Question: (Part B)(b) In addition to the errors and omissions that affected Inonge's bank account and statement, a closer look at the company's other ledger accounts

(Part B)(b) In addition to the errors and omissions that affected Inonge's bank account and statement, a closer look at the company's other ledger accounts reviewed the following errors had been committed:1. A cash discount of K625 allowed by Mukuni, Inonge's supplier had not been entered in the payables control account.2. The proprietor, Inonge made drawings of cash of K3,500 for private use during March but this had been debited to wages and salaries account.3. The total of the purchases day book of K813, 575 had been posted to the purchases account as K813, 755.4. The purchase of a motor van had been entered in a motor van account as K86, 345 instead of K86, 534.5. A loan from the bank of K74, 200 had been entered on the credit side of the capital account.Required:(i) Prepare journal entries required to correct all of the above errors.(Narrations are not required) (10 marks)(ii) Post the correcting entries to the suspense account to determine the difference that arose in trial balance as a result of errors (i) to (v) above.

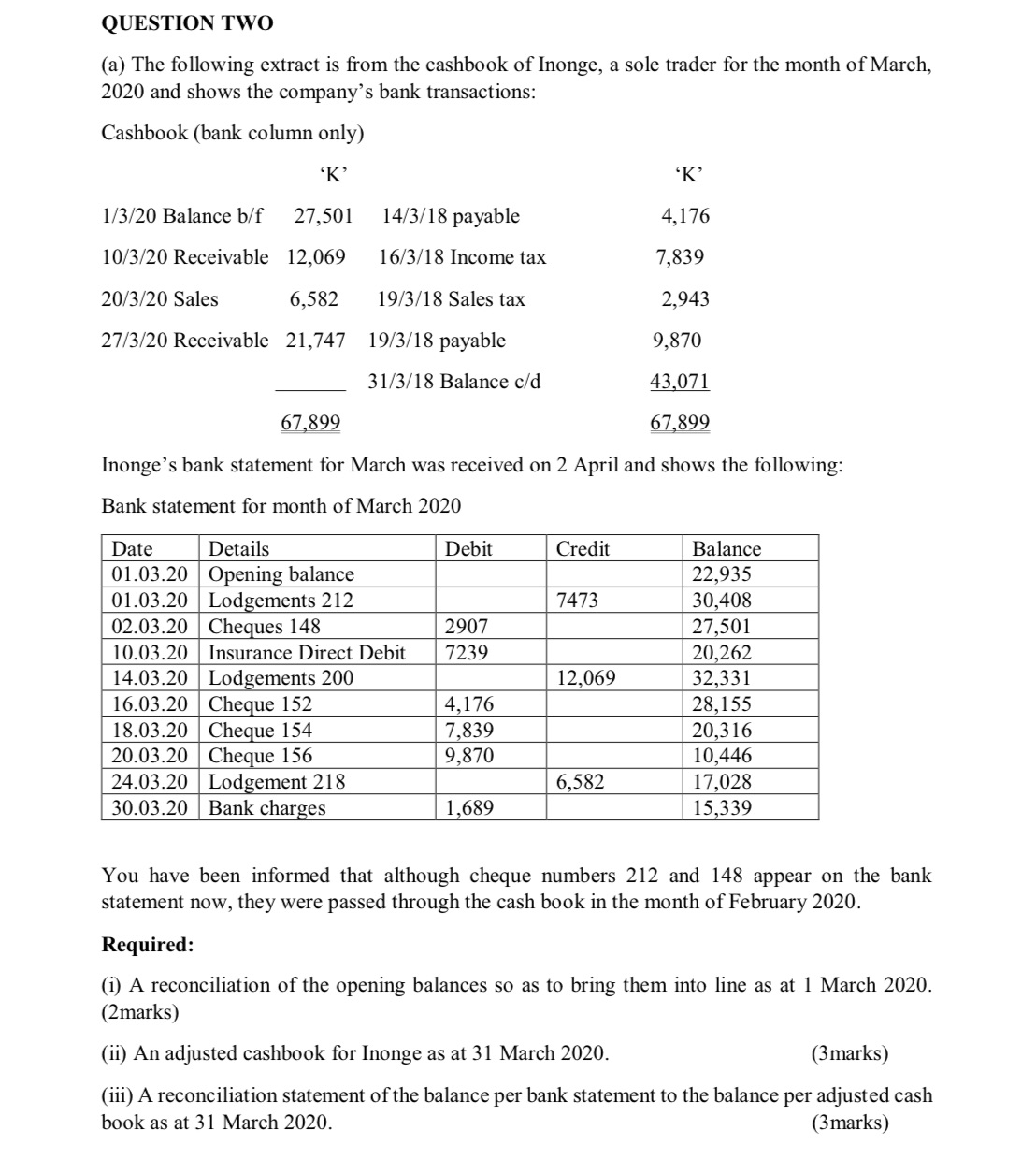

QUESTION TWO (a) The following extract is om the cashbook of lnonge, a sole trader for the month of March, 2020 and shows the company's bank transactions: Cashbook (bank column only) 'K' 'K' 173720 Balance bff 27,501 1473718 payable 4,176 1073720 Receivable 12,069 1673718 Income tax 7,839 207320 Sales 6,582 1973718 Sales tax 2,943 2773720 Receivable 21,747 1973718 payable 9,870 _ 3173718 Balance cx'd M 67 899 67 899 lnonge's bank statement for March was received on 2 April and shows the following: Bank statement for month of March 2020 Date Details Debit Credit Balance 01.03.20 Opening balance 22,935 01.03.20 Lodgements 212 7473 30,408 02.03.20 Cheques 148 2907 27,501 10.03.20 Insurance Direct Debit 7239 20,262 14.03.20 Lod ements 200 12,069 32,331 16.03.20 Cheque 152 4,176 28,155 18.03.20 Cheque 154 7,839 20,316 20.03.20 Cheque 156 9,870 10,446 24.03.20 Lodgement 218 6,582 17,028 30.03.20 Bank charges 1,689 15,339 You have been informed that although cheque numbers 212 and 148 appear on the bank statement now, they were passed through the cash book in the month of February 2020. Required : (i) A reconciliation of the opening balances so as to bring them into line as at 1 March 2020. (2marks) (ii) An adjusted cashbook for Inonge as at 31 March 2020. (3marks) (iii) A reconciliation statement of the balance per bank statement to the balance per adjusted cash book as at 31 March 2020. (3marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts