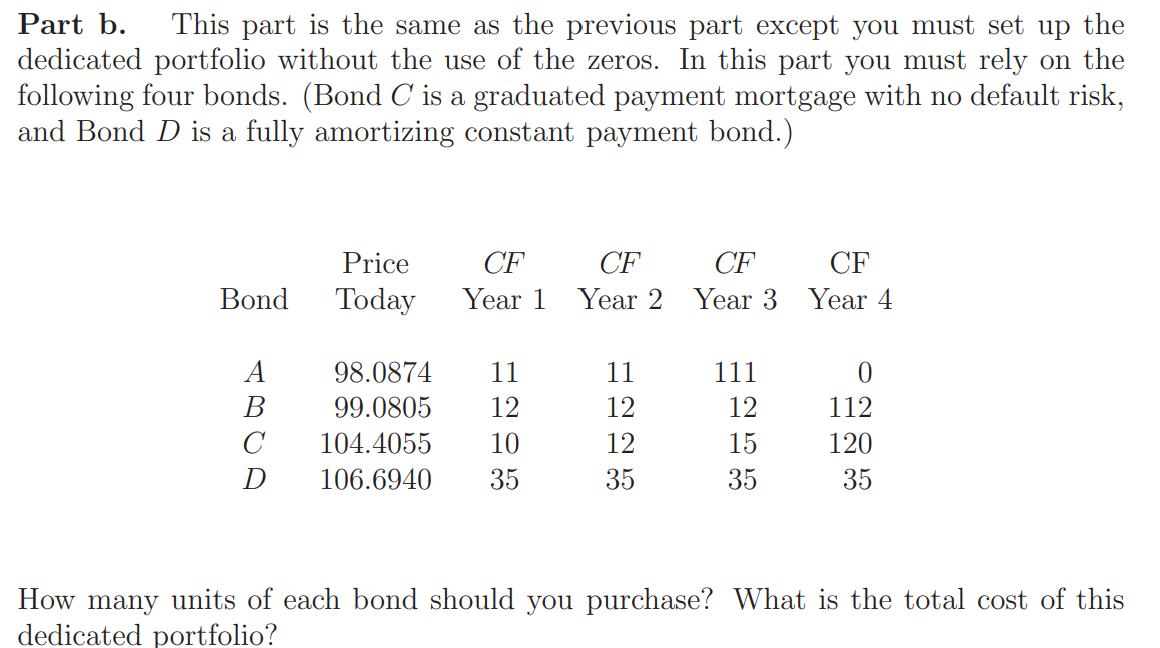

Question: Part b. This part is the same as the previous part except you must set up the dedicated portfolio without the use of the zeros.

Part b. This part is the same as the previous part except you must set up the dedicated portfolio without the use of the zeros. In this part you must rely on the following four bonds. (Bond C is a graduated payment mortgage with no default risk, and Bond D is a fully amortizing constant payment bond.) Price Today CF Year 1 CF CF CF Year 2 Year 3 Year 4 Bond A B D 98.0874 99.0805 104.4055 106.6940 11 12 10 35 11 12 12 35 111 12 15 35 0 112 120 35 How many units of each bond should you purchase? What is the total cost of this dedicated portfolio? Part b. This part is the same as the previous part except you must set up the dedicated portfolio without the use of the zeros. In this part you must rely on the following four bonds. (Bond C is a graduated payment mortgage with no default risk, and Bond D is a fully amortizing constant payment bond.) Price Today CF Year 1 CF CF CF Year 2 Year 3 Year 4 Bond A B D 98.0874 99.0805 104.4055 106.6940 11 12 10 35 11 12 12 35 111 12 15 35 0 112 120 35 How many units of each bond should you purchase? What is the total cost of this dedicated portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts