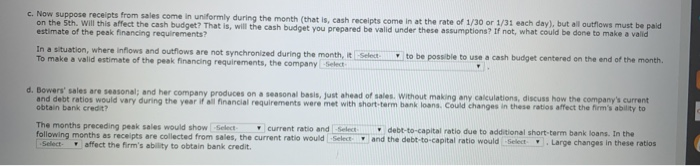

Question: Part C answer choices: 1. is likely / is not likely 2. needs no additional actions / should establish its maximum cash requirements / should

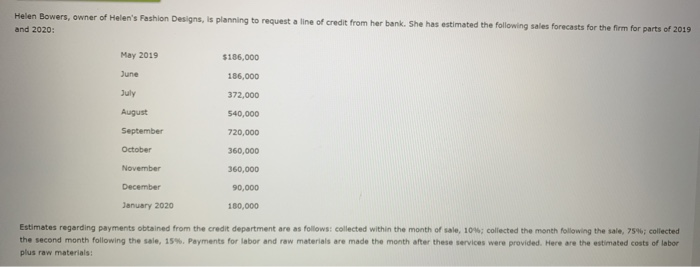

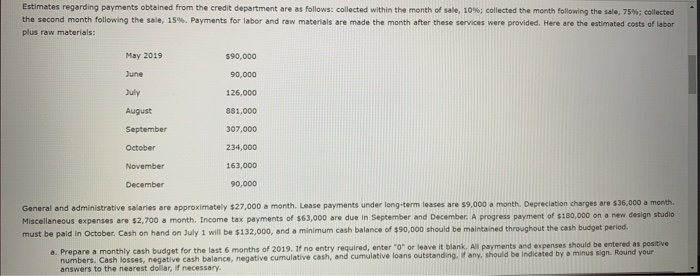

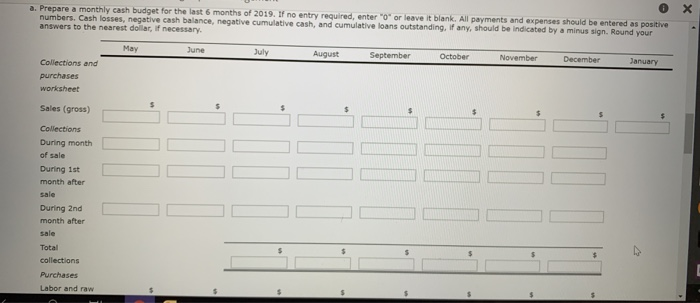

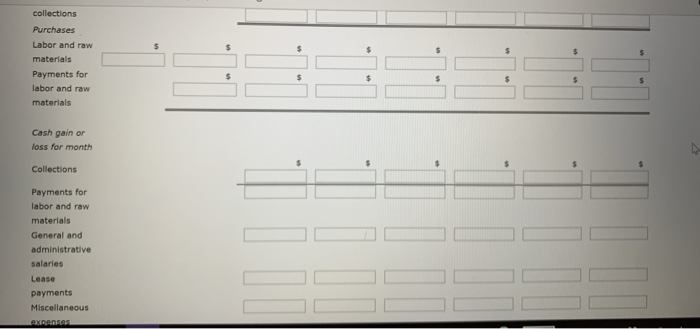

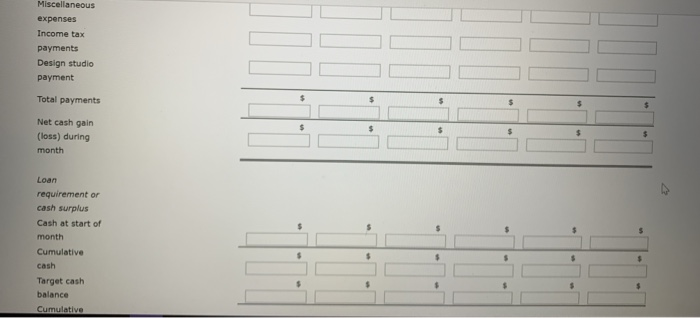

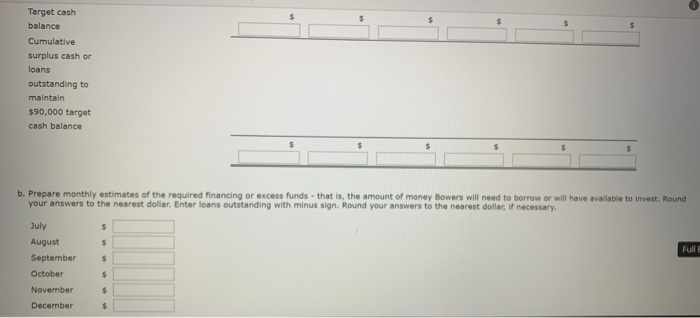

Helen Bowers, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: May 2019 June $156,000 186,000 372,000 July August September 540,000 720,000 360,000 October November December 360,000 90,000 160.000 January 2020 Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10% collected the month following the sale 75% collected the second month following the sale, 15. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: May 2019 $90,000 June July August September 90,000 126,000 881,000 307,000 234.000 163,000 90,000 October November December General and administrative salaries are approximately $27,000 a month. Lease payments under long-term leases are $9,000 a month. Depreciation charges are $36,000 a month. Miscellaneous expenses are $2,700 a month. Income tax payments of 563,000 are due in September and December. A progress payment of $180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be $132,000, and a minimum cash balance of $90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. If no entry required, enter"0" or leave it blank. All payments and expenses should be entered as positive numbers. Cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding any should be indicated by a minus sign. Round your answers to the nearest dollar, necessary. a. Prepare a monthly cash budget for the last 6 months of 2019. If no entry required, enter "0" or leave it blank. All payments and expenses should be entered as positive numbers, Cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding, if any, should be indicated by a minus sign. Round your answers to the nearest dollar, if necessary May June July August September October November December January Collections and purchases Sales (gross) Collections During month of sale month after During 2nd month after Tota collections Purchases Labor and raw collections Purchases materials Payments for labor and raw materials Cash gain or loss for month Collections Payments for labor and raw materials General and administrative salaries Lease payments Miscellaneous GRADA Miscellaneous expenses Income tax payments Design studio payment Total payments Net cash gain (loss) during month Loan requirement or cash surplus Cash at start of month Cumulative cash Target cash balance Cumulative Target cash balance Cumulative Surplus cash or loans outstanding to maintain $90,000 target cash balance b. Prepare monthly estimates of the required financing or excess Funds - that is, the amount of money Bowers will need to borrow or will have available to invest. Round your answers to the nearest dollar. Enter loans outstanding with minus sign. Round your answers to the nearest dollar, if necessary. July Full August September October November c. Now suppose receipts from sales come in uniformly during the month (that is cash receipts come in at the rate of 1/30 or 1/31 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? to be posible to use a cash budget centered on the end of the month In a situation, where now and outflows are not synchronized during the months To make a valid estimate of the peak financing requirements, the company Select d. Bowers' sales are seasonal; and her company produces on a seasonal basis, just ahead of sales without making any calculations, discuss how the company's current and debt ratios would vary during the year ifall financial requirements were met with short-term bankans Could changes in these rates affect the firm's ability to obtain bank credit? The months preceding peak sales would show current rate and debt-to-capital ratio due to additional short-term bank loans. In the following months as receipts are collected from sales, the current ratio would select and the debt-to-capital ratio would ect . Large changes in these ratios Select affect the firm's ability to obtain bank credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts