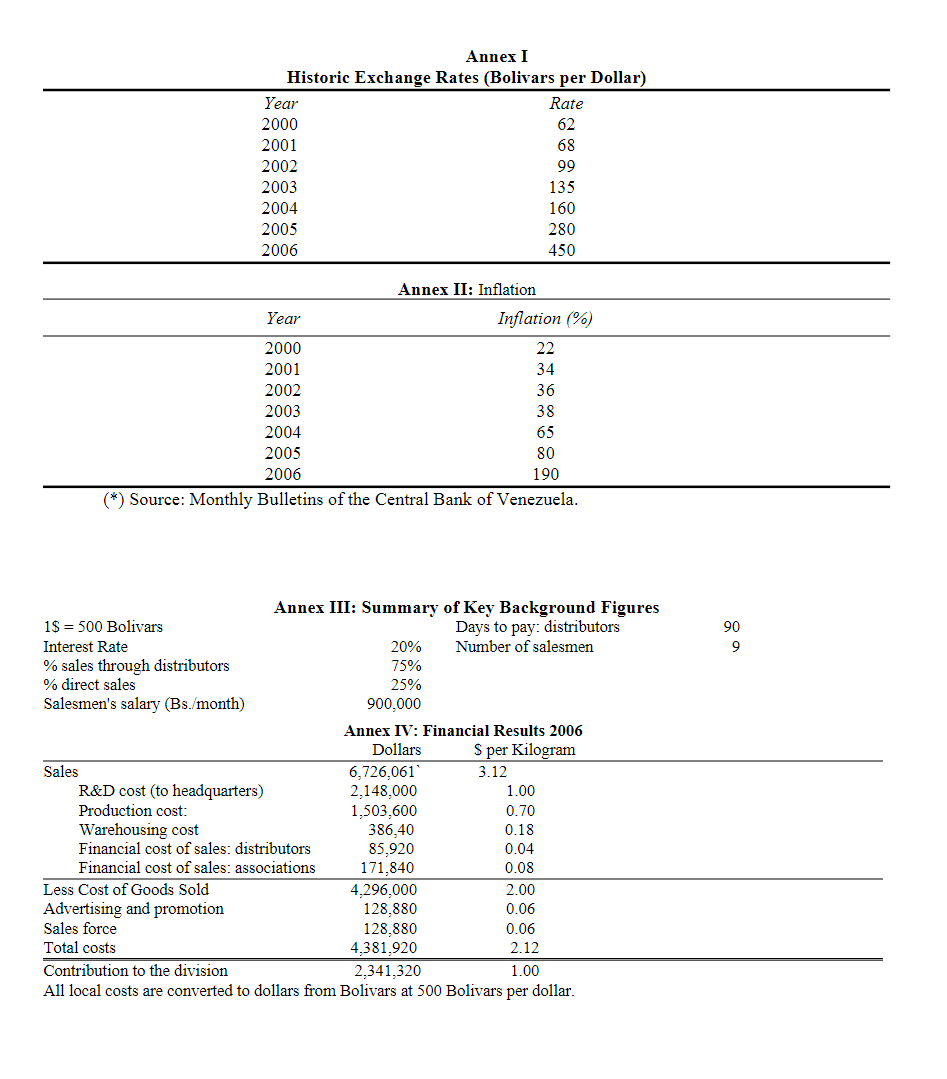

Part B: Pricing Based on Annexes 1& 2: 1. What inflation would you anticipate for next year? This affects local costs. ______ % 2. What exchange rate would you anticipate for next year? This affects foreign costs. _____ % i) First, graph the data on an X-Y chart in Excel (copy-paste the data from the case). ii) Do the points go up in a straight line? If so, the forecast function should work. Otherwise, eyeball it. iii) Note that you can ask excel to extend the line as many years as you want if you just add a trend line to the X-Y chart. Using the above calculations and the cost data in Annex 3: 3. Assume all costs are constant per kilogram except for inflation and exchange changes i) Last year, Cargills costs were $2.12. How much will Cargills total costs per kilogram of seed corn be next year? _______ 4. Just to maintain margins at the same levels as today ($1.00 per Kg.), i) how much should Cargill charge per Kg. to distributors next year (2007) given expected inflation and devaluation? 5. How much profit would a farmer have per hectare if he purchases Cargill seeds? ________ 6. How much profit would a farmer have per hectare if he purchases Pioneer seeds? ________ 7. Dividing the difference between these figures by the number of kilograms needed per hectare (20) gives the additional value per kilogram given by Cargill over Pioneer. ______ Logically, Cargill can charge Pioneers price plus the differential value given and farmers would still be just as well off. This is the maximum price Cargill can charge. 8. Given the above, what is the maximum price that Cargill can charge without losing customers to Pioneer? ___________ 9. What price would you charge? ___________. Do not consider lowering the price. If you lower prices, you get a zero on the case.

(*) Source: Monthly Bulletins of the Central Bank of Venezuela. All local costs are converted to dollars trom Bolivars at 00 Bolivars per dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts