Question: Part B: Target capital structure (10 marks) Skyrocket Electronic Company (SEC) is an all-equity firm. The number of ordinary shares outstanding is 1,000,000, which are

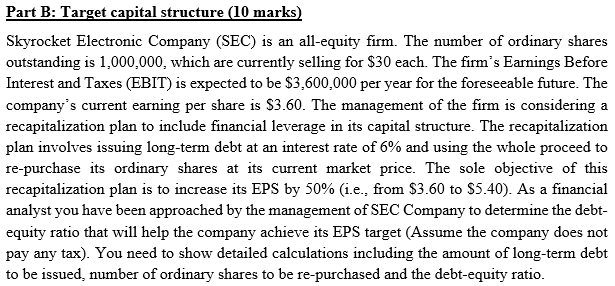

Part B: Target capital structure (10 marks) Skyrocket Electronic Company (SEC) is an all-equity firm. The number of ordinary shares outstanding is 1,000,000, which are currently selling for $30 each. The firm's Earnings Before Interest and Taxes (EBIT) is expected to be $3,600.000 per year for the foreseeable future. The company's current earning per share is $3.60. The management of the firm is considering a recapitalization plan to include financial leverage in its capital structure. The recapitalization plan involves issuing long-term debt at an interest rate of 6% and using the whole proceed to re-purchase its ordinary shares at its current market price. The sole objective of this recapitalization plan is to increase its EPS by 50% (i.e., from $3.60 to $5.40). As a financial analyst you have been approached by the management of SEC Company to determine the debt- equity ratio that will help the company achieve its EPS target (Assume the company does not pay any tax). You need to show detailed calculations including the amount of long-term debt to be issued, number of ordinary shares to be re-purchased and the debt-equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts