Question: Part C and E Analyzing and Computing Issue Price, Treasury Stock Cost, and Shares Outstanding Following is the stockholders' equity section of the December 31,

Part C and E

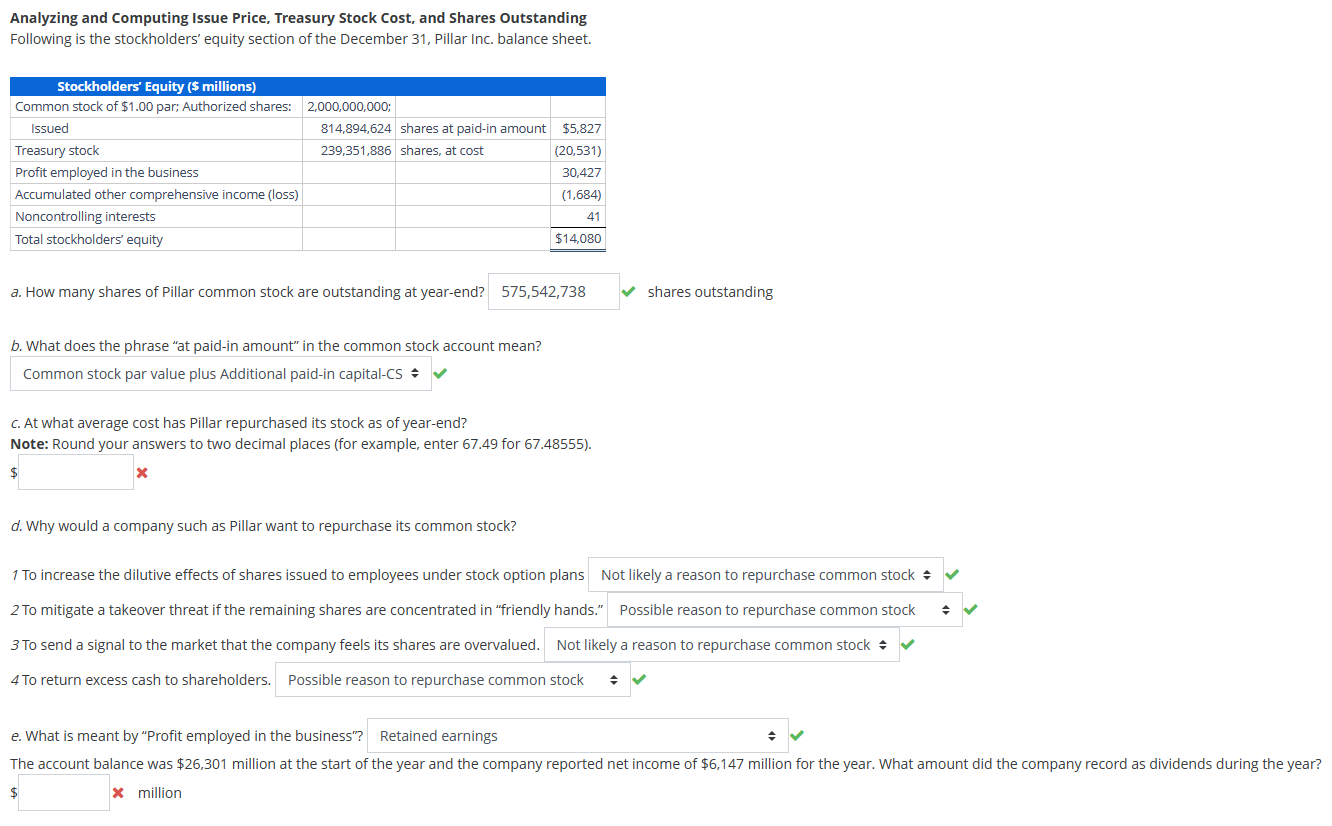

Analyzing and Computing Issue Price, Treasury Stock Cost, and Shares Outstanding Following is the stockholders' equity section of the December 31, Pillar Inc. balance sheet. a. How many shares of Pillar common stock are outstanding at year-end? b. What does the phrase "at paid-in amount" in the common stock account mean? c. At what average cost has Pillar repurchased its stock as of year-end? Note: Round your answers to two decimal places (for example, enter 67.49 for 67.48555 ). d. Why would a company such as Pillar want to repurchase its common stock? 1 To increase the dilutive effects of shares issued to employees under stock option plans 2 To mitigate a takeover threat if the remaining shares are concentrated in "friendly hands." Possible reason to repurchase common stock 3 To send a signal to the market that the company feels its shares are overvalued. 4 To return excess cash to shareholders. e. What is meant by "Profit employed in the business"? The account balance was $26,301 million at the start of the year and the company reported net income of $6,147 million for the year. What amount did the $ million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts