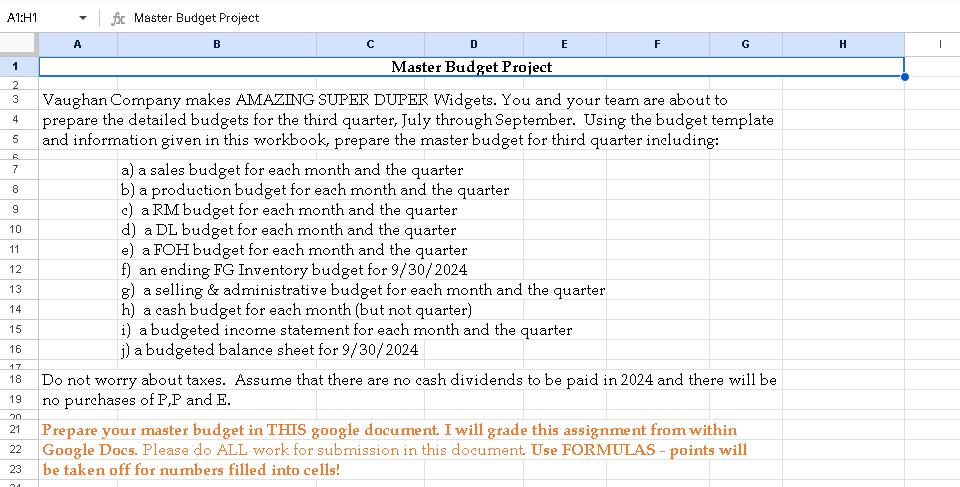

Question: part C and D (#3 and #4) please show formulas looking for FORMULAS in cells. Do not plug numbers into your cells - I want

part C and D (#3 and #4) please show formulas looking for FORMULAS in cells. Do not plug numbers into your cells - I want to be able to change the number of sales in units in your Sales Budget and see the WHOLE budget update. Please make sure you interlock your budgets with formulas.

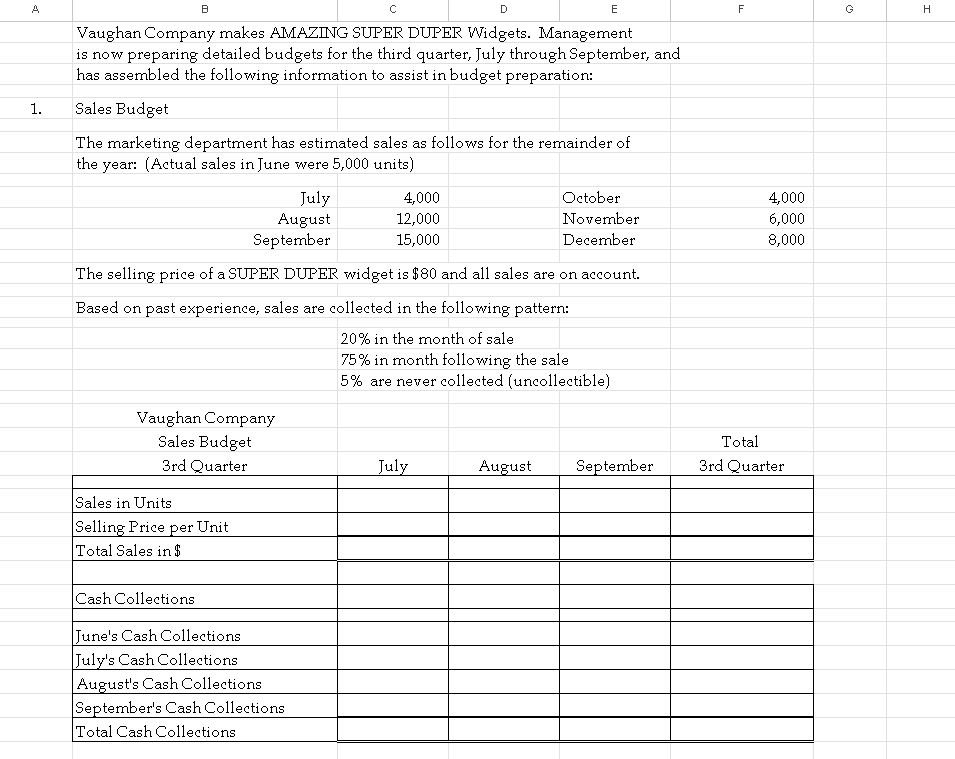

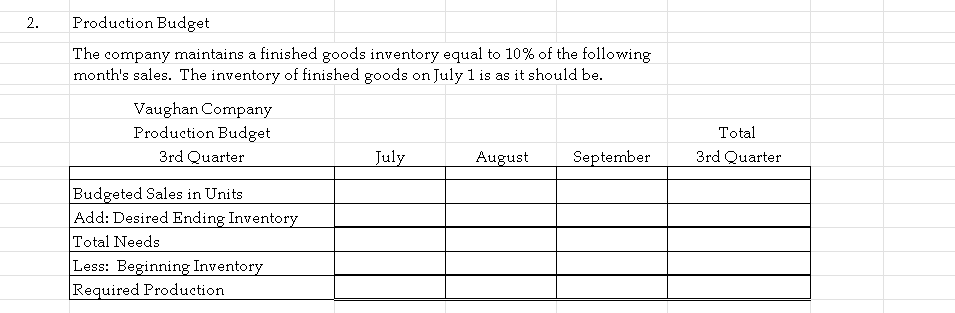

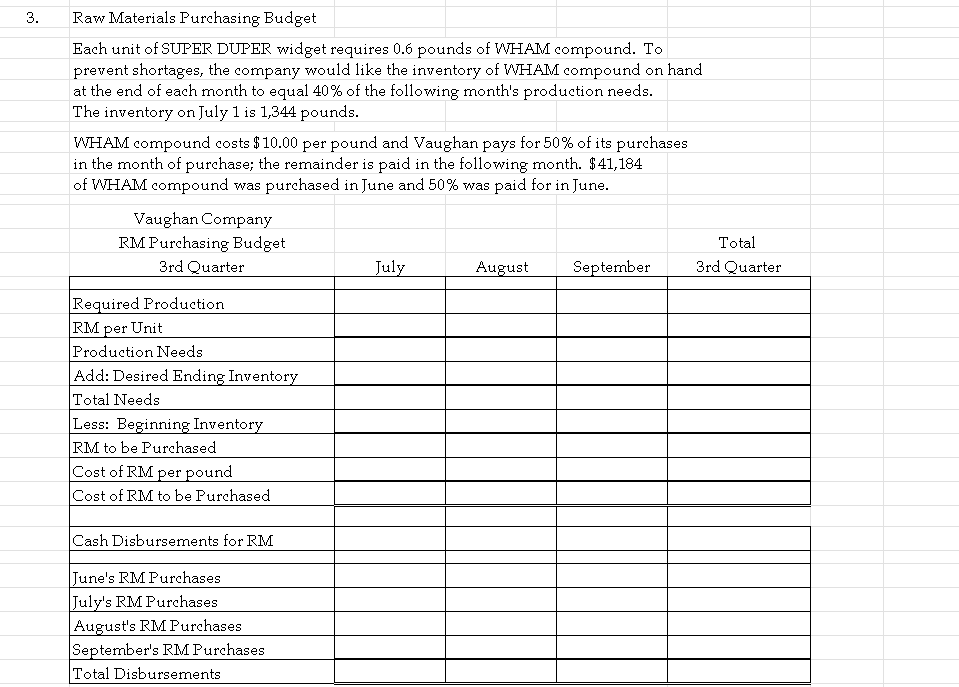

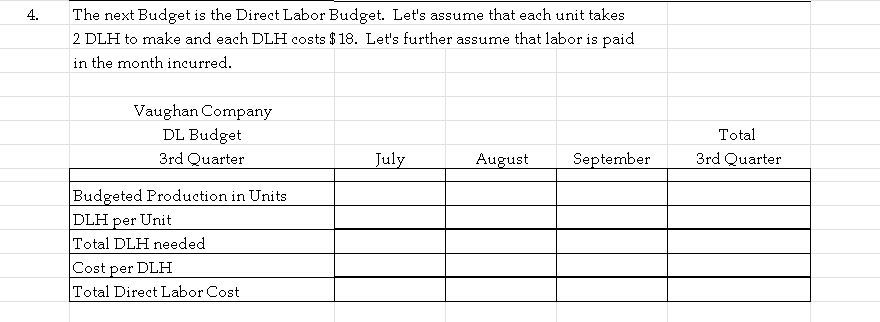

2. Production Budget The company maintains a finished goods inventory equal to 10% of the following month's sales. The inventory of finished goods on July 1 is as it should be. \begin{tabular}{|c|c|c|c|c|} \hline Vaughan Company & & & & \\ \hline Production Budget & & & & Total \\ \hline 3rd Quarter & July & August & September & 3rd Quarter \\ \hline \multicolumn{5}{|l|}{ Budgeted Sales in Units } \\ \hline \multicolumn{5}{|c|}{ Add: Desired Ending Inventory } \\ \hline \multicolumn{5}{|l|}{ Total Needs } \\ \hline \multicolumn{5}{|l|}{ Less: Beginning Inventory } \\ \hline Required Production & & & & \\ \hline \end{tabular} Vaughan Company makes AMAZING SUPER DUPER Widgets. Management is now preparing detailed budgets for the third quarter, July through September, and has assembled the following information to assist in budget preparation: 1. Sales Budget The marketing department has estimated sales as follows for the remainder of the year: (Actual sales in June were 5,000 units) \begin{tabular}{|r|r|l|l|} \hline July & 4,000 & October & 4,000 \\ \hline August & 12,000 & November & 6,000 \\ \hline September & 15,000 & December & 8,000 \\ \hline \end{tabular} The selling price of a SUPER DUPER widget is $80 and all sales are on account. Based on past experience, sales are collected in the following pattern: 20% in the month of sale 75% in month following the sale 5% are never collected (uncollectible) Vaughan Company Total Sales Budget 3rd Quarter July August September 3rd Quarter \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline Sales in Units & & & & \\ \hline Selling Price per Unit & & & & \\ \hline Total Sales in $ & & & & \\ \hline & & & & \\ \hline Cash Collections & & & & \\ \hline June's Cash Collections & & & & \\ \hline July's Cash Collections & & & & \\ \hline August's Cash Collections & & & & \\ \hline September's Cash Collections & & & & \\ \hline Total Cash Collections & & & & \\ \hline \end{tabular} 4. The next Budget is the Direct Labor Budget. Let's assume that each unit takes 2DLH to make and each DLH costs $18. Let's further assume that labor is paid in the month incurred. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Vaughan Company } \\ \hline DL Budget & & & & Total \\ \hline 3rd Quarter & July & August & September & 3rd Quarter \\ \hline \multicolumn{5}{|c|}{ Budgeted Production in Units } \\ \hline \multicolumn{5}{|l|}{ DLH per Unit } \\ \hline \multicolumn{5}{|l|}{ Total DLH needed } \\ \hline \multicolumn{5}{|l|}{ Cost per DLH } \\ \hline Total Direct Labor Cost & & & & \\ \hline \end{tabular} 3. Raw Materials Purchasing Budget Each unit of SUPER DUPER widget requires 0.6 pounds of WHAM compound. To prevent shortages, the company would like the inventory of WHAM compound on hand at the end of each month to equal 40% of the following month's production needs. The inventory on July 1 is 1,344 pounds. WHAM compound costs $10.00 per pound and Vaughan pays for 50% of its purchases in the month of purchase; the remainder is paid in the following month. $41,184 of WHAM compound was purchased in June and 50% was paid for in June. \begin{tabular}{|c|c|c|c|c|} \hline Vaughan Company & & & & \\ \hline RM Purchasing Budget & & & & Total \\ \hline 3rd Quarter & July & August & September & 3rd Quarter \\ \hline \multicolumn{5}{|l|}{ Required Production } \\ \hline \multicolumn{5}{|l|}{ RM per Unit } \\ \hline \multicolumn{5}{|l|}{ Production Needs } \\ \hline \multicolumn{5}{|l|}{ Add: Desired Ending Inventory } \\ \hline \multicolumn{5}{|l|}{ Total Needs } \\ \hline \multicolumn{5}{|l|}{ Less: Beginning Inventory } \\ \hline \multicolumn{5}{|l|}{ RM to be Purchased } \\ \hline \multicolumn{5}{|l|}{ Cost of RM per pound } \\ \hline \multicolumn{5}{|l|}{ Cost of RM to be Purchased } \\ \hline \multicolumn{5}{|l|}{ Cash Disbursements for RM } \\ \hline \multicolumn{5}{|l|}{ June's RM Purchases } \\ \hline \multicolumn{5}{|l|}{ July's RM Purchases } \\ \hline \multicolumn{5}{|l|}{ August's RM Purchases } \\ \hline \multicolumn{5}{|l|}{ September's RM Purchases } \\ \hline Total Disbursements & & & & \\ \hline \end{tabular} A:l:H1 fx. Master Budget Project 2. Production Budget The company maintains a finished goods inventory equal to 10% of the following month's sales. The inventory of finished goods on July 1 is as it should be. \begin{tabular}{|c|c|c|c|c|} \hline Vaughan Company & & & & \\ \hline Production Budget & & & & Total \\ \hline 3rd Quarter & July & August & September & 3rd Quarter \\ \hline \multicolumn{5}{|l|}{ Budgeted Sales in Units } \\ \hline \multicolumn{5}{|c|}{ Add: Desired Ending Inventory } \\ \hline \multicolumn{5}{|l|}{ Total Needs } \\ \hline \multicolumn{5}{|l|}{ Less: Beginning Inventory } \\ \hline Required Production & & & & \\ \hline \end{tabular} Vaughan Company makes AMAZING SUPER DUPER Widgets. Management is now preparing detailed budgets for the third quarter, July through September, and has assembled the following information to assist in budget preparation: 1. Sales Budget The marketing department has estimated sales as follows for the remainder of the year: (Actual sales in June were 5,000 units) \begin{tabular}{|r|r|l|l|} \hline July & 4,000 & October & 4,000 \\ \hline August & 12,000 & November & 6,000 \\ \hline September & 15,000 & December & 8,000 \\ \hline \end{tabular} The selling price of a SUPER DUPER widget is $80 and all sales are on account. Based on past experience, sales are collected in the following pattern: 20% in the month of sale 75% in month following the sale 5% are never collected (uncollectible) Vaughan Company Total Sales Budget 3rd Quarter July August September 3rd Quarter \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline Sales in Units & & & & \\ \hline Selling Price per Unit & & & & \\ \hline Total Sales in $ & & & & \\ \hline & & & & \\ \hline Cash Collections & & & & \\ \hline June's Cash Collections & & & & \\ \hline July's Cash Collections & & & & \\ \hline August's Cash Collections & & & & \\ \hline September's Cash Collections & & & & \\ \hline Total Cash Collections & & & & \\ \hline \end{tabular} 4. The next Budget is the Direct Labor Budget. Let's assume that each unit takes 2DLH to make and each DLH costs $18. Let's further assume that labor is paid in the month incurred. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Vaughan Company } \\ \hline DL Budget & & & & Total \\ \hline 3rd Quarter & July & August & September & 3rd Quarter \\ \hline \multicolumn{5}{|c|}{ Budgeted Production in Units } \\ \hline \multicolumn{5}{|l|}{ DLH per Unit } \\ \hline \multicolumn{5}{|l|}{ Total DLH needed } \\ \hline \multicolumn{5}{|l|}{ Cost per DLH } \\ \hline Total Direct Labor Cost & & & & \\ \hline \end{tabular} 3. Raw Materials Purchasing Budget Each unit of SUPER DUPER widget requires 0.6 pounds of WHAM compound. To prevent shortages, the company would like the inventory of WHAM compound on hand at the end of each month to equal 40% of the following month's production needs. The inventory on July 1 is 1,344 pounds. WHAM compound costs $10.00 per pound and Vaughan pays for 50% of its purchases in the month of purchase; the remainder is paid in the following month. $41,184 of WHAM compound was purchased in June and 50% was paid for in June. \begin{tabular}{|c|c|c|c|c|} \hline Vaughan Company & & & & \\ \hline RM Purchasing Budget & & & & Total \\ \hline 3rd Quarter & July & August & September & 3rd Quarter \\ \hline \multicolumn{5}{|l|}{ Required Production } \\ \hline \multicolumn{5}{|l|}{ RM per Unit } \\ \hline \multicolumn{5}{|l|}{ Production Needs } \\ \hline \multicolumn{5}{|l|}{ Add: Desired Ending Inventory } \\ \hline \multicolumn{5}{|l|}{ Total Needs } \\ \hline \multicolumn{5}{|l|}{ Less: Beginning Inventory } \\ \hline \multicolumn{5}{|l|}{ RM to be Purchased } \\ \hline \multicolumn{5}{|l|}{ Cost of RM per pound } \\ \hline \multicolumn{5}{|l|}{ Cost of RM to be Purchased } \\ \hline \multicolumn{5}{|l|}{ Cash Disbursements for RM } \\ \hline \multicolumn{5}{|l|}{ June's RM Purchases } \\ \hline \multicolumn{5}{|l|}{ July's RM Purchases } \\ \hline \multicolumn{5}{|l|}{ August's RM Purchases } \\ \hline \multicolumn{5}{|l|}{ September's RM Purchases } \\ \hline Total Disbursements & & & & \\ \hline \end{tabular} A:l:H1 fx. Master Budget Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts