Question: Part B: RISK AND RETURN (15 marks) Using historical prices of the TSAI index and four Saudi listed companies traded on Saudi Stock Exchange, answer

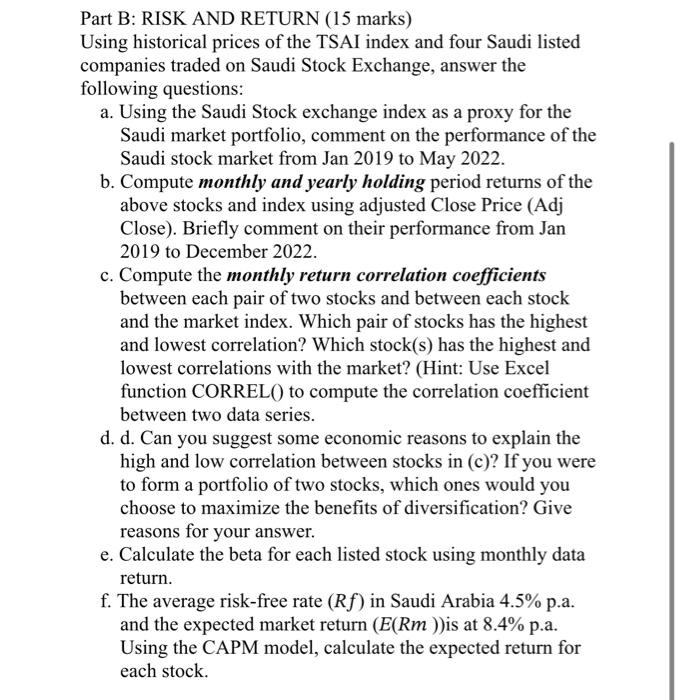

Part B: RISK AND RETURN (15 marks) Using historical prices of the TSAI index and four Saudi listed companies traded on Saudi Stock Exchange, answer the following questions: a. Using the Saudi Stock exchange index as a proxy for the Saudi market portfolio, comment on the performance of the Saudi stock market from Jan 2019 to May 2022. b. Compute monthly and yearly holding period returns of the above stocks and index using adjusted Close Price (Adj Close). Briefly comment on their performance from Jan 2019 to December 2022. c. Compute the monthly return correlation coefficients between each pair of two stocks and between each stock and the market index. Which pair of stocks has the highest and lowest correlation? Which stock(s) has the highest and lowest correlations with the market? (Hint: Use Excel function CORREL() to compute the correlation coefficient between two data series. d. d. Can you suggest some economic reasons to explain the high and low correlation between stocks in (c)? If you were to form a portfolio of two stocks, which ones would you choose to maximize the benefits of diversification? Give reasons for your answer. e. Calculate the beta for each listed stock using monthly data return. f. The average risk-free rate (Rf) in Saudi Arabia 4.5% p.a. and the expected market return (E(Rm)) is at 8.4% p.a. Using the CAPM model, calculate the expected return for each stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts