Question: part C please Q1. A) Your client is evaluating between the following two retirement options: Option 1: Pays a lump sum of $2.8 million in

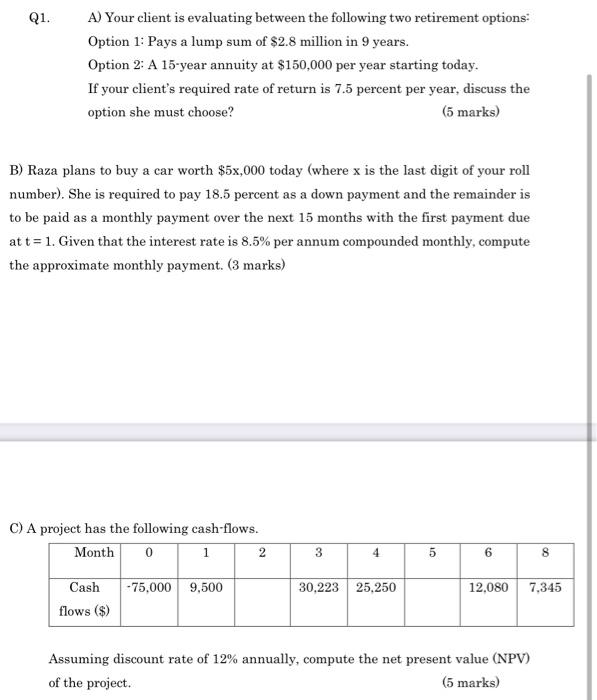

Q1. A) Your client is evaluating between the following two retirement options: Option 1: Pays a lump sum of $2.8 million in 9 years. Option 2: A 15-year annuity at $150,000 per year starting today. If your client's required rate of return is 7.5 percent per year, discuss the option she must choose? (5 marks) B) Raza plans to buy a car worth $5x,000 today (where x is the last digit of your roll number). She is required to pay 18.5 percent as a down payment and the remainder is to be paid as a monthly payment over the next 15 months with the first payment due at t= 1. Given that the interest rate is 8.5% per annum compounded monthly, compute the approximate monthly payment. (3 marks) C) A project has the following cash-flows. Month 0 1 2 3 5 6 8 Cash -75.000 9,500 30,223 25,250 12,080 7,345 flows ($) Assuming discount rate of 12% annually, compute the net present value (NPV) of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts