Question: Part (c). Please show work, thank you! 27. Goodwill from business combination and intangible assets (a) On January 1, 2020, CP Logistics Company paid $3,200,000

Part (c). Please show work, thank you!

Part (c). Please show work, thank you!

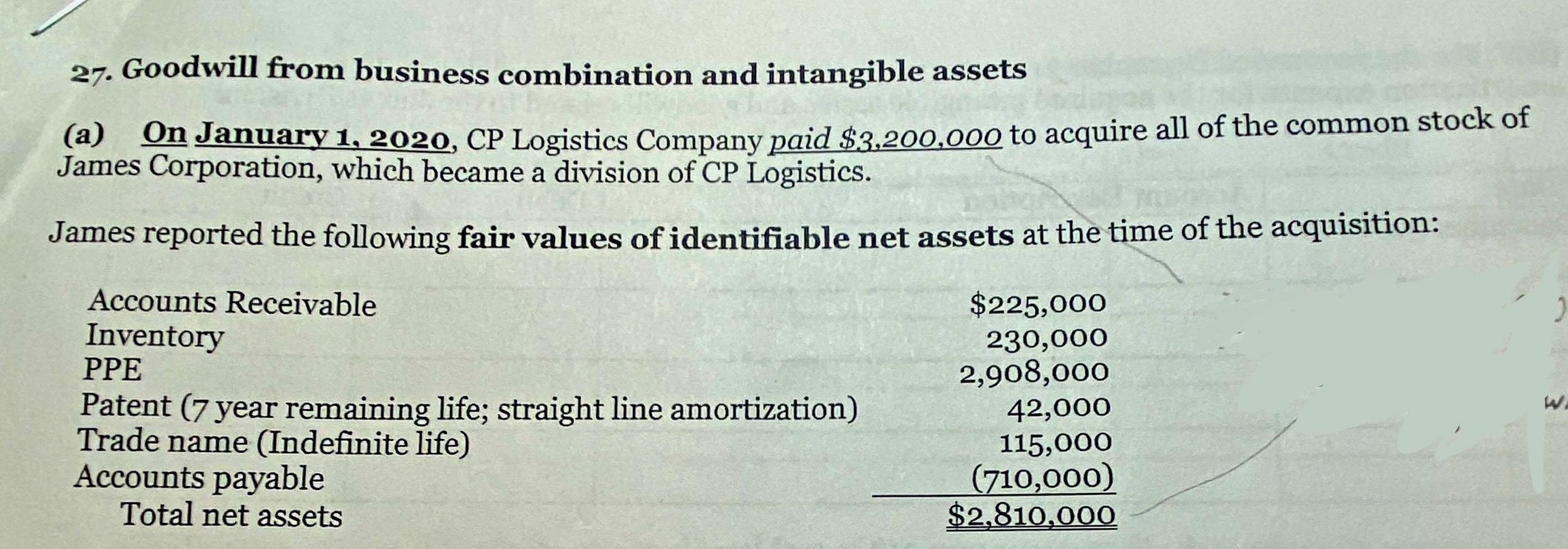

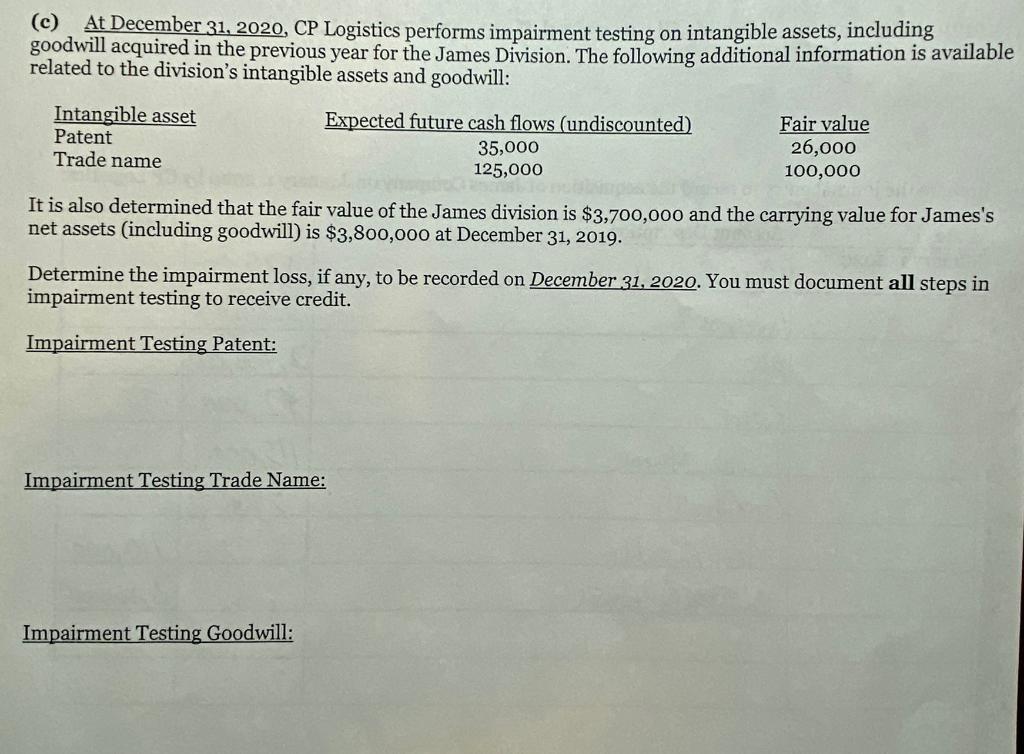

27. Goodwill from business combination and intangible assets (a) On January 1, 2020, CP Logistics Company paid $3,200,000 to acquire all of the common stock of James Corporation, which became a division of CP Logistics. James reported the following fair values of identifiable net assets at the time of the acquisition: (c) At December 31,2020, CP Logistics performs impairment testing on intangible assets, including goodwill acquired in the previous year for the James Division. The following additional information is available related to the division's intangible assets and goodwill: It is also determined that the fair value of the James division is $3,700,000 and the carrying value for James's net assets (including goodwill) is $3,800,000 at December 31,2019 . Determine the impairment loss, if any, to be recorded on December 31,2020 . You must document all steps in impairment testing to receive credit. Impairment Testing Patent: Impairment Testing Trade Name: Impairment Testing Goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts