Question: Part B1. INCOME STATEMENT ANALYSIS There are also many,many ways to analyze profitability. One useful approach is to do vertical analysis of the income statement.

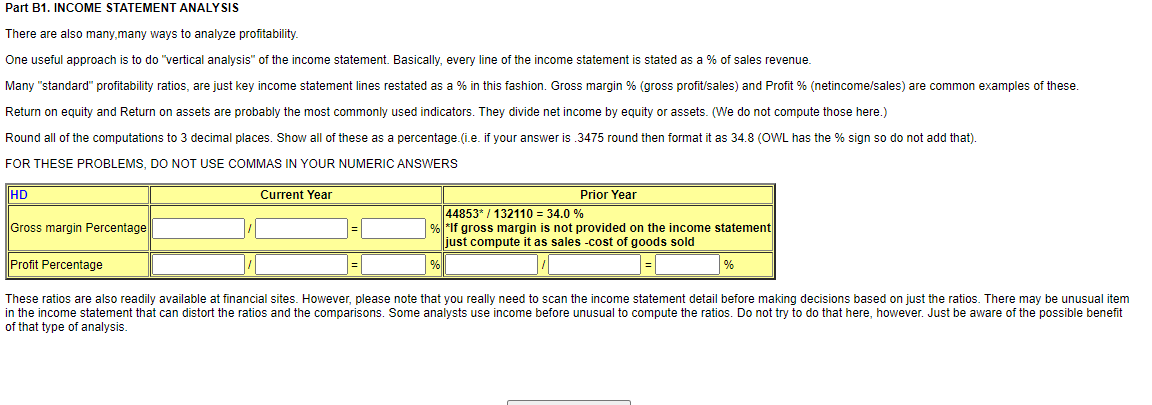

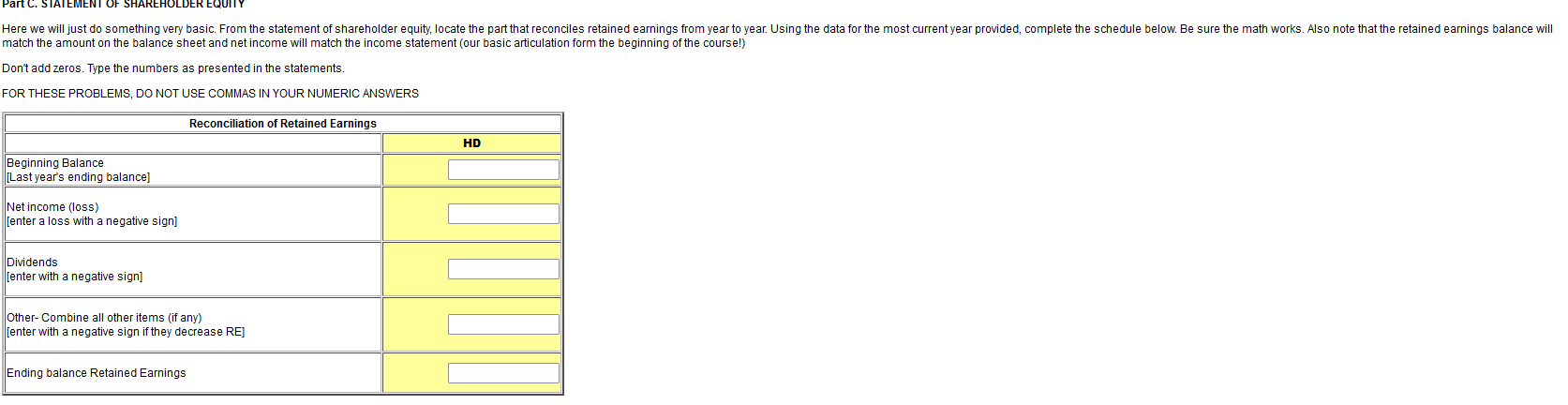

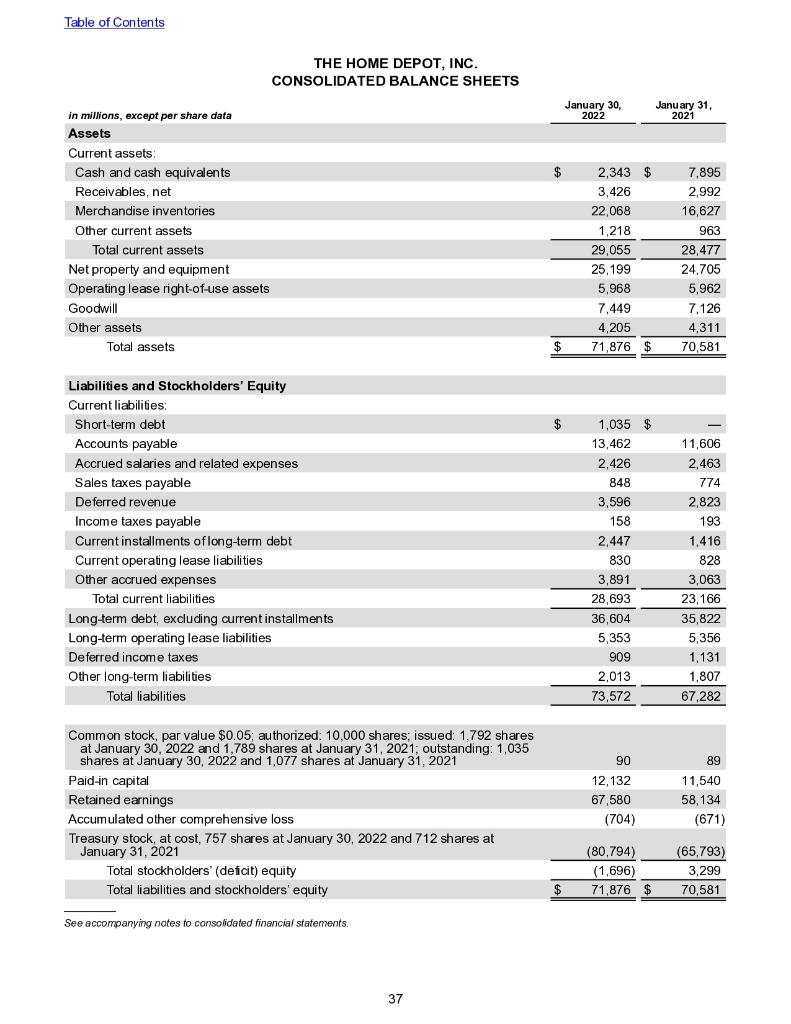

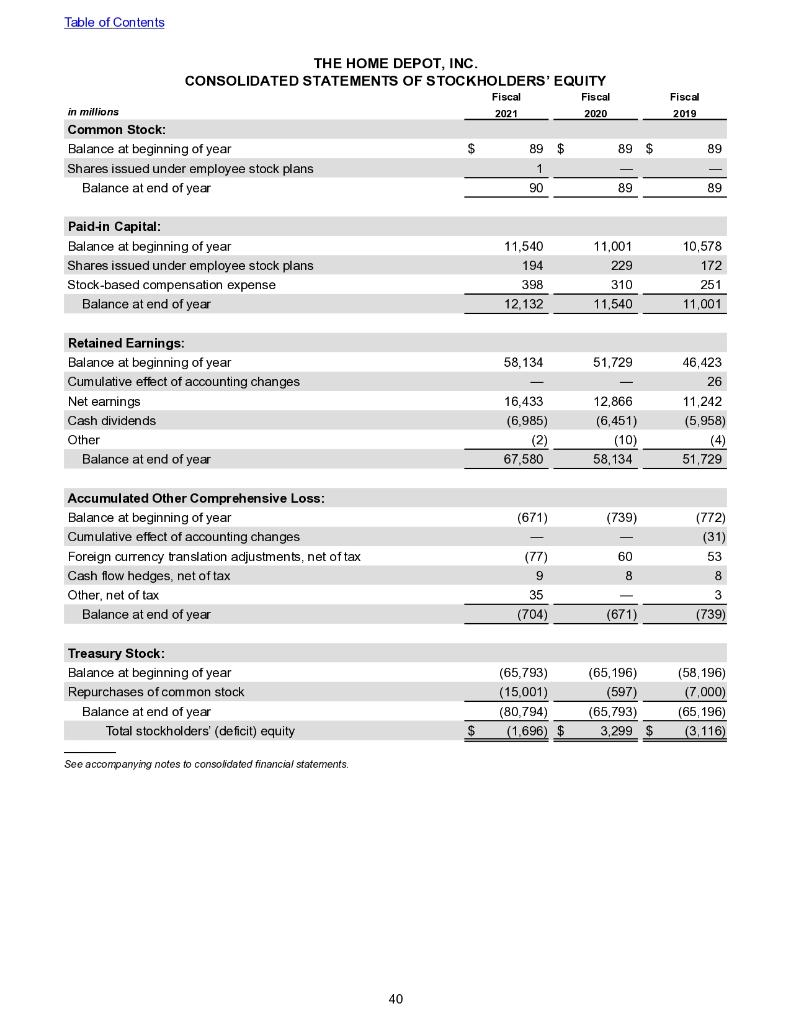

Part B1. INCOME STATEMENT ANALYSIS There are also many,many ways to analyze profitability. One useful approach is to do "vertical analysis" of the income statement. Basically, every line of the income statement is stated as a of sales revenue. Return on equity and Return on assets are probably the most commonly used indicators. They divide net income by equity or assets. (We do not compute those here.) Round all of the computations to 3 decimal places. Show all of these as a percentage.(i.e. if your answer is 3475 round then format it as 34.8 (OWL has the % sign so do not add that). FOR THESE PROBLEMS, DO NOT USE COMMAS IN YOUR NUMERIC ANSWERS of that type of analysis. atch the amount on the balance sheet and net income will match the income statement (our basic articulation form the beginning of the course!) on't add zeros. Type the numbers as presented in the statements. OR THESE PROBLEMS, DO NOT USE COMMAS IN YOUR NUMERIC ANSWERS Table of Contents THE HOME DEPOT, INC. CONSOLIDATED BALANCE SHEETS Liabilities and Stockholders' Equity Current liabilities: See accompanying notes to consolidated financial statements. 37 Table of Contents THE HOME DEPOT, INC. See accompanying notes to consolidated financial statements. 40 Part B1. INCOME STATEMENT ANALYSIS There are also many,many ways to analyze profitability. One useful approach is to do "vertical analysis" of the income statement. Basically, every line of the income statement is stated as a of sales revenue. Return on equity and Return on assets are probably the most commonly used indicators. They divide net income by equity or assets. (We do not compute those here.) Round all of the computations to 3 decimal places. Show all of these as a percentage.(i.e. if your answer is 3475 round then format it as 34.8 (OWL has the % sign so do not add that). FOR THESE PROBLEMS, DO NOT USE COMMAS IN YOUR NUMERIC ANSWERS of that type of analysis. atch the amount on the balance sheet and net income will match the income statement (our basic articulation form the beginning of the course!) on't add zeros. Type the numbers as presented in the statements. OR THESE PROBLEMS, DO NOT USE COMMAS IN YOUR NUMERIC ANSWERS Table of Contents THE HOME DEPOT, INC. CONSOLIDATED BALANCE SHEETS Liabilities and Stockholders' Equity Current liabilities: See accompanying notes to consolidated financial statements. 37 Table of Contents THE HOME DEPOT, INC. See accompanying notes to consolidated financial statements. 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts