Question: Part (b) Question (ii) - 6 Marks Prepare a table showing the fair value and the gain or loss on the forward contract (hedging instrument).

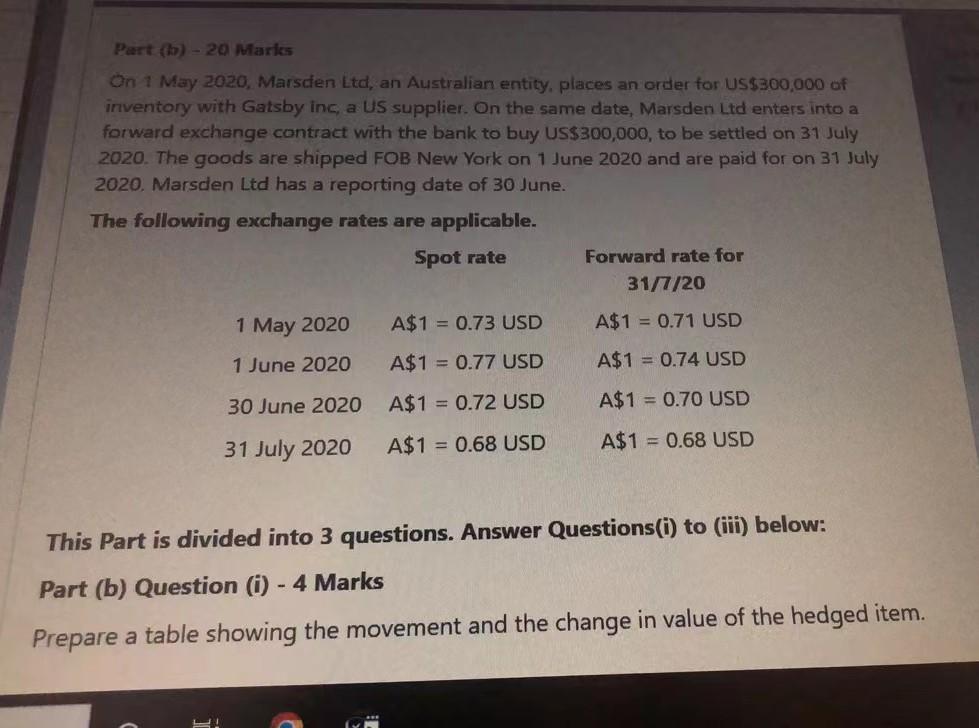

Part (b) Question (ii) - 6 Marks Prepare a table showing the fair value and the gain or loss on the forward contract (hedging instrument). A B I ! BEE Part (b)- 20 Marks On 1 May 2020, Marsden Ltd, an Australian entity, places an order for US$300,000 of inventory with Gatsby inc, a US supplier. On the same date, Marsden Ltd enters into a forward exchange contract with the bank to buy US$300,000, to be settled on 31 July 2020. The goods are shipped FOB New York on 1 June 2020 and are paid for on 31 July 2020. Marsden Ltd has a reporting date of 30 June. The following exchange rates are applicable. Spot rate 1 May 2020 1 June 2020 30 June 2020 31 July 2020 A$1 = 0.73 USD A$1 = 0.77 USD A$1 = 0.72 USD A$1 = 0.68 USD Forward rate for 31/7/20 A$1 = 0.71 USD A$1 = 0.74 USD A$1 = 0.70 USD A$1 = 0.68 USD This Part is divided into 3 questions. Answer Questions(i) to (iii) below: Part (b) Question (i) - 4 Marks Prepare a table showing the movement and the change in value of the hedged item. Part (b) Question (ii) - 6 Marks Prepare a table showing the fair value and the gain or loss on the forward contract (hedging instrument). A B I ! BEE Part (b)- 20 Marks On 1 May 2020, Marsden Ltd, an Australian entity, places an order for US$300,000 of inventory with Gatsby inc, a US supplier. On the same date, Marsden Ltd enters into a forward exchange contract with the bank to buy US$300,000, to be settled on 31 July 2020. The goods are shipped FOB New York on 1 June 2020 and are paid for on 31 July 2020. Marsden Ltd has a reporting date of 30 June. The following exchange rates are applicable. Spot rate 1 May 2020 1 June 2020 30 June 2020 31 July 2020 A$1 = 0.73 USD A$1 = 0.77 USD A$1 = 0.72 USD A$1 = 0.68 USD Forward rate for 31/7/20 A$1 = 0.71 USD A$1 = 0.74 USD A$1 = 0.70 USD A$1 = 0.68 USD This Part is divided into 3 questions. Answer Questions(i) to (iii) below: Part (b) Question (i) - 4 Marks Prepare a table showing the movement and the change in value of the hedged item

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts