Question: Part b with explanation please 3 AB Ltd makes its accounts to 31 March yearly and had been experiencing several years of difficult trading conditions.

Part b with explanation please

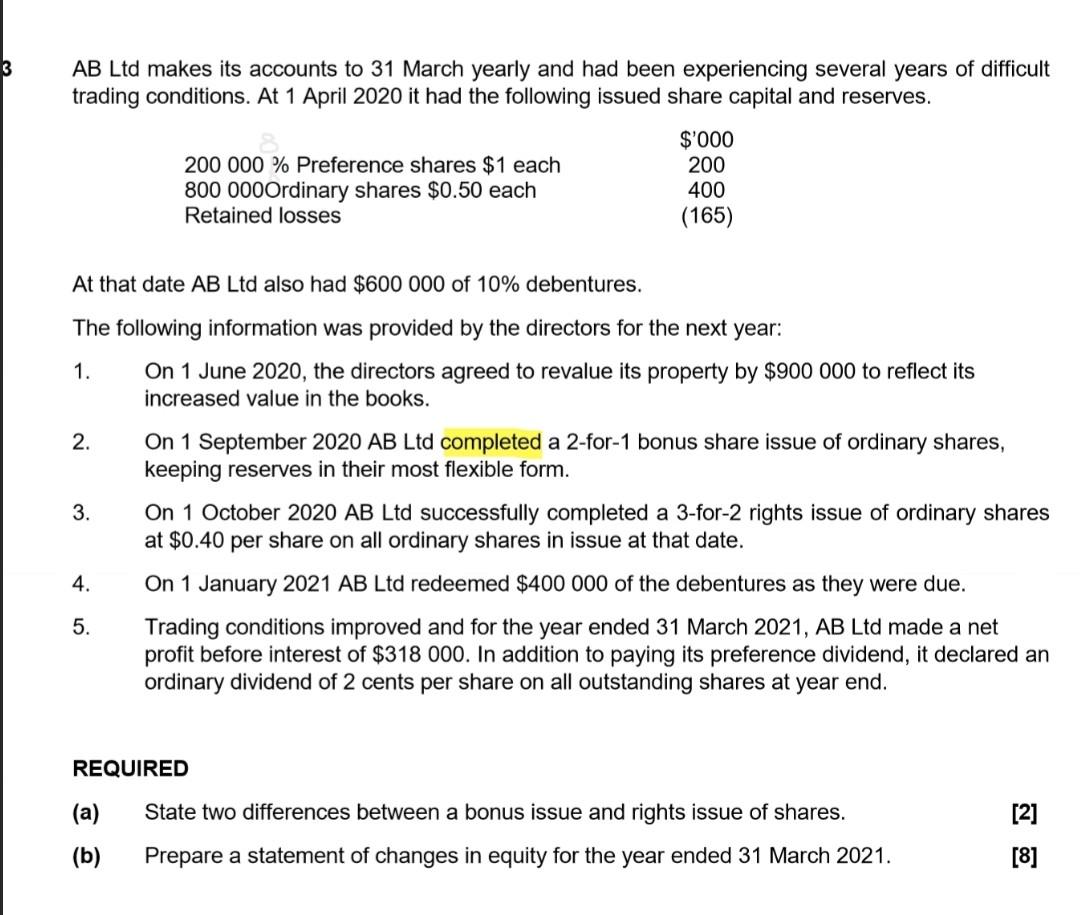

3 AB Ltd makes its accounts to 31 March yearly and had been experiencing several years of difficult trading conditions. At 1 April 2020 it had the following issued share capital and reserves. 200 000 % Preference shares $1 each 800 000Ordinary shares $0.50 each Retained losses $'000 200 400 (165) At that date AB Ltd also had $600 000 of 10% debentures. The following information was provided by the directors for the next year: 1. On 1 June 2020, the directors agreed to revalue its property by $900 000 to reflect its increased value in the books. 2. On 1 September 2020 AB Ltd completed a 2-for-1 bonus share issue of ordinary shares, keeping reserves in their most flexible form. 3. 4. On 1 October 2020 AB Ltd successfully completed a 3-for-2 rights issue of ordinary shares at $0.40 per share on all ordinary shares in issue at that date. On 1 January 2021 AB Ltd redeemed $400 000 of the debentures as they were due. Trading conditions improved and for the year ended 31 March 2021, AB Ltd made a net profit before interest of $318 000. In addition to paying its preference dividend, it declared an ordinary dividend of 2 cents per share on all outstanding shares at year end. 5. REQUIRED (a) State two differences between a bonus issue and rights issue of shares. Prepare a statement of changes in equity for the year ended 31 March 2021. [2] [8] (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts