Question: Part C: Comparative Balance Sheet - Horizontal and Vertical Analysis Assets 2014 2013 Current assets $430 $285 Capital assets 790 585 Current liabilities $280 $120

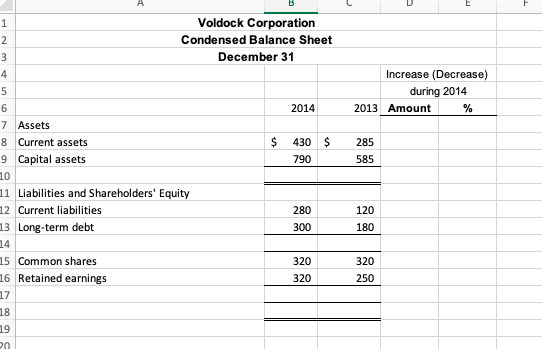

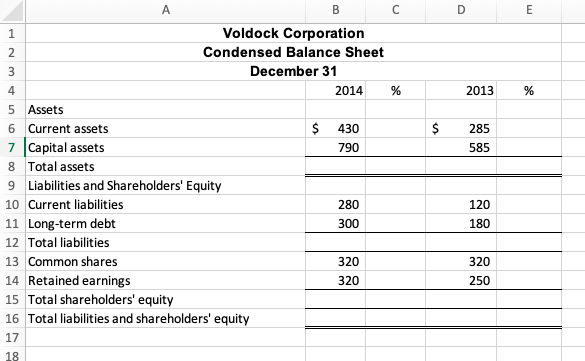

Part C: Comparative Balance Sheet - Horizontal and Vertical Analysis

| Assets | 2014 | 2013 |

|---|---|---|

| Current assets | $430 | $285 |

| Capital assets | 790 | 585 |

| Current liabilities | $280 | $120 |

| Long-term debt | 300 | 180 |

| Common shares | 320 | 320 |

| Retained earnings | 320 | 250 |

Instructions:

1.Using horizontal analysis, show the percentage change for each balance sheet item of Voldock Corporation, using 2013 as a base year. Explain whether the trends are favourable or unfavourable.

2.Using vertical analysis, prepare a common size comparative balance sheet for Voldock Corporation for each year. Explain whether the trends are favourable or unfavourable.

Please answer using the template next to each part

A 1 Voldock Corporation Condensed Balance Sheet December 31 2 3 4 5 6 7 Assets Increase (Decrease) during 2014 2013 Amount % 2014 $ 430 $ 790 285 585 8 Current assets 9 Capital assets 10 11 Liabilities and Shareholders' Equity 12 Current liabilities 13 Long-term debt 14 15 Common shares 16 Retained earnings 17 280 300 120 180 320 320 320 250 18 19 20 A B D E Nm 2013 % $ 285 585 1 Voldock Corporation 2 Condensed Balance Sheet 3 December 31 4 2014 % 5 Assets 6 Current assets $ 430 7 Capital assets 790 8 Total assets 9 Liabilities and Shareholders' Equity 10 Current liabilities 280 11 Long-term debt 300 12 Total liabilities 13 Common shares 320 14 Retained earnings 320 15 Total shareholders' equity 16 Total liabilities and shareholders' equity 17 18 120 180 320 250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts