Question: Part B which is not pictured asks: Using a complete sentence, describe the action you must take to lift the hedge. Thank you! Production Hedge

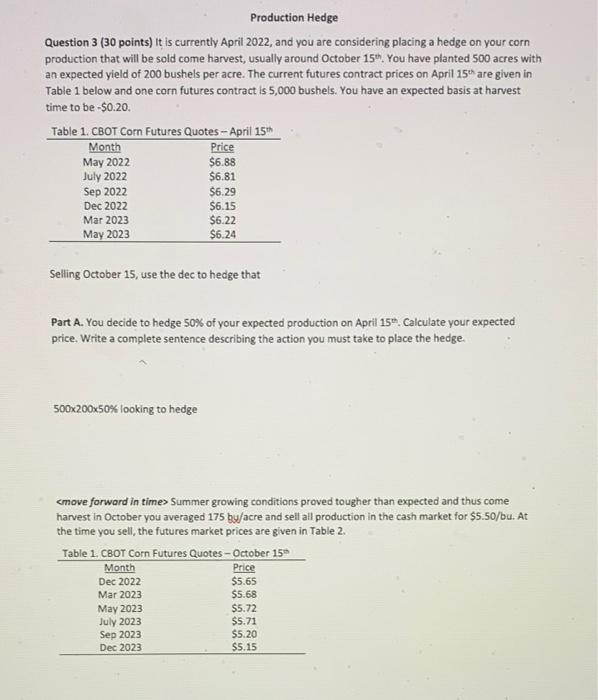

Production Hedge Question 3 (30 points) it is currently April 2022, and you are considering placing a hedge on your corn production that will be sold come harvest, usually around October 15. You have planted 500 acres with an expected yield of 200 bushels per acre. The current futures contract prices on April 15 are given in Table 1 below and one corn futures contract is 5,000 bushels. You have an expected basis at harvest time to be 50.20 Selling October 15 , use the dec to hedge that Part A. You decide to hedge 50% of your expected production on April 15t.. Calculate your expected price. Write a complete sentence describing the action you must take to place the hedge. 50020050% looking to hedge cmove forward in times Summer growing conditions proved tougher than expected and thus come harvest in October you averaged 175 bu/acre and sell all production in the cash market for $5.50/ bu. At the time you sell, the futures market prices are given in Table 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts