Question: part C and D please d. Assuming that the expected yen return on the Nikkei 225 index is 8%, and its volatility is 22%, and

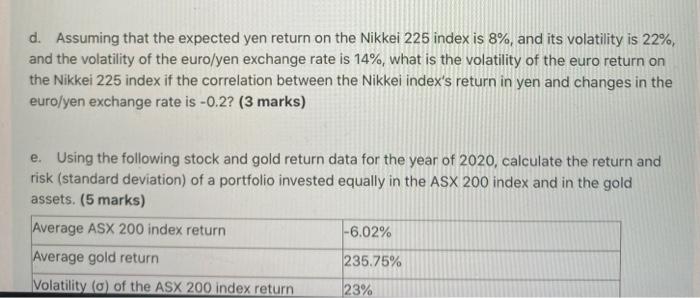

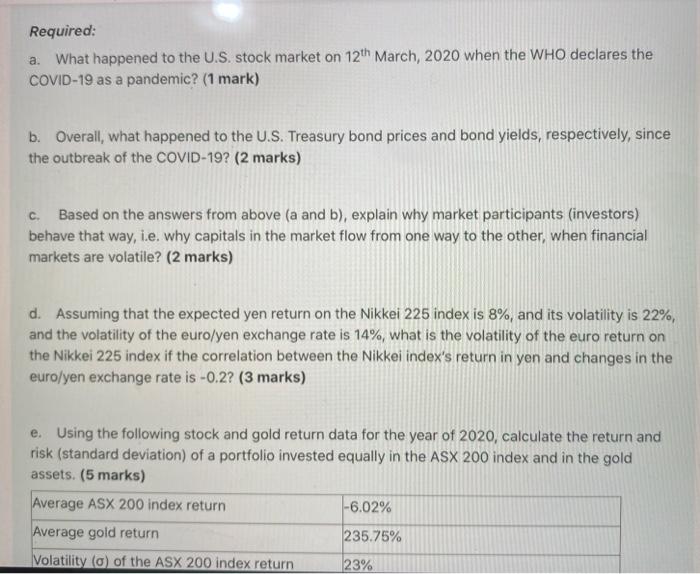

d. Assuming that the expected yen return on the Nikkei 225 index is 8%, and its volatility is 22%, and the volatility of the euro/yen exchange rate is 14%, what is the volatility of the euro return on the Nikkei 225 index if the correlation between the Nikkei index's return in yen and changes in the euro/yen exchange rate is -0.2? (3 marks) e. Using the following stock and gold return data for the year of 2020, calculate the return and risk (standard deviation) of a portfolio invested equally in the ASX 200 index and in the gold assets. (5 marks) Average ASX 200 index return -6.02% Average gold return 235.75% Volatility (c) of the ASX 200 index return 23% Required: a. What happened to the U.S. stock market on 12th March, 2020 when the WHO declares the COVID-19 as a pandemic? (1 mark) b. Overall, what happened to the U.S. Treasury bond prices and bond yields, respectively, since the outbreak of the COVID-19? (2 marks) c. Based on the answers from above (a and b), explain why market participants (investors) behave that way, i.e. why capitals in the market flow from one way to the other, when financial markets are volatile? (2 marks) d. Assuming that the expected yen return on the Nikkei 225 index is 8%, and its volatility is 22%, and the volatility of the euro/yen exchange rate is 14%, what is the volatility of the euro return on the Nikkei 225 index if the correlation between the Nikkei index's return in yen and changes in the euro/yen exchange rate is -0.2? (3 marks) e. Using the following stock and gold return data for the year of 2020, calculate the return and risk (standard deviation) of a portfolio invested equally in the ASX 200 index and in the gold assets. (5 marks) Average ASX 200 index return -6.02% Average gold return 235.75% Volatility (a) of the ASX 200 index return 23% d. Assuming that the expected yen return on the Nikkei 225 index is 8%, and its volatility is 22%, and the volatility of the euro/yen exchange rate is 14%, what is the volatility of the euro return on the Nikkei 225 index if the correlation between the Nikkei index's return in yen and changes in the euro/yen exchange rate is -0.2? (3 marks) e. Using the following stock and gold return data for the year of 2020, calculate the return and risk (standard deviation) of a portfolio invested equally in the ASX 200 index and in the gold assets. (5 marks) Average ASX 200 index return -6.02% Average gold return 235.75% Volatility (c) of the ASX 200 index return 23% Required: a. What happened to the U.S. stock market on 12th March, 2020 when the WHO declares the COVID-19 as a pandemic? (1 mark) b. Overall, what happened to the U.S. Treasury bond prices and bond yields, respectively, since the outbreak of the COVID-19? (2 marks) c. Based on the answers from above (a and b), explain why market participants (investors) behave that way, i.e. why capitals in the market flow from one way to the other, when financial markets are volatile? (2 marks) d. Assuming that the expected yen return on the Nikkei 225 index is 8%, and its volatility is 22%, and the volatility of the euro/yen exchange rate is 14%, what is the volatility of the euro return on the Nikkei 225 index if the correlation between the Nikkei index's return in yen and changes in the euro/yen exchange rate is -0.2? (3 marks) e. Using the following stock and gold return data for the year of 2020, calculate the return and risk (standard deviation) of a portfolio invested equally in the ASX 200 index and in the gold assets. (5 marks) Average ASX 200 index return -6.02% Average gold return 235.75% Volatility (a) of the ASX 200 index return 23%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts