Question: PART B: Short Answer Problems/Discussion Questions (Total= 50 marks) Question B-1 (Total= 16 marks) You are an equity analyst working at P&Q Fund Management Ltd.

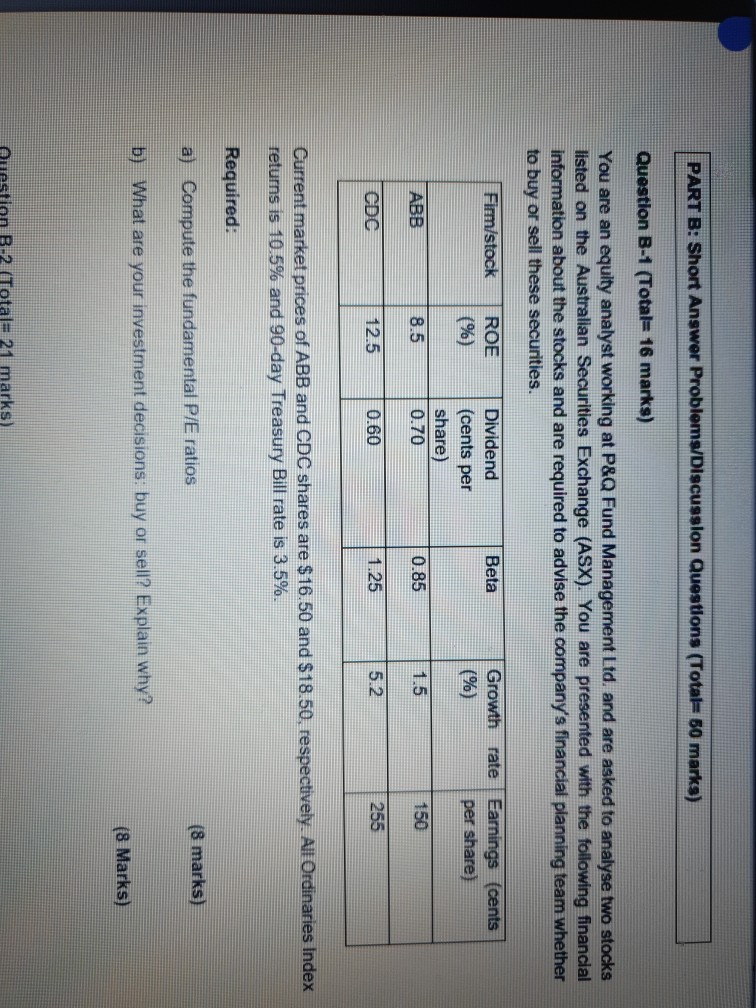

PART B: Short Answer Problems/Discussion Questions (Total= 50 marks) Question B-1 (Total= 16 marks) You are an equity analyst working at P&Q Fund Management Ltd. and are asked to analyse two stocks listed on the Australian Securities Exchange (ASX). You are presented with the following financial information about the stocks and are required to advise the company's financial planning team whether to buy or sell these securities. Firm/stock Beta ROE (%) Growth (%) rate Earnings (cents per share) Dividend (cents per share) 0.70 ABB 8.5 0.85 1.5 150 CDC 12.5 0.60 1.25 5.2. 255 Current market prices of ABB and CDC shares are $16.50 and $18.50, respectively. All Ordinaries Index returns is 10.5% and 90-day Treasury Bill rate is 3.5%. Required: (8 marks) a) Compute the fundamental P/E ratios b) What are your investment decisions: buy or sell? Explain why? (8 Marks) B92 (Total 21 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts